With so many changes taking place in the credit industry, understanding your credit score is more important than ever. That’s why it is essential to know and understand your 529 Credit Score. A 529 Credit Score is a 3-digit number typically ranging from 300 to 850 and is used to help determine how likely you are to pay back a loan on time. Different lenders may also consider different aspects of your 529 Credit Score when making decisions about loan eligibility, rates, and terms.

Table Of Content:

- 529 Credit Score: Is it Good or Bad?

- 529 Credit Score: Is it Good or Bad? How do I Improve it?

- 529 Credit Score: What Does It Mean? | Credit Karma

- 529 Credit Score: Good or Bad, Loan Options & Tips

- 529 Credit Score (+ #1 Way To Fix It )

- 529 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- Best Auto Loan Rates With a Credit Score of 520 to 529

- Is 529 a good credit score? | Lexington Law

- 529 Credit Score: Is it Good or Bad? (Approval Odds)

- How Do Student Loans Affect Your Credit Scores?

1. 529 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/529-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 529 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 529 FICO® Score is significantly below the average credit score.

2. 529 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/529-credit-score

A 529 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

3. 529 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/529 May 4, 2021 ... A 529 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

May 4, 2021 ... A 529 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

4. 529 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/529-credit-score/

A 529 credit score is classified as "bad" on the standard 300-to-850 scale. It is 171 points away from being a “good” credit score, which many people use as ...

5. 529 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/529-credit-score

Jun 11, 2022 ... Is 529 a Good Credit Score? ... A 529 FICO® Score is considered “Poor”. It means you've had past payment problems, including collection accounts, ...

6. 529 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/529-credit-score-mortgage/

Frequently Asked Questions ... Can I get a conventional loan with a 529 credit score? No, the minimum credit score required for a conventional loan is a 620. Can ...

7. Best Auto Loan Rates With a Credit Score of 520 to 529

https://finmasters.com/best-auto-loan-rates-credit-score-520-to-529/ Summary: A review of the best car loan rates for new, used & refinanced vehicles for borrowers with credit scores between 520 and 529. Your credit score ...

Summary: A review of the best car loan rates for new, used & refinanced vehicles for borrowers with credit scores between 520 and 529. Your credit score ...

8. Is 529 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/529 Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 529 ) ...

Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 529 ) ...

9. 529 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/529-credit-score/ FICO scores range from 300 to 850. As you can see below, a 529 credit score is considered Poor. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 529 credit score is considered Poor. Credit Score, Credit Rating, % of population.

10. How Do Student Loans Affect Your Credit Scores?

https://www.savingforcollege.com/article/how-do-student-loans-affect-your-credit-scores

Feb 15, 2019 ... This limits the impact on the your credit score. The credit bureaus can recognize that you are seeking just one student loan, not multiple ...

What impacts a 529 Credit Score?

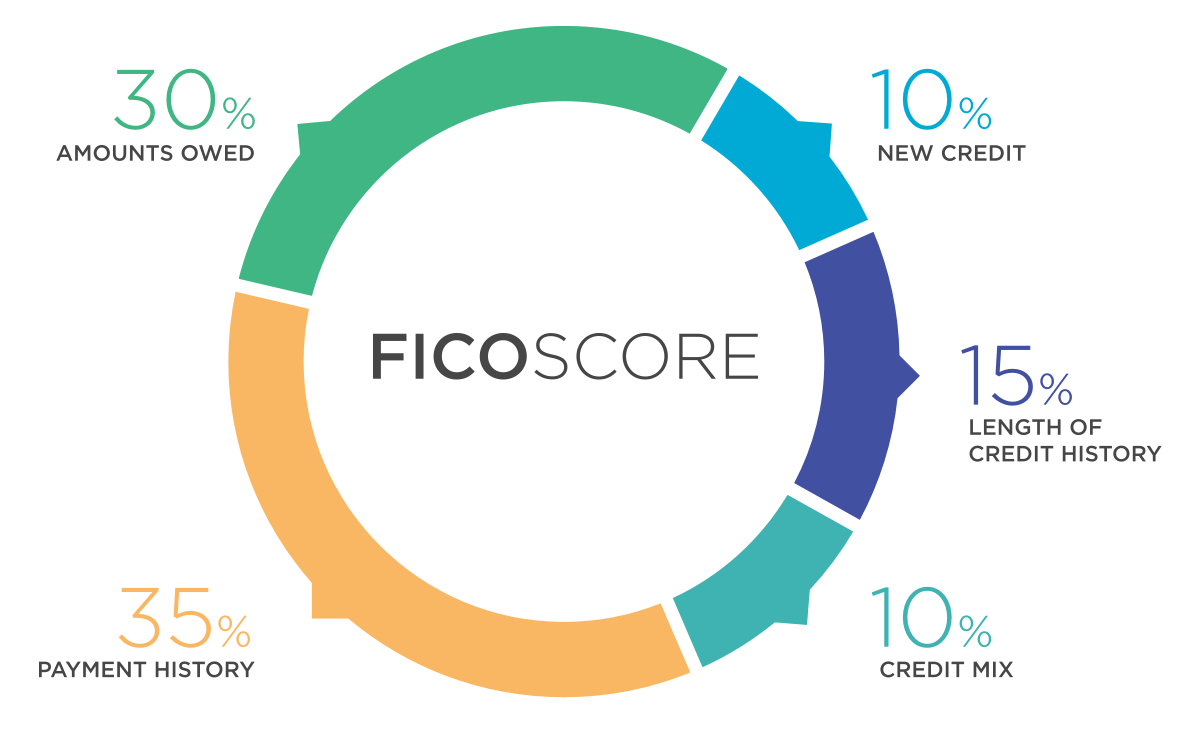

Your 529 Credit Score considers several factors such as payment history, age of the accounts, type of accounts, amount of debt, and available credit. Positive actions such as making payments on time or managing credit limits properly can improve your score while negative behaviors like missing payments or maxing out cards can lower it.

What types of entities use the 529 Credit Score for decisions?

Lenders such as banks and other financial institutions regularly use the 529 Credit Score when evaluating applications for loans or other types of financing options. This includes mortgages, auto loans, home equity lines of credit (HELOCs), personal loans, student loans, and more. Additionally, employers may review this information when considering potential candidates for certain positions or roles within their company.

How often should I check my 529 Credit Score?

It is recommended to check your score at least once per year for accuracy as errors can occur that could affect its accuracy. Additionally, if you are looking to take advantage of certain loan opportunities or apply for new jobs with specific requirements concerning credits scores then it would be helpful to keep track of your score that much more regularly.

Conclusion:

Knowing and understanding your 529 Credit Score can be beneficial in order to make better informed decisions related to borrowing money and applying for jobs that require certain credit criteria be met. Being aware of how various activities impact this score can also help you build a strong financial future over time through smart habits and remaining knowledgeable about how best to manage debts and finances responsibly.