Exeter Finance LLC, a leading automobile loan lender and servicer, is facing a lawsuit filed in 2022 that could affect more than half-a-million of their customers. The lawsuit alleges that Exeter Finance charged excessive rates and deceptive practices for borrowers who received consumer automobile loans from the company. This article will explain the details of the lawsuit, potential implications for consumers, and frequently asked questions about the case.

Table Of Content:

- Exeter Finance Corp | Complaints | Better Business Bureau® Profile

- Exeter Finance - Franchise & Independent Dealership Financing ...

- Case 8:21-cv-02371-VMC-JSS Document 49 Filed 02/04/22 Page 1 ...

- Healey: More than 3,000 could get relief from auto loan settlement

- In Largest Settlement of Its Kind, AG Healey Secures $27 Million for ...

- Exeter Finance Auto Loan Reviews 2022 | Credit Karma

- Henderson v Exeter Finance, LLC et al | 1:21-CV-03258 | Court ...

- Exeter Finance Corporation EFC Collection Complaints. Stop the calls

- Federal Court Denies Class Certification in TCPA Suit Against Auto ...

- Attorney General Jennings Secures Relief for Consumers in ...

1. Exeter Finance Corp | Complaints | Better Business Bureau® Profile

https://www.bbb.org/us/tx/irving/profile/loans/exeter-finance-corp-0875-90225713/complaints View customer complaints of Exeter Finance Corp, BBB helps resolve disputes with the ... June 16, 2022 Better Business Bureau of Metropolitan Dallas, ...

View customer complaints of Exeter Finance Corp, BBB helps resolve disputes with the ... June 16, 2022 Better Business Bureau of Metropolitan Dallas, ...

2. Exeter Finance - Franchise & Independent Dealership Financing ...

https://www.exeterfinance.com/ Exeter Finance offers franchise & independent dealership financing and subprime auto lending to credit-challenged customers. Our partnership with dealers, ...

Exeter Finance offers franchise & independent dealership financing and subprime auto lending to credit-challenged customers. Our partnership with dealers, ...

3. Case 8:21-cv-02371-VMC-JSS Document 49 Filed 02/04/22 Page 1 ...

https://buckleyfirm.com/sites/default/files/Buckley%20InfoBytes%20-%20Brown%20v.%20TransUnion%2C%20LLC%20et%20al%20-%20Order%202022.02.04.pdfFeb 4, 2022 ... Finance, LLC on December 27, 2021. (Doc. # 35). Plaintiff. Shekevia Brown responded on January 17, 2022, and Exeter filed.

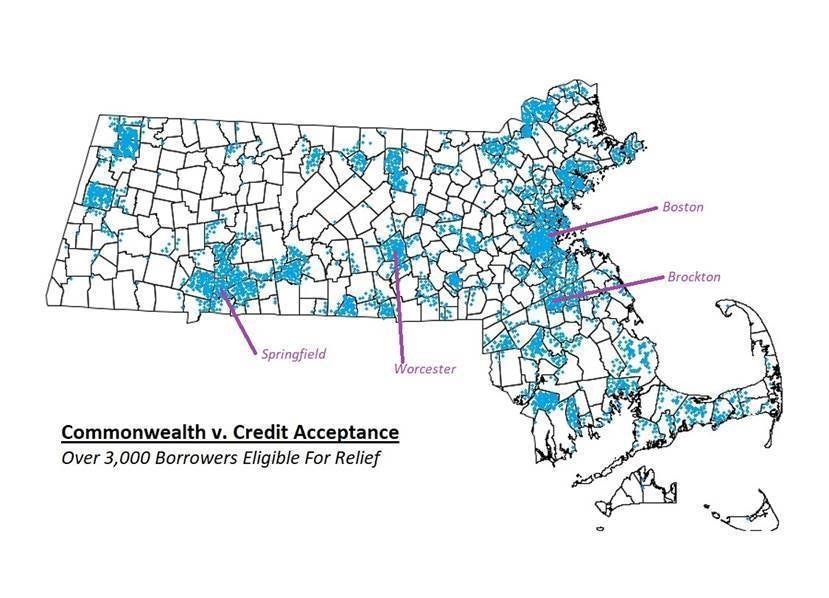

4. Healey: More than 3,000 could get relief from auto loan settlement

https://www.patriotledger.com/story/news/2021/09/01/healey-more-than-3-000-could-get-relief-auto-loan-settlement/5685225001/ Sep 1, 2021 ... Healey, who has secured similar settlements with Exeter Finance and Santander over their auto loan practices, described the Credit ...

Sep 1, 2021 ... Healey, who has secured similar settlements with Exeter Finance and Santander over their auto loan practices, described the Credit ...

5. In Largest Settlement of Its Kind, AG Healey Secures $27 Million for ...

https://www.mass.gov/news/in-largest-settlement-of-its-kind-ag-healey-secures-27-million-for-thousands-of-massachusetts-consumers-from-subprime-auto-lender Sep 1, 2021 ... Specifically, the lawsuit alleged that CAC made high-interest ... In 2019, she reached a $5.5 million settlement with Exeter Finance for its ...

Sep 1, 2021 ... Specifically, the lawsuit alleged that CAC made high-interest ... In 2019, she reached a $5.5 million settlement with Exeter Finance for its ...

6. Exeter Finance Auto Loan Reviews 2022 | Credit Karma

https://www.creditkarma.com/reviews/auto-loan/single/id/ExeterFinance See if a Exeter Finance auto loan could be right for you by reading ratings and reviews from customers and our editors.

See if a Exeter Finance auto loan could be right for you by reading ratings and reviews from customers and our editors.

7. Henderson v Exeter Finance, LLC et al | 1:21-CV-03258 | Court ...

https://unicourt.com/case/pc-db5-henderson-v-exeter-finance-llc-et-al-935202 Case Summary. On 06/17/2021 Henderson filed a Finance - Consumer Credit lawsuit against Exeter Finance , LLC. This case was filed in U.S. District Courts ...

Case Summary. On 06/17/2021 Henderson filed a Finance - Consumer Credit lawsuit against Exeter Finance , LLC. This case was filed in U.S. District Courts ...

8. Exeter Finance Corporation EFC Collection Complaints. Stop the calls

https://lemberglaw.com/exeter-finance-corporation-efc-collection-complaints/ Since March 2015, the Consumer Financial Protection Bureau (CFPB) has received 145 complaints about EFC . Justia lists at least 12 cases of civil litigation ...

Since March 2015, the Consumer Financial Protection Bureau (CFPB) has received 145 complaints about EFC . Justia lists at least 12 cases of civil litigation ...

9. Federal Court Denies Class Certification in TCPA Suit Against Auto ...

https://www.burr.com/blogs/consumer-finance-litigation/2017/12/04/federal-court-denies-class-certification-in-tcpa-suit-against-auto-lender-exeter-finance/ Dec 4, 2017 ... Exeter is an automobile finance company that purchases retail installment ... were not “apt to drive the resolution of the litigation.

Dec 4, 2017 ... Exeter is an automobile finance company that purchases retail installment ... were not “apt to drive the resolution of the litigation.

10. Attorney General Jennings Secures Relief for Consumers in ...

https://news.delaware.gov/2019/04/08/attorney-general-jennings-secures-relief-for-consumers-in-subprime-auto-loan-settlement/ Apr 8, 2019 ... An auto finance company operating in Delaware, Exeter Finance LLC, ... consumer relief for its role in financing subprime auto loans to ...

Apr 8, 2019 ... An auto finance company operating in Delaware, Exeter Finance LLC, ... consumer relief for its role in financing subprime auto loans to ...

What is the lawsuit against Exeter Finance alleging?

The lawsuit alleges that Exeter finance overcharged borrowers on their consumer automobile loans with undisclosed fees and excessive interest rates. It also claims that they used deceptive means to collect payments from borrowers without informing them of their rights to defer those payments.

How many people are affected by this lawsuit?

Over 500,000 customers across all 50 states are estimated to have been impacted by this alleged misconduct by Exeter Finance.

Are there any potential remedies for affected borrowers?

If the plaintiffs are successful in their case, affected customers may be eligible for refunds on overpaid fees and/or interest charges resulting from this alleged misconduct by Exeter Finance. Additionally, any false or misleading statements made to these customers during collection proceedings may result in penalties or damages being awarded as well.

When will a decision be announced regarding this lawsuit?

The court has yet to issue any official ruling but involved parties have anticipated a resolution sometime near the end of 2022.

How can I determine if I am eligible for assistance under this lawsuit?

If you have received an automobile loan from Exeter Finance between 2014-2020, you may wish to consult a lawyer or contact your state attorney general's office about your rights under this case.

Conclusion:

Understanding your legal rights concerning this case is important for anyone who has taken out an auto loan from Exeter finance between 2014-2020. Keep an eye out for updates concerning this ongoing legal battle - as a resolution is expected sometime towards the end of 2022 - as it contains potential remedies that could benefit affected borrowers throughout all 50 states significantly.