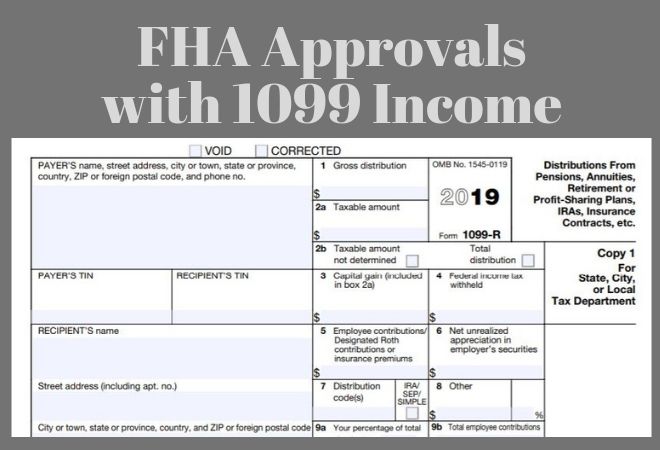

FHA (Federal Housing Administration) Loans are an attractive form of loan for independent contractors. They are designed to help individuals with weak credit or small down payments purchase a home. The FHA provides insurance on qualified mortgages, allowing lenders to offer more favorable terms to eligible borrowers who might not otherwise qualify for a conventional mortgage.

Table Of Content:

- FHA Loan with 1099 Income - FHA Lenders

- FHA Loan Guidelines Self Employed Buyers | FHA Mortgage Source

- How to Get a Mortgage with 1099 Income - Luxury Mortgage

- Self-employed mortgage borrower? Here are the rules

- Self-Employed, Contractor, Or Employee? It Matters When You ...

- Section D. Borrower Employment and Employment Related Income ...

- FHA Loan Myths -- The Self-employed and FHA Loan Qualification

- Home Loans for Independent Contractors - Non-Prime Lenders ...

- W-2 vs. 1099 Compensation Not so Fuzzy After All

- How To Get A Mortgage When Self-Employed | Bankrate

1. FHA Loan with 1099 Income - FHA Lenders

https://fhalenders.com/fha-loan-with-1099-income/ If you earn 1099 income as an independent contractor, freelance worker or a salesman, you can qualify for an FHA loan if you can document steady 1099 income ...

If you earn 1099 income as an independent contractor, freelance worker or a salesman, you can qualify for an FHA loan if you can document steady 1099 income ...

2. FHA Loan Guidelines Self Employed Buyers | FHA Mortgage Source

https://www.fhamortgagesource.com/fha-loan-guidelines-self-employed-buyers/ FHA guidelines for someone considered an independent contractor will require copies of the most recent year's 1099s. Someone who is considered an independent ...

FHA guidelines for someone considered an independent contractor will require copies of the most recent year's 1099s. Someone who is considered an independent ...

3. How to Get a Mortgage with 1099 Income - Luxury Mortgage

https://luxurymortgage.com/get-mortgage-1099-income/ Jan 29, 2021 ... More and more people are working as independent contractors, freelancers, ... FHA loans (mortgages backed by the Federal Housing ...

Jan 29, 2021 ... More and more people are working as independent contractors, freelancers, ... FHA loans (mortgages backed by the Federal Housing ...

4. Self-employed mortgage borrower? Here are the rules

https://themortgagereports.com/18303/mortgage-self-employed-1099-business-get-approved Proving your cash flow as a business owner, contractor, freelancer, or gig worker can ... Avoiding PMI can save you a lot compared to, say, an FHA mortgage.

Proving your cash flow as a business owner, contractor, freelancer, or gig worker can ... Avoiding PMI can save you a lot compared to, say, an FHA mortgage.

5. Self-Employed, Contractor, Or Employee? It Matters When You ...

https://www.fhanewsblog.com/self-employed-contractor-or-employee-it-matters-when-you-apply-for-an-fha-loan/ Jul 21, 2015 ... ... FHA loan questions regarding the difference between workers who act as independent contractors and those who work as employees.

Jul 21, 2015 ... ... FHA loan questions regarding the difference between workers who act as independent contractors and those who work as employees.

6. Section D. Borrower Employment and Employment Related Income ...

https://www.hud.gov/sites/documents/4155-1_4_SECD.PDFMar 1, 2011 ... Income Analysis: Individual Tax Returns (IRS. Form 1040). 4-D-17 ... To be eligible for a mortgage, FHA does not require a minimum length of.

7. FHA Loan Myths -- The Self-employed and FHA Loan Qualification

https://www.fha.com/fha_article?id=63 Apr 28, 2017 ... Your FHA loan application requires you to show not only that you were gainfully employed, but also what your net income was compared to business ...

Apr 28, 2017 ... Your FHA loan application requires you to show not only that you were gainfully employed, but also what your net income was compared to business ...

8. Home Loans for Independent Contractors - Non-Prime Lenders ...

https://www.nonprimelenders.com/home-loans-for-contractors/ If you work as an independent contractor, you will want to review mortgage information that pertains to your unique employment. Contractors may still be ...

If you work as an independent contractor, you will want to review mortgage information that pertains to your unique employment. Contractors may still be ...

9. W-2 vs. 1099 Compensation Not so Fuzzy After All

https://www.innovativemlo.com/w-2-vs-1099-compensation-not-so-fuzzy-after-all Oct 17, 2020 ... Direct Endorsement (DE) lenders that write FHA loans must be ... as a 1099 independent contractor, the contractor becomes responsible for ...

Oct 17, 2020 ... Direct Endorsement (DE) lenders that write FHA loans must be ... as a 1099 independent contractor, the contractor becomes responsible for ...

10. How To Get A Mortgage When Self-Employed | Bankrate

https://www.bankrate.com/mortgages/self-employed-how-to-get-a-mortgage/ Jun 2, 2022 ... If you run your own business — or are a gig worker or independent contractor — and you want to buy a home or refinance, it could be more ...

Jun 2, 2022 ... If you run your own business — or are a gig worker or independent contractor — and you want to buy a home or refinance, it could be more ...

What kind of credit score do I need to be eligible for an FHA loan?

Generally, an applicant must have a credit score of at least 580 to receive an FHA loan. This score may be lower depending on the specific lender and their guidelines.

Do I need to provide any documentation as an independent contractor?

Yes, you will need to provide evidence that you have been working as an independent contractor regularly for the past two years in order to qualify for an FHA loan. You'll also likely need to provide bank statements or tax returns demonstrating your income during this time period.

Does the FHA offer special programs for first-time home buyers?

Yes, the FHA has several special programs specifically designed for first-time home buyers, including down payment assistance and closing cost assistance. In addition, first-time home buyers may only need 3.5% down instead of the standard 10%.

Conclusion:

FHA loans are designed to make homeownership accessible and affordable for those with limited resources, including independent contractors who may have difficulty qualifying through traditional routes. With attractive rates and flexible requirements, these loans can be a great way to get into your first home without spending much upfront.