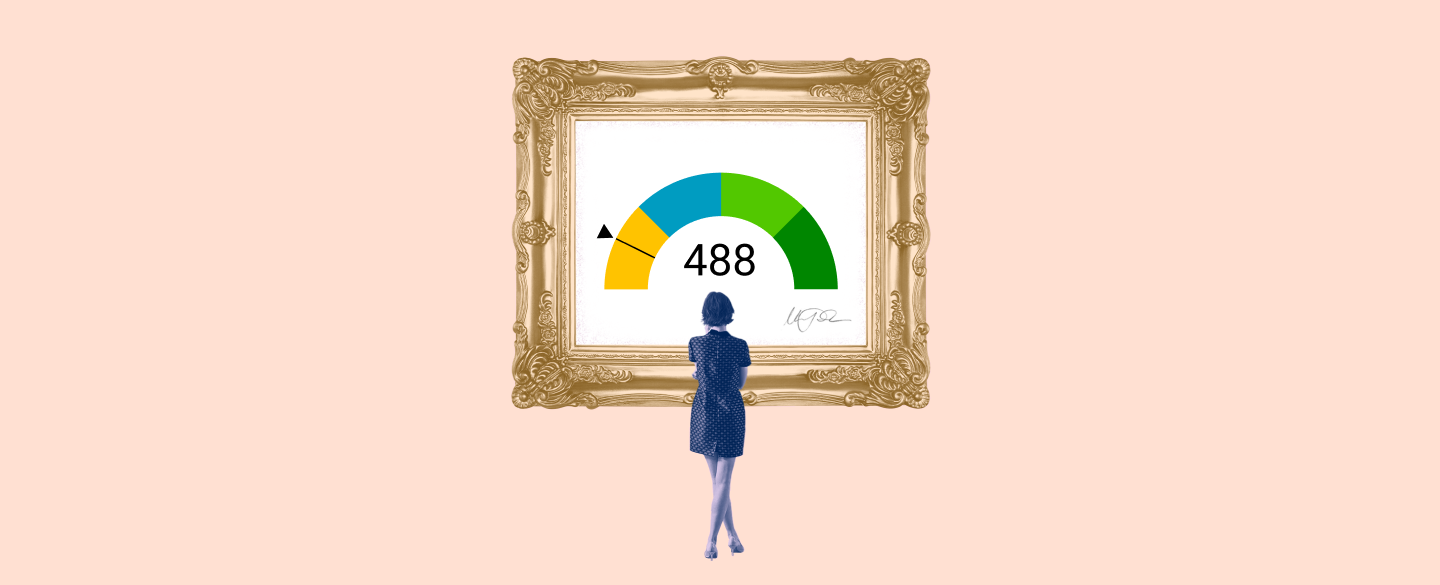

A 488 credit score puts you in the ‘poor’ category according to most lenders. This means that although it is possible to get approved for a loan or credit card, it could take longer or require additional steps and documentation. All borrowers will need to work towards improving their credit score to get better rates and terms - but it is still possible if your score currently falls into this range.

Table Of Content:

- 488 Credit Score: Is it Good or Bad?

- 488 Credit Score: What Does It Mean? | Credit Karma

- 488 Credit Score: Borrowing Options & How to Fix

- 488 Credit Score: Is it Good or Bad? How do I Improve it?

- 488 Credit Score (+ #1 Way To Fix It )

- Credit Score is 488, What can I do? : r/CRedit

- 488 Credit Score – Is it Good or Bad? How to Improve Your 488 ...

- 8 Best Loans & Credit Cards (450 to 500 Credit Score) - 2022

- Credit Scoring - ILS

- Car loan interest rates with 488 credit score in 2022

1. 488 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/488-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 488 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 488 FICO® Score is significantly below the average credit score.

2. 488 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/488 May 3, 2021 ... A 488 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

May 3, 2021 ... A 488 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. 488 Credit Score: Borrowing Options & How to Fix

https://wallethub.com/credit-score-range/488-credit-score/

A 488 credit score is a bad credit score, unfortunately, as it's a lot closer to the lowest score possible (300) than the highest credit score (850).

4. 488 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/488-credit-score

A 488 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

5. 488 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/488-credit-score

Jun 11, 2022 ... Is 488 a Good Credit Score? ... A 488 FICO® Score is considered “Poor”. It means you've had past payment problems, including collection accounts, ...

6. Credit Score is 488, What can I do? : r/CRedit

https://www.reddit.com/r/CRedit/comments/8wc0rr/credit_score_is_488_what_can_i_do/

Jul 5, 2018 ... My real question is, what else can I do aside from paying off my credit card debt do I need to do to improve my credit score. On a side note, is ...

7. 488 Credit Score – Is it Good or Bad? How to Improve Your 488 ...

https://www.creditrepairexpert.org/488-credit-score/ Before you can do anything to increase your 488 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to…

Before you can do anything to increase your 488 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to…

8. 8 Best Loans & Credit Cards (450 to 500 Credit Score) - 2022

https://www.cardrates.com/advice/450-500-credit-score/ Sep 24, 2019 ... That said, with a 450 to 500 credit score, you will likely be ... 486, 487, 488, 489, 490, 491, 492, 493, 494, 495, 496, 497, 498, 499, 500 ...

Sep 24, 2019 ... That said, with a 450 to 500 credit score, you will likely be ... 486, 487, 488, 489, 490, 491, 492, 493, 494, 495, 496, 497, 498, 499, 500 ...

9. Credit Scoring - ILS

https://www.indianalegalservices.org/node/488/credit-scoring May 13, 2012 ... Presently, a score of about 660 or better is considered good. Who uses credit scores? Many lenders – including about 90% of credit card issuers ...

May 13, 2012 ... Presently, a score of about 660 or better is considered good. Who uses credit scores? Many lenders – including about 90% of credit card issuers ...

10. Car loan interest rates with 488 credit score in 2022

https://creditscoregeek.com/bad-credit/488/auto/ Find out what auto loan rates your 488 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 488.

Find out what auto loan rates your 488 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 488.

What causes a low credit score?

Low credit scores can be caused by missing payments on loans or credit cards, having high balances on revolving accounts, and lacking sufficient open accounts. Additionally, certain activities such as too many inquiries from lenders over a short period of time can also cause a low score.

How do I increase my 488 credit score?

The best way to improve your 488 credit score is by setting up automatic payments for all bills and making sure those payments are always on-time. You should also consider paying down any existing balances on accounts over time and keep your overall utilization low. Additionally, building up your amount of available credit can increase your score over time.

What risks come with a 488 credit rating?

A 488 credit rating can make it more difficult to obtain loans or even some services that require proof of good financial health (such as apartment rentals). Borrowers may also be subject to higher interest rates or fees due to the risk associated with lower scores like these.

Conclusion:

Having a 488 credit score doesn’t mean that getting loans and other services are impossible; however it does come with some risks associated with the level of risk viewed by potential lenders. Your best bet when starting out with this type of rating is to begin taking steps to build up your credit through responsible payment history, low utilization, and increased available amounts over time.