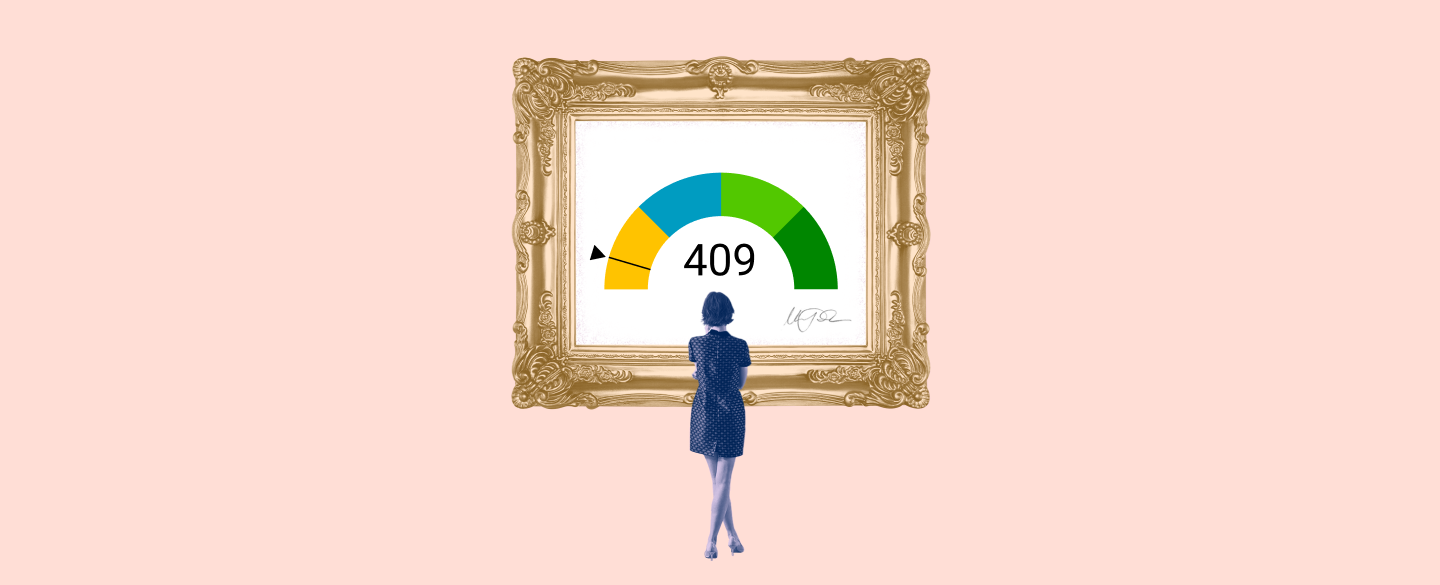

A credit score of 409 is typically associated with a borrower who has a history of missing payments and other financial struggles. This type of score can indicate poor financial health, but it may also be the result of a lack of credit history. Understanding what this score means and how it’s calculated is important for anyone interested in improving their financial standing.

Table Of Content:

- 409 Credit Score: Is it Good or Bad?

- 409 Credit Score: Is it Good or Bad? How do I Improve it?

- 409 Credit Score: What Does It Mean? | Credit Karma

- 409 Credit Score: Borrowing Options & How to Fix

- Is 409 a good credit score? | Lexington Law

- Credit Score Information: Guide to Credit Scores | Equifax

- Car loan interest rates with 409 credit score in 2022

- Can I Get A Car With A 400 Credit Score Hotsell, 56% OFF | www ...

- Credit Score Estimator

- 12 Best Loans & Credit Cards for 400 to 450 Credit Scores (2022 ...

1. 409 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/409-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 409 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 409 FICO® Score is significantly below the average credit score.

2. 409 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/409-credit-score

A 409 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

3. 409 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/409 Apr 30, 2021 ... A 409 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 409 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

4. 409 Credit Score: Borrowing Options & How to Fix

https://wallethub.com/credit-score-range/409-credit-score/

A 409 credit score is a bad credit score, unfortunately, as it's a lot closer to the lowest score possible (300) than the highest credit score (850).

5. Is 409 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/409 Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 409 ) ...

Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 409 ) ...

6. Credit Score Information: Guide to Credit Scores | Equifax

https://www.equifax.com/personal/education/credit/score/ Learn more about credit scores. Whether you're getting started or getting back on track, Equifax can help you better understand your credit score.

Learn more about credit scores. Whether you're getting started or getting back on track, Equifax can help you better understand your credit score.

7. Car loan interest rates with 409 credit score in 2022

https://creditscoregeek.com/bad-credit/409/auto/ Find out what auto loan rates your 409 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 409.

Find out what auto loan rates your 409 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 409.

8. Can I Get A Car With A 400 Credit Score Hotsell, 56% OFF | www ...

https://www.ingeniovirtual.com/descubrezapatillas/tags/2672?p=6.40.5512085.4.18.84.can+i+get+a+car+with+a+400+credit+score Shop the cheapest selection of can i get a car with a 400 credit score, 56% Discount Last 2 Days. pampers dispenser ... Is A 400 to 409 Credit Score Bad?

Shop the cheapest selection of can i get a car with a 400 credit score, 56% Discount Last 2 Days. pampers dispenser ... Is A 400 to 409 Credit Score Bad?

9. Credit Score Estimator

https://www.energycountryford.com/black-book-credit-score-estimator.aspxBlack Book is not a consumer reporting agency. *The Equifax Credit Score is based on an Equifax Credit Score model and is not the same as scores used by third ...

10. 12 Best Loans & Credit Cards for 400 to 450 Credit Scores (2022 ...

https://www.badcredit.org/how-to/loans-credit-cards-for-400-to-450-credit-score/ Consumers with very poor credit scores between 400 and 450 often have their ... 401, 402, 403, 404, 405, 406, 407, 408, 409, 410, 411, 412, 413, 414, 415, ...

Consumers with very poor credit scores between 400 and 450 often have their ... 401, 402, 403, 404, 405, 406, 407, 408, 409, 410, 411, 412, 413, 414, 415, ...

Q1: What does a credit score of 409 mean?

A credit score of 409 indicates a poor financial standing and suggests that the individual has struggled to make payments on time or to keep good credit habits.

How is a credit score of 409 calculated?

Credit scores are based on the information contained in the individual's credit report, which includes payment histories, amount owed, age of accounts, types of accounts, and recent inquiries. A low-scoring borrower will have delinquent payments, maxed out accounts, and derogatory marks on their report which would all contribute towards their low score.

What steps can I take to improve my credit score if it’s at 409?

Improving your credit starts with making sure that all current debts are being paid off in full each month and on time. You should also reduce any outstanding debts so that they are below 30% utilization rate, as well as establish new lines of (good)credit by opening up additional accounts. Additionally, you should avoid unnecessary hard inquiries while also regularly monitoring your credit report for inaccuracies or potential fraud.

Will my bad credit prevent me from getting approved for loans or products?

Having bad credit can make it difficult to get approved for loans or products because lenders often see it as an indication that you are not financially responsible enough to manage debt. However, there may still be options such as secured loans or specialized lenders who specialize in lending to customers with bad credit scores like yours.

How long does it take to raise my credit score if it's at 409?

Because there is no one-size-fits-all answer when it comes to improving your credit score, the timeframe may vary depending on individual circumstances such as existing debt levels or payment habits. Generally speaking though, taking consistent measures such as opening new lines of (good)credit and paying bills off in full and on time can make significant improvements within 6 months’ time.

Conclusion:

Achieving good financial health can seem daunting when facing a low-scoring FICO® Score such as one at 409; however there are ways you can improve your overall rating by taking consistent actions towards achieving better payment habits and establishing new lines (of good)credit. With effort and perseverance you may find yourself back at an average range within weeks or months’ time!