Disney Call Options are investment contracts that give the holder the right to purchase Disney shares at a predetermined price in the future. These options provide investors with an opportunity to make money from stock market volatility and manage their risk by buying a lower-cost contract and hoping that Disney's share price will move higher. With Disney Call Options, you can benefit no matter what direction Disney's stock is heading.

Table Of Content:

- DIS - Walt Disney Company Stock Options Prices - Barchart.com

- Walt Disney Company (The) Common Stock (DIS) Option Chain ...

- The Walt Disney Company (DIS) Options Chain - Yahoo Finance

- This is how one trader made millions on Disney

- DIS | Walt Disney Co. Options | MarketWatch

- Disney Option Traders Mildly Bullish

- DIS Options Chain | Walt Disney Put and Call Options

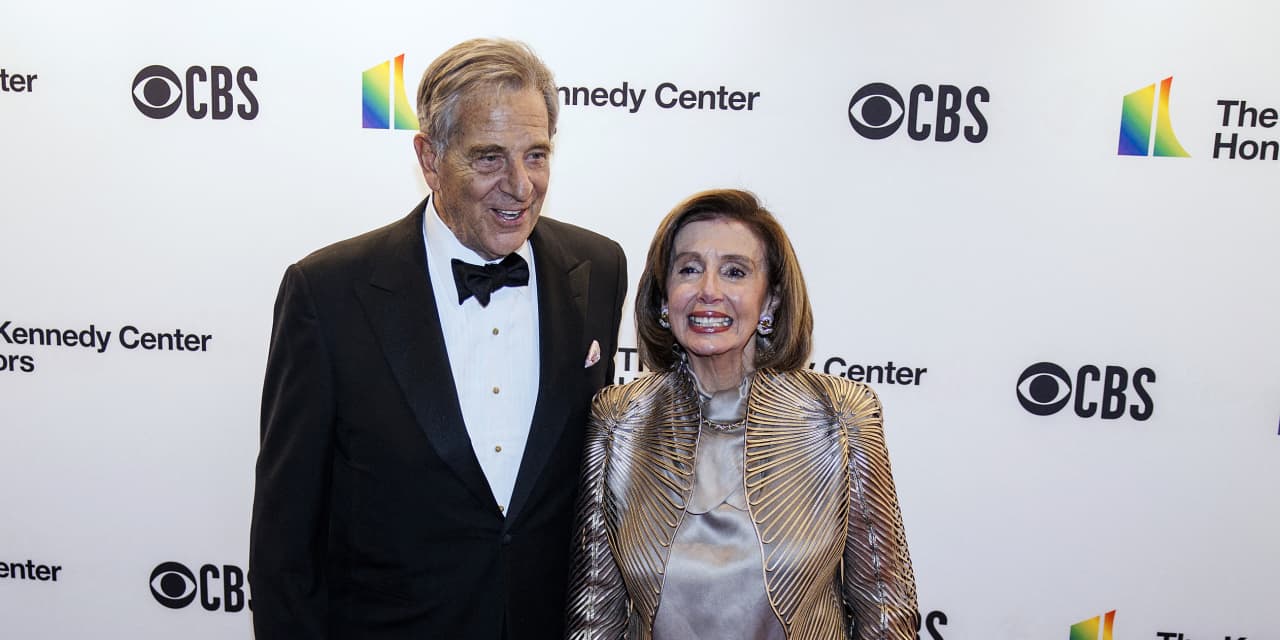

- Pelosi's husband bought Google, Disney call options that would pay ...

- Nancy Pelosi buys call options for Google, Disney stocks

- Nancy Pelosi buys millions in call options in Google, Disney, others ...

1. DIS - Walt Disney Company Stock Options Prices - Barchart.com

https://www.barchart.com/stocks/quotes/DIS/options Strike: The price at which the contract can be exercised. Strike prices are fixed in the contract. For call options, the strike price is where the shares can be ...

Strike: The price at which the contract can be exercised. Strike prices are fixed in the contract. For call options, the strike price is where the shares can be ...

2. Walt Disney Company (The) Common Stock (DIS) Option Chain ...

https://www.nasdaq.com/market-activity/stocks/dis/option-chain

Call and put options are quoted in a table called a chain sheet. The chain sheet shows the price, volume and open interest for each option strike price and ...

3. The Walt Disney Company (DIS) Options Chain - Yahoo Finance

https://finance.yahoo.com/quote/dis/options/ View the basic DIS option chain and compare options of The Walt Disney Company on Yahoo Finance. ... In The Money. Show:ListStraddle. CallsforAugust 5, 2022 ...

View the basic DIS option chain and compare options of The Walt Disney Company on Yahoo Finance. ... In The Money. Show:ListStraddle. CallsforAugust 5, 2022 ...

4. This is how one trader made millions on Disney

https://www.cnbc.com/2015/04/20/this-is-how-one-trader-made-millions-on-disney.html Apr 20, 2015 ... Since a call represents the right to buy a stock for a certain price at a given time, owning those calls granted the options holder the right to ...

Apr 20, 2015 ... Since a call represents the right to buy a stock for a certain price at a given time, owning those calls granted the options holder the right to ...

5. DIS | Walt Disney Co. Options | MarketWatch

https://www.marketwatch.com/investing/stock/dis/options Walt Disney Co. options data by MarketWatch. View DIS option chain data and pricing information for given maturity periods. ... Calls. Expires Aug 5, 2022.

Walt Disney Co. options data by MarketWatch. View DIS option chain data and pricing information for given maturity periods. ... Calls. Expires Aug 5, 2022.

6. Disney Option Traders Mildly Bullish

https://www.investopedia.com/disney-option-traders-mildly-bullish-5218487/0723ZQ_0435MS-scaled-68c58347222c41c2bfea56507598eb34.jpg) Feb 8, 2022 ... A growing number of call options remain in the open interest for Disney stock, and option premiums are unusually high ahead of earnings.

Feb 8, 2022 ... A growing number of call options remain in the open interest for Disney stock, and option premiums are unusually high ahead of earnings.

7. DIS Options Chain | Walt Disney Put and Call Options

https://www.marketbeat.com/stocks/NYSE/DIS/options/ Walt Disney (DIS) Options Chain & Prices ; Today's Range: $105.20 · $106.35 ; 50-Day Range: $91.84 · $110.87 ; 52-Week Range: $90.23 · $187.58.

Walt Disney (DIS) Options Chain & Prices ; Today's Range: $105.20 · $106.35 ; 50-Day Range: $91.84 · $110.87 ; 52-Week Range: $90.23 · $187.58.

8. Pelosi's husband bought Google, Disney call options that would pay ...

https://www.marketwatch.com/story/pelosis-husband-bought-google-disney-call-options-that-would-pay-off-if-bull-market-continues-11640894240

9. Nancy Pelosi buys call options for Google, Disney stocks

https://nypost.com/2021/12/30/nancy-pelosi-buys-call-options-for-google-disney-stocks/ Dec 30, 2021 ... The Pelosi family's trades this month include Google and Salesforce call options worth between $500,000 and $1 million each, as well as Roblox ...

Dec 30, 2021 ... The Pelosi family's trades this month include Google and Salesforce call options worth between $500,000 and $1 million each, as well as Roblox ...

10. Nancy Pelosi buys millions in call options in Google, Disney, others ...

https://seekingalpha.com/news/3784178-house-speaker-nancy-pelosi-buys-millions-of-dollars-in-call-options-in-google-disney-others Dec 30, 2021 ... ... have purchased millions of dollars in call options in several technology stocks, including Google (GOOGL), Roblox (RBLX) and Disney...

Dec 30, 2021 ... ... have purchased millions of dollars in call options in several technology stocks, including Google (GOOGL), Roblox (RBLX) and Disney...

How do I know if buying a Disney call option is right for me?

You should consider your individual financial goals and risk tolerance when deciding whether to invest in a Disney call option. Investing in call options can be beneficial as they provide protection against loss in the event of a market downturn, however they also carry significant risks due to their leveraged nature. Additionally, you should research factors such as current market conditions, news concerning individual companies, and analyst reports that may affect how well you believe the stock will perform.

What happens if I don't exercise my call option?

If you choose not to exercise your Disney call option then it will expire with no value and you will lose the price of the premium paid for it. A call option's value is derived from time decay (theta) which results in its prices decreasing as it approaches expiration, so even if there was still an expected gain on the underlying asset, if too much time decayed away then it would have no intrinsic value left in order for it to be exercised.

How much do I need to pay when buying a call option?

When purchasing a Disney call option you must pay an upfront fee known as the premium which compensates the seller for taking on additional risk associated with selling this type of contract. The amount of this fee depends on several factors such as underlying stock price, strike price (price at which you have agreed to buy back), time remaining until expiration date (Theta), implied volatility (Vega), and dividend history of underlying asset among others.

When does my Disney call option expire?

The expiration date for your Disney call option contract will depend on when it was purchased but generally tends to range between one week or up until two years from purchase date depending on markets traded in and how long ago it was bought.

Conclusion:

In conclusion, options can be an effective way to reduce your risk while still potentially profiting from any changes in stock prices if used correctly. You should make sure that you understand all of the risks associated with these contracts prior to investing by carefully selecting your options based on factors such as expiry date, implied volatility levels competency forecast etcetera making sure that you do not overextend yourself financially or psychologically. Finally remember that exercising an option prematurely could mean missing out on potential profits due to time decay so simply speculating whether or not an investment is going upwards or downwards may not always be enough.