This estate assets and liabilities spreadsheet provides a comprehensive overview of your financial situation. It gives you the ability to track your assets, liabilities, and net worth over time. It can help you identify areas where you might need to focus more attention in order to improve your financial standing. With this invaluable tool, you can make sure that your assets and liabilities are properly managed so that you can better plan for your future.

Table Of Content:

- Estate Inventory Workbook

- Probate inventory

- Simple Executor Checklists & Tools for a Deceased Estate

- Estate Planning Checklist | Charles Schwab

- Estate Liquidation Form and Inventory Spreadsheet - Schneider Legal

- Assets & Liabilities Worksheet

- Equitable Distribution Spreadsheet User Guide v36

- How to Probate an Estate: Inventory, Documents, and Assets

- Assets and liabilities worksheet for couples - Canada.ca

- Estate & Divorce Division Help Docs, free spreadsheets

1. Estate Inventory Workbook

https://www.bmo.com/estate/Executors%20Inventory%20Workbook%20-%20English.pdfOne of the key tasks as the executor of an estate is to establish a list of the estate's assets and liabilities. To assist with this task, we have created ...

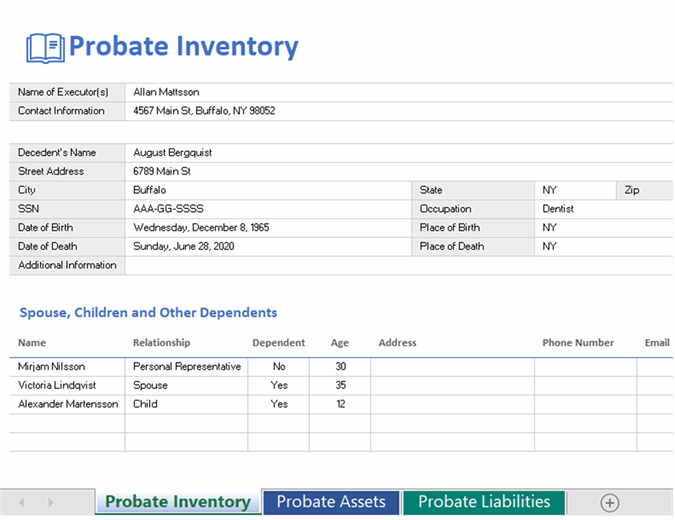

2. Probate inventory

https://templates.office.com/en-us/probate-inventory-tm33996222 Use our probate inventory template spreadsheet to record the details you need to settle an estate. This is an accessible estate inventory template.

Use our probate inventory template spreadsheet to record the details you need to settle an estate. This is an accessible estate inventory template.

3. Simple Executor Checklists & Tools for a Deceased Estate

https://www.simplyestate.com.au/services/executor-checklists-tools/ The simplyEstate Assets & Liabilities Inventory is a simple estate spreadsheet Executors use to capture everything belonging to a deceased person.

The simplyEstate Assets & Liabilities Inventory is a simple estate spreadsheet Executors use to capture everything belonging to a deceased person.

4. Estate Planning Checklist | Charles Schwab

https://www.schwab.com/estate-planning/estate-planning-checklist List all liabilities, including mortgages, lines of credit, and other debt. What you can do now: Use our Asset Inventory worksheet for a consolidated view ...

List all liabilities, including mortgages, lines of credit, and other debt. What you can do now: Use our Asset Inventory worksheet for a consolidated view ...

5. Estate Liquidation Form and Inventory Spreadsheet - Schneider Legal

https://schneiderlegal.com/estate-liquidation-form/

(3) a listing of valuable documents. It also contains a statement of liabilities and concludes with a recapitulation of assets and liabilities. The inventory is ...

6. Assets & Liabilities Worksheet

https://lsggroup.com/wp-content/uploads/2015/04/15fADV-Assets-Liabilities-Worksheet-120726.pdf

Assets & Liabilities Worksheet. Page 1 of 3 ... Other Real Estate. Second Residence ... Balance. Primary Mortgage. 2 nd. Mortgage/HEL. Other Real Estate.

7. Equitable Distribution Spreadsheet User Guide v36

https://ninthcircuit.org/sites/default/files/Equitable-Distribution-Spreadsheet-User-Guide-v36.docx

The Equitable Distribution Spreadsheet organizes assets, liabilities and ... in Florida Statute 61.075 (pre-marital real estate for example) information ...

8. How to Probate an Estate: Inventory, Documents, and Assets

https://www.thebalance.com/step-by-step-guide-how-to-probate-an-estate-3505261/stk318047rkn-F-57a6446a3df78cf4591b5896.jpg) Value the Decedent's Assets. Decedent home is included in an estate executor spreadsheet. Ed ...

Value the Decedent's Assets. Decedent home is included in an estate executor spreadsheet. Ed ...

9. Assets and liabilities worksheet for couples - Canada.ca

https://www.canada.ca/en/financial-consumer-agency/services/living-as-couple/asset-liability-worksheet.html Oct 25, 2017 ... The assets and liabilities worksheet below can help you with this by showing you both your individual and combined net worth.

Oct 25, 2017 ... The assets and liabilities worksheet below can help you with this by showing you both your individual and combined net worth.

10. Estate & Divorce Division Help Docs, free spreadsheets

https://www.fairsplit.com/help-docs/

Dividing personal property and assets info and spreadsheets. Docs provide guidance to help divorcing couples or heirs with property division and settlement.

What type of information can I track with an estate asset and liability spreadsheet?

An estate asset and liability spreadsheet allows you to track your assets (such as bank accounts, stocks, real estate investments, etc.), liabilities (debts that are owed), and net worth over time. This helps you keep tabs on your financials so that you can better plan for the future.

How often should I update my estate asset and liability spreadsheet?

Your estate asset and liability spreadsheet should be updated at least once a month. This will ensure that all of the information is accurate and up-to-date so that you have an accurate view of your financial situation at any given point in time.

Can an estate asset and liability spreadsheet help me make better decisions?

Yes! By tracking your assets, liabilities, and net worth over time using an estate asset and liability spreadsheet, it can help you identify areas where improvements could be made or adjustments need to be made in order to benefit from certain opportunities. This makes it easier for you to make smarter decisions when it comes to managing your money and planning for the future.

What other uses does an estate asset and liability spreadsheet have?

In addition to providing visibility into your finances over time, an estate asset and liability spreadsheet also allows easier comparison of various scenarios by enabling “what if” scenarios such as optimizing retirement contributions or budgeting scenarios based on different retirement vehicles. Therefore, this helpful tool not only enables visibility but also helps generate ideas on how best to maximize assets while keeping current debts under control.

Is an Estate Asset & Liability Spreadsheet secure?

Yes! All the data stored in the Estate Asset & Liability Spreadsheet is confidential between client & accountant; depending on which platform is used it is possible to set access levels for additional users if needed too such as family members or advisors who may also need access without compromising security of individual account details & information.

Conclusion:

The use of an Estate Assets & Liabilities Spreadsheet provides a valuable view into one’s finances enabling easy tracking of both assets & liabilities allowing individuals/families/businesses better understanding their overall financial position introducing transparency in regards thereto allowing them to make informed / educated decisions about their finances moving forward taking their long-term goals into consideration thereby helping them potentially achieve those goals faster or reduce risk associated with potential negative impacts due unforeseen events like market fluctuations etc..