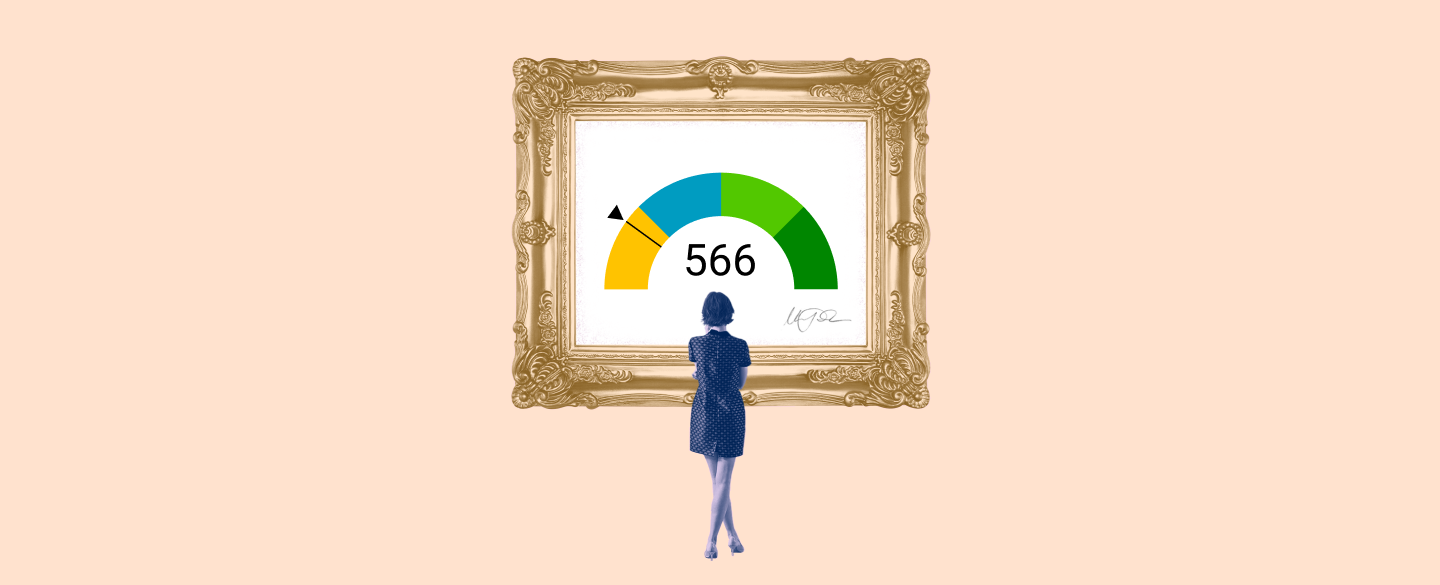

If you're looking for a credit card with great rewards and no complicated terms, then you should consider the 566 Credit Score Visa. This Visa offers excellent benefits for those with below-average credit scores and can be approved within minutes. Plus, you'll earn cashback rewards on every purchase and have access to 0% APR promotional financing.

Table Of Content:

- 566 Credit Score: Good or Bad, Loan Options & Tips

- 566 Credit Score: Is it Good or Bad?

- 9 “Guaranteed Approval” Credit Cards for Bad Credit (2022)

- Is 566 a good credit score? | Lexington Law

- Best credit cards for credit score under 599 (bad credit)

- 566 Credit Score: What Does It Mean? | Credit Karma

- 566 Credit Score: Is it Good or Bad? How do I Improve it?

- 566 Credit Score (+ #1 Way To Fix It )

- 566 Credit Score: Good or Bad? | Credit Card & Loan Options

- 566 Credit Score – Is it Good or Bad? How to Improve Your 566 ...

1. 566 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/566-credit-score/

Credit Cards for a 566 Credit Score ; OpenSky Secured Visa Credit Card image · OpenSky® Secured Visa® Credit Card ; Credit One Bank Platinum Visa image · Credit One ...

2. 566 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/566-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 566 FICO® Score is significantly below the average credit score. Many ...

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 566 FICO® Score is significantly below the average credit score. Many ...

3. 9 “Guaranteed Approval” Credit Cards for Bad Credit (2022)

https://www.cardrates.com/advice/guaranteed-approval-credit-cards/ May 16, 2022 ... Generally speaking, a credit score of between 300 (the lowest FICO score) and 600 is considered bad credit. But some card issuers will ...

May 16, 2022 ... Generally speaking, a credit score of between 300 (the lowest FICO score) and 600 is considered bad credit. But some card issuers will ...

4. Is 566 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/566 Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 566 ) ...

Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 566 ) ...

5. Best credit cards for credit score under 599 (bad credit)

https://www.moneyunder30.com/credit-cards/credit-score-under-599 May 31, 2022 ... Some options (Petal® 1 "No Annual Fee" Visa® Credit Card) offer rewards. Most, are basic cards, though. Unfortunately, a credit score or FICO ...

May 31, 2022 ... Some options (Petal® 1 "No Annual Fee" Visa® Credit Card) offer rewards. Most, are basic cards, though. Unfortunately, a credit score or FICO ...

6. 566 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/566 A 566 credit score can be a sign of past credit difficulties or a lack of credit history.

A 566 credit score can be a sign of past credit difficulties or a lack of credit history.

7. 566 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/566-credit-score

A 566 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

8. 566 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/566-credit-score

9. 566 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/566/

Nov 8, 2021 ... 566 is a bad credit score. It's rated as “poor” by every major credit scoring model. Scores in this range make it difficult to get a mortgage ...

10. 566 Credit Score – Is it Good or Bad? How to Improve Your 566 ...

https://www.creditrepairexpert.org/566-credit-score/ If you have opened up multiple new credit card accounts, ...

If you have opened up multiple new credit card accounts, ...

What is the 566 Credit Score Visa?

The 566 Credit Score Visa is a credit card designed for those with below-average credit scores. It offers great rewards and 0% APR promotional financing, making it a great way to improve your financial situation.

How do I apply for the 566 Credit Score Visa?

Applying for the 566 Credit Score Visa is easy - just fill out an online application or visit your local bank or credit union branch to start the process. Once approved, you can start earning cashback rewards and take advantage of 0% APR promotional financing right away.

What rewards do I get with the 566 Credit Score Visa?

With the 566 Credit Score Visa, you'll earn unlimited 1% cashback on every purchase. You also get discounts at popular retailers, access to special events and more.

Is there a limit to how much I can spend with my 566 Credit Score Visa?

No - your spending limit will depend on your personal financial situation and other factors that may affect your ability to pay off the balance each month.

Is there an annual fee associated with this card?

No - there is no annual fee associated with this card, making it a great choice for those looking to save money while building their credit score.

Conclusion:

The 566 Credit Score Visa is an excellent option for those with below-average credit scores who want access to great rewards without complicated terms or conditions. With no annual fee and cashback rewards on every purchase, this card has everything you need to help boost your financial standing in no time.