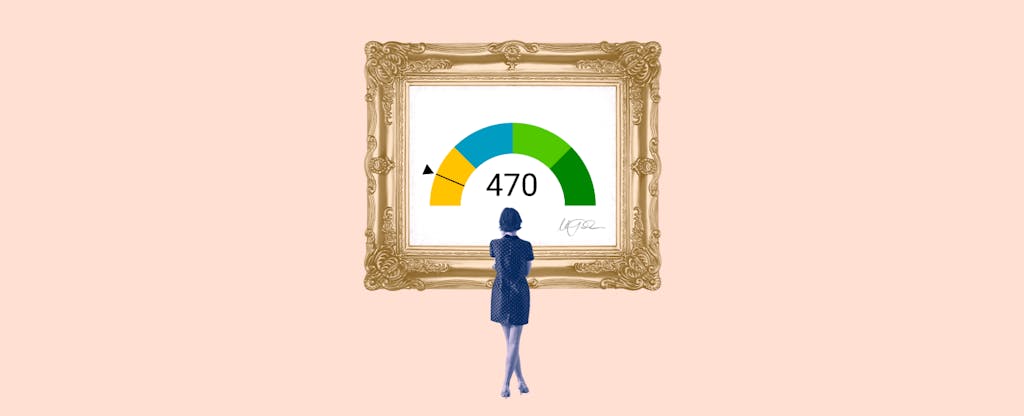

A credit score is a 3-digit number that summarizes your credit history and helps lenders decide if you're a good candidate for loans or credit cards. A score of 470 reflects an individual’s creditworthiness and likelihood of managing their finances responsibly. This score is considered “poor” and will make it difficult to access competitive loan terms or get approved for new lines of credit. However, with diligent financial management, it is possible to improve the score over time.

Table Of Content:

- 470 Credit Score: Is it Good or Bad?

- 470 Credit Score: Is it Good or Bad? How do I Improve it?

- 470 Credit Score: What Does It Mean? | Credit Karma

- 470 Credit Score (+ #1 Way To Fix It )

- 470 Credit Score: Borrowing Options & How to Fix

- Will a 470 credit score get me an auto loan with no money down ...

- 2022's Best Personal Loans for a 470 Credit Score

- 470 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 470 a Good Credit Score for a Car Loan? | Jerry

- Jovanny Has A Transunion Score Of 470, And Gets $30000 From ...

1. 470 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/470-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 470 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 470 FICO® Score is significantly below the average credit score.

2. 470 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/470-credit-score

A 470 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

3. 470 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/470 May 3, 2021 ... A 470 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

May 3, 2021 ... A 470 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

4. 470 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/470-credit-score

Jun 11, 2022 ... Is 470 a Good Credit Score? ... A 470 FICO® Score is considered “Poor”. It means you've had past payment problems, including collection accounts, ...

5. 470 Credit Score: Borrowing Options & How to Fix

https://wallethub.com/credit-score-range/470-credit-score/

A 470 credit score is a bad credit score, unfortunately, as it's a lot closer to the lowest score possible (300) than the highest credit score (850).

6. Will a 470 credit score get me an auto loan with no money down ...

https://www.compareauto.loan/credit-scores/will-a-470-credit-score-get-me-an-auto-loan

A: With a credit score standing at 470 it is entirely possible to apply successfully for an auto loan, but rates of interest for loans like this are often a ...

7. 2022's Best Personal Loans for a 470 Credit Score

https://wallethub.com/answers/pl/best-personal-loans-for-470-credit-score-2140747334/

8. 470 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/470/ Feb 18, 2022 ... A credit score of 470 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. Both ...

Feb 18, 2022 ... A credit score of 470 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. Both ...

9. Is 470 a Good Credit Score for a Car Loan? | Jerry

https://getjerry.com/questions/is-470-a-good-credit-score-for-a-car-loan![]() Feb 23, 2022 ... We're not gonna lie, friend—this is gonna be tough. Technically a 470 credit score can't disqualify you from a car loan, but you're going to ...

Feb 23, 2022 ... We're not gonna lie, friend—this is gonna be tough. Technically a 470 credit score can't disqualify you from a car loan, but you're going to ...

10. Jovanny Has A Transunion Score Of 470, And Gets $30000 From ...

https://americaloanservice.com/loan/jovanny-has-a-transunion-score-of-470-and-gets-30000-from-citizens-bank Searching for a $30,000 personal loan with bad credit can be challenging if you have a credit score ranging from 470 to 600. You can still apply to a bad ...

Searching for a $30,000 personal loan with bad credit can be challenging if you have a credit score ranging from 470 to 600. You can still apply to a bad ...

Why is a 470 credit score considered “poor”?

A 470 credit score falls in the "poor" range which usually begins around 300-579 on the FICO scale. This low score indicates that there have been several negative actions on an individual's account such as late payments or too many accounts in collections. Lenders consider this to be a high risk and will often deny or decline loan applications with this level of credit score.

How can I improve my 470 credit score?

To improve a 470 credit score, individuals should work on building positive payment habits such as paying bills on time and making more than the minimum payments due. Additionally, paying down existing debt can help lift the overall utilization ratio, leading to an improved rating. Checking one's free annual credit report regularly can also help identify any errors or outdated information that could be weighing down one's rating.

What are some potential consequences of having a poor credit score?

Having a low credit score of 470 could lead to being denied for loans or unable to get competitive rates for new lines of credit. It may also increase insurance premiums since insurers view individuals with lower scores as higher risk clients. To add insult to injury, landlords might refuse rental agreements due to concerns about timely payment histories or deny employment opportunities because some employers check potential hirees' ratings when making decisions.

What type of actions could negatively affect my 470 credit score?

Actions such as missing payments, maxing out available lines of credits, going over-limit on accounts, applying for too much new debt within short spans of time, incurring legal judgements against you, or filing bankruptcy can all severely harm your overall rating by lowering it further into the poor category.

Conclusion:

A 470 credit score may seem daunting at first but with effective budgeting strategies and consistent repayment practices over time it is possible to improve your overall rating significantly and gain better access to more financial services that previously seemed out of reach. With discipline and dedication it's possible to build up your profile steadily until you have the financial opportunities you desire.