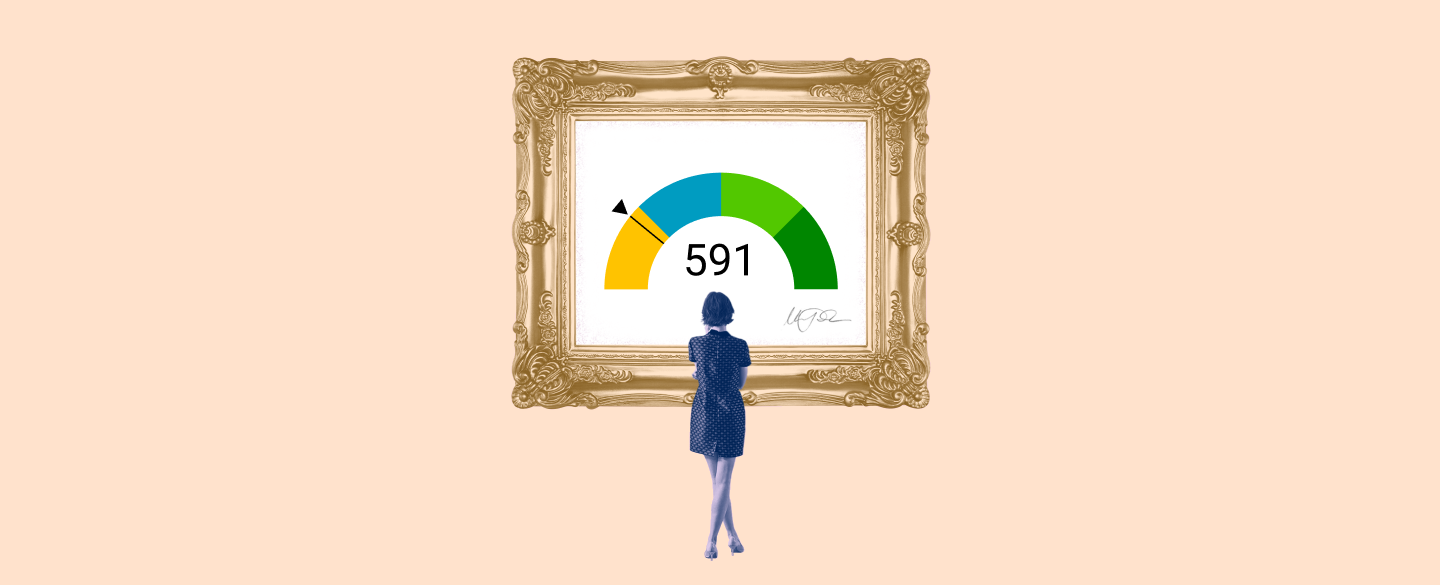

A 591 credit score is a credit score that falls within the "poor" range. People with this rating may find it difficult to qualify for mortgages and other forms of loan financing, as well as have difficulty when it comes to obtaining lower interest rates on those loans when they do qualify.

Table Of Content:

- 591 Credit Score: Is it Good or Bad?

- 591 Credit Score: What Does It Mean? | Credit Karma

- Is 591 a Good Credit Score? Rating, Loans & How to Improve

- Is 591 a good credit score? | Lexington Law

- 591 Credit Score (+ #1 Way To Fix It )

- 591 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 591 Credit Score: Is it Good or Bad? (Approval Odds)

- 591 Credit Score: Good or Bad? | Credit Card & Loan Options

- Car loan interest rates with 591 credit score in 2022

- 591 Credit Score – Is it Good or Bad? How to Improve Your 591 ...

1. 591 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/591-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 591 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 591 FICO® Score is below the average credit score.

2. 591 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/591 Apr 30, 2021 ... A 591 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 591 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. Is 591 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/591-credit-score/

A credit score of 591 isn't “good.” It's not even “fair.” Rather, a 591 credit score is actually considered “bad,” according to the standard 300 to 850 ...

4. Is 591 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/591 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

5. 591 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/591-credit-score

Jun 11, 2022 ... A 591 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 591 Credit Score. Lenders ...

6. 591 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/591-credit-score-mortgage/

The most common type of loan available to borrowers with a 591 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, ...

7. 591 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/591-credit-score/ FICO scores range from 300 to 850. As you can see below, a 591 credit score is considered Fair. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 591 credit score is considered Fair. Credit Score, Credit Rating, % of population.

8. 591 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/591/ Nov 9, 2021 ... 591 is a below-average credit score. It's considered “fair” or “poor” by every major credit scoring model. Scores in this range are high ...

Nov 9, 2021 ... 591 is a below-average credit score. It's considered “fair” or “poor” by every major credit scoring model. Scores in this range are high ...

9. Car loan interest rates with 591 credit score in 2022

https://creditscoregeek.com/poor-credit/591/auto/ Individuals with a 591 FICO credit score pay a normal 13.7% interest rate for a 60-month new auto loan beginning in August 2017, while individuals with low FICO ...

Individuals with a 591 FICO credit score pay a normal 13.7% interest rate for a 60-month new auto loan beginning in August 2017, while individuals with low FICO ...

10. 591 Credit Score – Is it Good or Bad? How to Improve Your 591 ...

https://www.creditrepairexpert.org/591-credit-score/ What Counts Towards Your 591 Credit Score? ... In essence, your credit score tells you whether YOU have a responsible credit management and a history showing that ...

What Counts Towards Your 591 Credit Score? ... In essence, your credit score tells you whether YOU have a responsible credit management and a history showing that ...

What does a 591 credit score mean?

A 591 credit score means that you have a poor credit rating. This rating can make it more difficult to secure loan opportunities and receive competitive interest rates on loan offers.

How can I improve my 591 credit score?

To improve your 591 credit score, you should focus on paying bills on time and managing the amount of debt you are carrying. Additionally, avoid opening multiple lines of credit or closing existing ones without careful consideration.

What happens if I don't take action to improve my credit?

If you don't take action to improve your bad 591 credit score, it will remain low which will continue to make it hard for you to be approved for loans in the future or get access to competitive interest rates even if you are approved for them.

Will getting rejected from loan applications hurt my already low 591 credit score?

Unfortunately, applying for a loan and being rejected can temporarily hurt your already low 591 credit score. To avoid this issue, consider working with a lender who specializes in helping people with bad or poor credit ratings before submitting a full application.

Conclusion:

A 591 credit score is within the "poor" range making it harder to qualify for mortgage and other forms of loan financing as well as lower interest rates on those loans if they are approved. Although this lower rating can be improved by focusing on paying bills on time and managing debt carefully, sudden rejections when applying for loans can further damage the current standing of that particular individual's financial standing in the market today.