A Federal Housing Administration (FHA) loan is a popular mortgage option for people in San Diego. With an FHA loan, you can benefit from lower down payments with easier credit and income requirements than conventional loans. FHA loans are insured by the U.S. government, meaning you don't have to worry about defaulting on your mortgage payment. You can use an FHA loan to purchase a single-family home, multi-family home or condominium in San Diego.

Table Of Content:

- Homeownership Programs you can use in California | HUD.gov ...

- Down Payment Closing Costs Assistance

- San Diego 3.5% Down FHA Home Loan (Updated Numbers and ...

- FHA Loans in San Diego | FHA Loan Professional CA 92121

- Why Choose an FHA Loan in San Diego - San Diego Mortgage Broker

- County of San Diego's First-Time Homebuyer Down Payment and ...

- San Diego Housing Commission First-Time Homebuyer Programs

- FHA Loan Limits for CALIFORNIA

- FHA Mortgage Loans San Diego | National Home Loans

- FHA Approved Condos for sale San Diego | FHA Approved Homes ...

1. Homeownership Programs you can use in California | HUD.gov ...

https://www.hud.gov/states/california/homeownership/sdsupguideeng

Homebuyer Programs Supplemental Information: San Diego Area ... CalFHA (California Housing Finance Agency): These loans are available through many of the ...

2. Down Payment Closing Costs Assistance

https://www.sandiegocounty.gov/content/sdc/sdhcd/home-buyers-owners/payment-assistance.html

Lenders · To become a participating lender, please see SDHC Lenders site. · For more information or loan payoff, please contact the San Diego Housing Commission ...

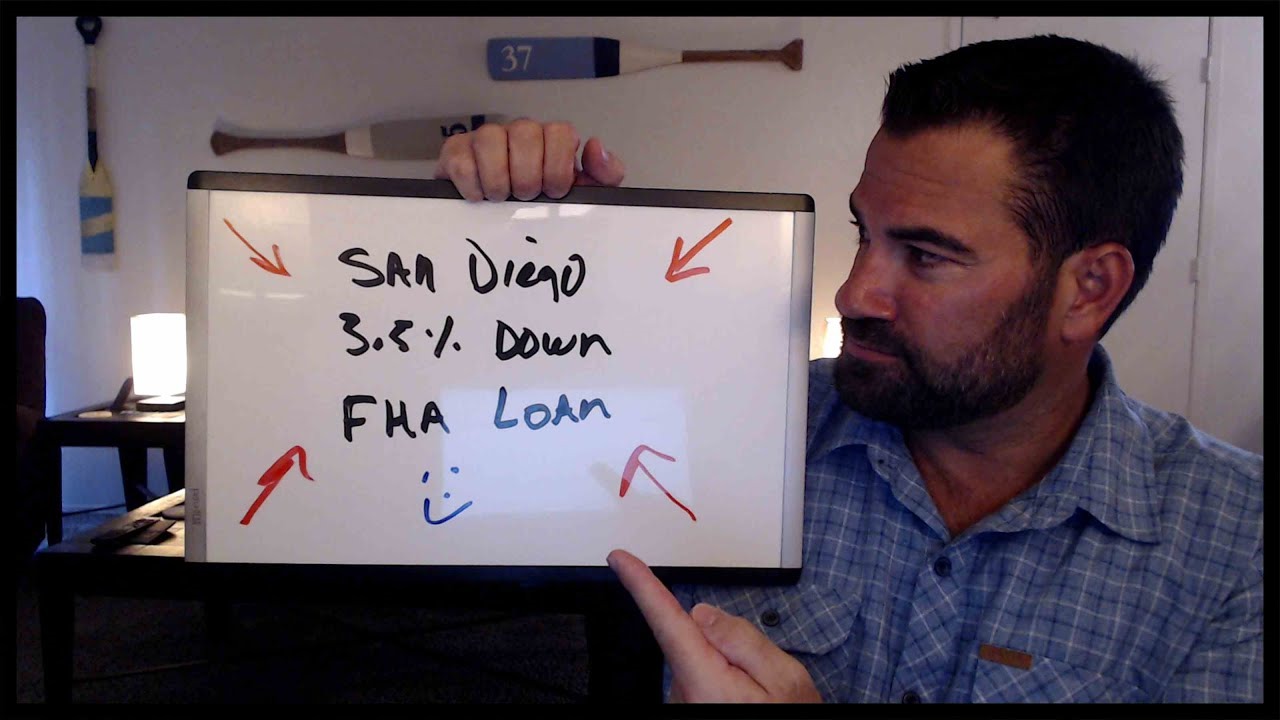

3. San Diego 3.5% Down FHA Home Loan (Updated Numbers and ...

https://www.sandiegorealestatehunter.com/blog/san-diego-fha-home-loan/ Jul 13, 2022 ... The minimum down payment needed for an fha loan up to a $879,750 loan amount is 3.5%. ➡️ Secret #2: Even if you have had a short sale, ...

Jul 13, 2022 ... The minimum down payment needed for an fha loan up to a $879,750 loan amount is 3.5%. ➡️ Secret #2: Even if you have had a short sale, ...

4. FHA Loans in San Diego | FHA Loan Professional CA 92121

https://www.sandiegohomelender.com/home-loans/fha-loan/ San Diego FHA Loan Benefits and Features · Your down payment could be as low as 3.5%. · There is no limit on borrower income, and there is also more flexibility ...

San Diego FHA Loan Benefits and Features · Your down payment could be as low as 3.5%. · There is no limit on borrower income, and there is also more flexibility ...

5. Why Choose an FHA Loan in San Diego - San Diego Mortgage Broker

https://www.sandiegomortgagenews.net/san-diego-fha-loans/ A San Diego FHA Loan (Federal Housing Administration) is a government program that allows a borrower to purchase a home with as little as 3.5% down payment ...

A San Diego FHA Loan (Federal Housing Administration) is a government program that allows a borrower to purchase a home with as little as 3.5% down payment ...

6. County of San Diego's First-Time Homebuyer Down Payment and ...

https://www.fha.com/first-time-home-buyers-program/county-of-sandiego-first-time-homebuyer-program NOTICE: Some FHA mortgage lenders are substantially raising FICO score requirements ... The San Diego Housing Commission (SDHC) aims to assist low- and ...

NOTICE: Some FHA mortgage lenders are substantially raising FICO score requirements ... The San Diego Housing Commission (SDHC) aims to assist low- and ...

7. San Diego Housing Commission First-Time Homebuyer Programs

https://www.sdhc.org/housing-opportunities/first-time-homebuyers/ The San Diego Housing Commission (SDHC) offers deferred loans, homeownership grants, and mortgage credit certificates to help low- and moderate-income ...

The San Diego Housing Commission (SDHC) offers deferred loans, homeownership grants, and mortgage credit certificates to help low- and moderate-income ...

8. FHA Loan Limits for CALIFORNIA

https://www.fha.com/lending_limits_state?state=CALIFORNIA FHA loans are designed for low to moderate income borrowers who are unable to make a large down payment. ... SAN DIEGO-CHULA VISTA-CARLSBAD, CA.

FHA loans are designed for low to moderate income borrowers who are unable to make a large down payment. ... SAN DIEGO-CHULA VISTA-CARLSBAD, CA.

9. FHA Mortgage Loans San Diego | National Home Loans

https://www.nationalhomeloans.com/fha-mortgage-loans/ San Diego FHA Loan Eligibility Requirements · Credit score higher than 500 · Ability to cover 3.5% down payment · Reasonable debt-to-income ratio · Home must be the ...

San Diego FHA Loan Eligibility Requirements · Credit score higher than 500 · Ability to cover 3.5% down payment · Reasonable debt-to-income ratio · Home must be the ...

10. FHA Approved Condos for sale San Diego | FHA Approved Homes ...

https://www.homesalessandiego.com/fha-approved-condos/ FHA Approved Condo List in San Diego. FHA approved condos. The FHA loan is the most popular loan program for first time home buyers.

FHA Approved Condo List in San Diego. FHA approved condos. The FHA loan is the most popular loan program for first time home buyers.

What is the minimum credit score for an FHA loan in San Diego?

The minimum credit score for an FHA loan in San Diego is 580. However, depending on the lender, it may vary slightly and require a higher score of 620 or 640.

What are the benefits of an FHA loan?

An FHA loan offers several advantages over conventional loans including lower down payments (as low as 3%), more lenient income and credit requirements, and flexible closing costs. Borrowers also have access to additional assistance programs which can help cover expenses related to closing costs and other fees associated with buying a home through an FHA loan.

How long does it take to get approved for an FHA loan in San Diego?

Generally speaking, it takes about 30 days to get approved for an FHA loan in San Diego due to the required paperwork processing time and waiting period once the application has been submitted.

What documents are needed when applying for an FHA loan?

Common documents needed when applying for an FHA Loan include paystubs, W2s or 1099s showing proof of employment/income over two years; tax returns; banking statements; recent utility bills; driver's license; signed contract from seller; appraisal; and homeowner's insurance policy information if applicable.

Conclusion:

An FHA loan is one of the most popular options for people looking to purchase a home in San Diego because of its many benefits such as low down payment requirements, more lenient credit and income scores compared to conventional loans, and flexible closing costs assistance programs available as well as other important features that make this type of mortgage very attractive. With all these advantages at hand, it’s easy to see why acquiring an FHA Loan makes sense!