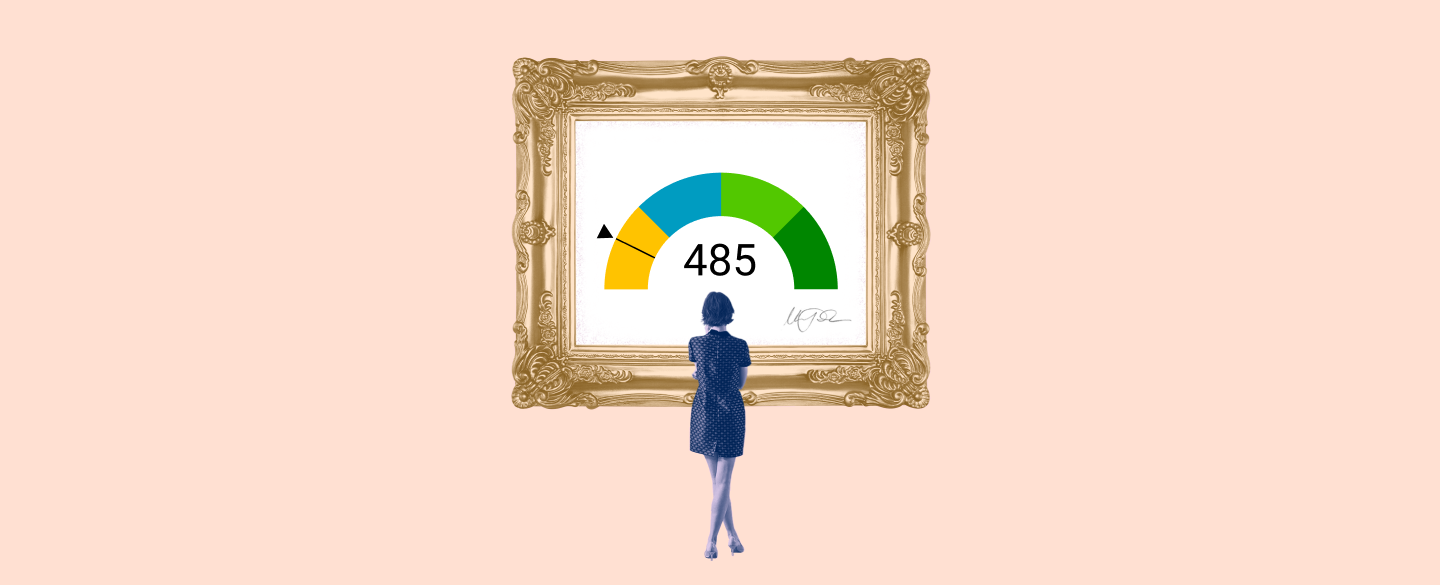

A credit score of 485 is a measure of your overall creditworthiness. It represents the likelihood that you will be able to obtain financing and manage debt responsibly. This score can help lenders determine whether or not they should extend credit to you and how much interest they should charge. It also helps creditors make decisions about whether or not to open lines of credit with you. Understanding the meaning behind this score and how it can affect your finances is key for making smart decisions about borrowing and spending

Table Of Content:

- 485 Credit Score: Is it Good or Bad?

- 485 Credit Score: Borrowing Options & How to Fix

- 485 Credit Score: What Does It Mean? | Credit Karma

- 485 Credit Score: Is it Good or Bad? How do I Improve it?

- 485 Credit Score (+ #1 Way To Fix It )

- 485 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 485 a good credit score? | Lexington Law

- Question about credit card debt and credit score for I-485 ...

- 8 Best Loans & Credit Cards (450 to 500 Credit Score) - 2022

- Car loan interest rates with 485 credit score in 2022

1. 485 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/485-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 485 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 485 FICO® Score is significantly below the average credit score.

2. 485 Credit Score: Borrowing Options & How to Fix

https://wallethub.com/credit-score-range/485-credit-score/

A 485 credit score is a bad credit score, unfortunately, as it's a lot closer to the lowest score possible (300) than the highest credit score (850).

3. 485 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/485 Apr 30, 2021 ... A 485 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 485 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

4. 485 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/485-credit-score

A 485 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

5. 485 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/485-credit-score

Jun 11, 2022 ... Is 485 a Good Credit Score? ... A 485 FICO® Score is considered “Poor”. It means you've had past payment problems, including collection accounts, ...

6. 485 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/485/ Feb 18, 2022 ... A credit score of 485 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. Both ...

Feb 18, 2022 ... A credit score of 485 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. Both ...

7. Is 485 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/485 Oct 11, 2021 ... So, what does having a credit score of 485 mean for you? Essentially, when it comes to applying for loans, you're unlikely to qualify for many.

Oct 11, 2021 ... So, what does having a credit score of 485 mean for you? Essentially, when it comes to applying for loans, you're unlikely to qualify for many.

8. Question about credit card debt and credit score for I-485 ...

https://www.immihelp.com/forum/adjustment-of-status-i-485/743953-question-about-credit-card-debt-and-credit-score-for-i-485

Sep 29, 2020 ... Hello, Since the priority date of EB-3 became current, my attorney is gong to file I-140 along with I-485. I will have to mention my credit ...

9. 8 Best Loans & Credit Cards (450 to 500 Credit Score) - 2022

https://www.cardrates.com/advice/450-500-credit-score/ Sep 24, 2019 ... 8 Best Loans & Credit Cards for a 450 to 500 Credit Score · 1. Fingerhut Credit Account · 2. Capital One Platinum Secured Credit Card · 3. Brink's ...

Sep 24, 2019 ... 8 Best Loans & Credit Cards for a 450 to 500 Credit Score · 1. Fingerhut Credit Account · 2. Capital One Platinum Secured Credit Card · 3. Brink's ...

10. Car loan interest rates with 485 credit score in 2022

https://creditscoregeek.com/bad-credit/485/auto/ Find out what auto loan rates your 485 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 485.

Find out what auto loan rates your 485 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 485.

What do creditors look at when evaluating my 485 credit score?

The primary factor creditors consider when evaluating a 485 credit score is the borrower's payment history, which includes paying bills on time, avoiding late payments, minimizing defaults, and avoiding bankruptcy. Additionally, other factors such as the length of an individuals’s credit history, total outstanding debt, available credit, number of inquiries on file in the past year can also play a role in determining a potential borrower’s 485 credit score

How can I raise my 485 credit score?

The best way to raise your 485 credit score is by improving your payment history. Paying off any outstanding debts and making timely payments on current accounts are important steps to take. Additionally, limiting new applications for loans and other forms of financing could help keep your total outstanding debt low while also decreasing the number of inquiries made to your report from potential lenders

How long does it take to rebuild a 485 Credit Score?

It depends on several factors such as how regularly someone pays their bills on time, maintains their existing accounts responsibly and limits any additional borrowing; but generally speaking, rebuilding a 485 Credit Score can take anywhere between three months to one year

Are there any other ways to improve my 485 Credit Score?

Yes! Monitoring your spending habits closely so that you stay within budget is one way that could potentially help build up your score over time. Living below one’s means and maintaining good financial discipline throughout all aspects of life are crucial components in increasing one’s chances for success with regards to managing finances

Conclusion:

Finally, that is all about 485 credit score. You reached at the last stage of this article. Hope you will get the right information about 485 Credit Score: Is it Good or Bad?.