A 537 credit score car loan is a type of secured loan that provides borrowers with an opportunity to purchase a car despite their poor credit score. With this loan, your repayment terms will be flexible and cater to your financial needs. It is also possible to receive a pre-approved car loan even for those with a 537 credit score.

Table Of Content:

- 537 Credit Score: Good or Bad, Loan Options & Tips

- 537 Credit Score: What Does It Mean? | Credit Karma

- 537 Credit Score: Is it Good or Bad?

- Is 537 a good credit score? | Lexington Law

- 537 Credit Score (+ #1 Way To Fix It )

- Car loan interest rates with 537 credit score in 2022

- 537 Credit Score: Is it Good or Bad? How do I Improve it?

- 537 Credit Score: Is it Good or Bad? (Approval Odds)

- Best Auto Loan Rates With a Credit Score of 530 to 539

- How much will my vehicle payments be? | myFICO

1. 537 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/537-credit-score/

Credit cards and auto loans offer the best approval odds for someone with a 537 credit score. For example, people with credit scores below 580 take out ...

2. 537 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/537 There's no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, ...

There's no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, ...

3. 537 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/537-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 537 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 537 FICO® Score is significantly below the average credit score.

4. Is 537 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/537 Oct 11, 2021 ... It won't be easy to get approved for a car loan with a credit score of 537. If you are approved, it may be at an extremely high interest rate ...

Oct 11, 2021 ... It won't be easy to get approved for a car loan with a credit score of 537. If you are approved, it may be at an extremely high interest rate ...

5. 537 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/537-credit-score

6. Car loan interest rates with 537 credit score in 2022

https://creditscoregeek.com/bad-credit/537/auto/ Those with 537 score tend to have the most problems when applying and trying to obtain a vehicle loan. It does not matter the type or price of the vehicle they' ...

Those with 537 score tend to have the most problems when applying and trying to obtain a vehicle loan. It does not matter the type or price of the vehicle they' ...

7. 537 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/537-credit-score

A 537 credit score is a poor credit score. ... As of December 9th, 2020, the bank estimated an interest rate of 3.39% for a car loan (2020 Ford) to ...

8. 537 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/537-credit-score/ Most auto lenders will not lend to someone with a 537 score. If you are able to get approved for an auto loan with a 537 score, it will be costly. If you can ...

Most auto lenders will not lend to someone with a 537 score. If you are able to get approved for an auto loan with a 537 score, it will be costly. If you can ...

9. Best Auto Loan Rates With a Credit Score of 530 to 539

https://finmasters.com/best-auto-loan-rates-credit-score-530-to-539/ Your credit score will play a big factor if you are looking to get the best rates for an auto loan. A credit score of around 530 to 539 is considered subprime.

Your credit score will play a big factor if you are looking to get the best rates for an auto loan. A credit score of around 530 to 539 is considered subprime.

10. How much will my vehicle payments be? | myFICO

https://www.myfico.com/credit-education/financial-calculators/vehicle-payments

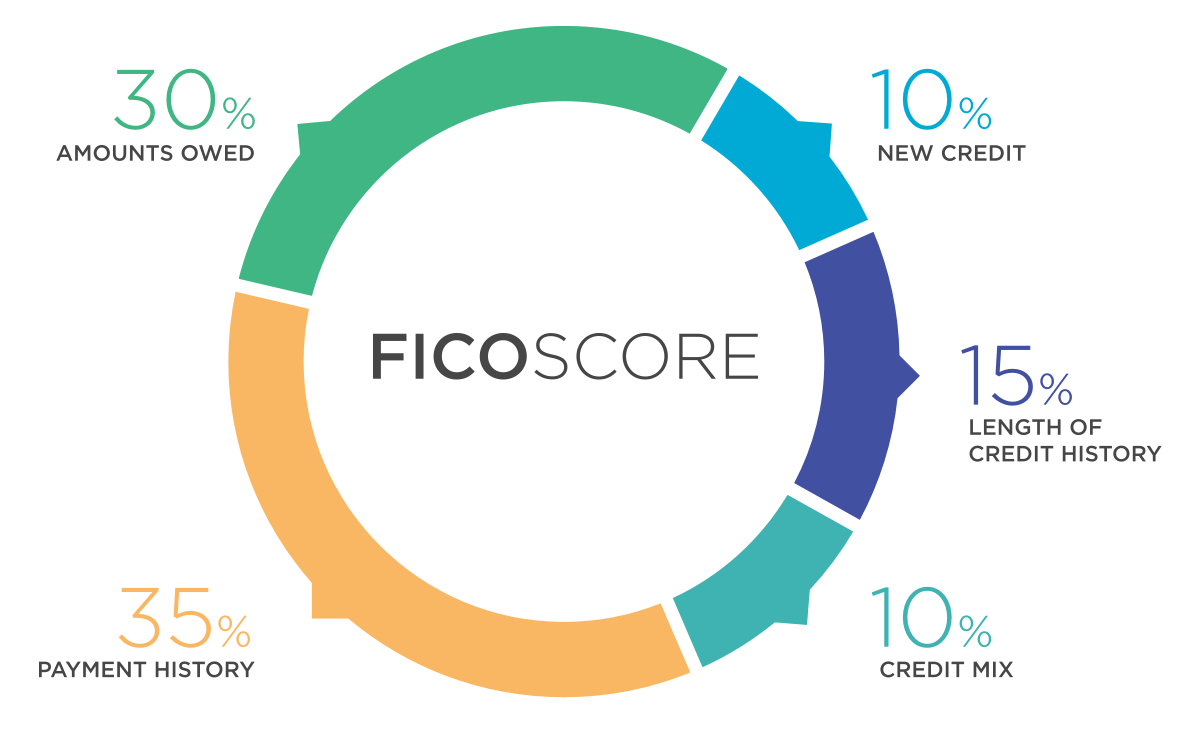

Equifax Credit Report is a trademark of Equifax, Inc. and its affiliated companies. Many factors affect your FICO Scores and the interest rates you may receive.

What is a 537 credit score?

A 537 credit score is considered an extremely bad credit rating. It means you have a number of delinquent payments on your accounts or that you have defaulted on loans in the past.

Can I get pre-approved for a car loan with my 537 credit score?

Yes, it is possible to obtain pre-approval for a car loan even if you have a 537 credit score. To find out more about pre-approval options, contact the lender directly.

How long will my 537 credit score car loan last?

The length of the loan will depend on the terms agreed upon between you and your lender, such as the interest rate and repayment period. Generally, these types of loans are offered over shorter periods compared to standard auto loans such as 36 months or 48 months.

What happens if I am unable to pay back my 537 Credit Score Car Loan?

Defaulting on any type of loan can be damaging to your financial reputation and result in serious consequences including further damage to your credit score and potential legal action taken by the lender if necessary. Therefore it’s best to communicate openly with your lender if you think there may be issues with repaying the loan on time in order for them to provide assistance where appropriate.

Will taking out a 537 Credit Score Car Loan raise my Credit Score?

Taking out this type of secured loan can help rebuild your poor credit rating and improve it over time if payments are made as agreed upon in the contract. However, it is important to remember that paying back secured loans each month on time helps minimize debt, thus helping improve your overall financial position as well as increasing chances of raising your credit rating too.

Conclusion:

Taking out a car loan with a 537 Credit Score can be beneficial as it can help rebuild bad credit ratings over time and enable borrowers to purchase their own cars despite having low scores initially. However due care must be taken when considering any type of funding option because any missed payments could cause further damage to already bad debt reputation which could lead into legal action from lenders if necessary.