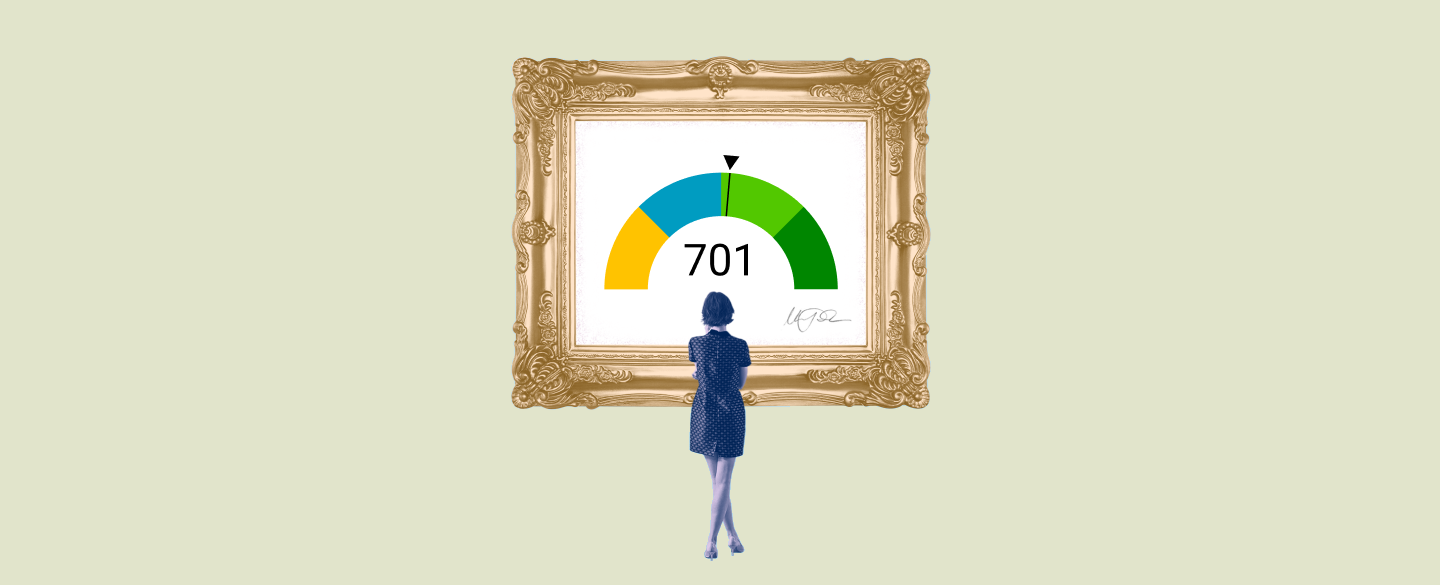

A credit score is an important part of a person’s financial health. It enables lenders and other agencies to assess the individual’s creditworthiness and predict their ability to pay back a loan. A credit score of 701 is considered to be good and is indicative of the individual being financially responsible and reliable.

Table Of Content:

- Going higher than this credit score is a 'waste of time,' expert says

- 701 Credit Score: Is it Good or Bad?

- 701 Credit Score: What Does It Mean? | Credit Karma

- 701 Credit Score

- Is 701 a good credit score? | Lexington Law

- 701 Credit Score (+ #1 Way To Improve it )

- 701 Credit Score: Is it Good or Bad? (Approval Odds)

- 701 Credit Score – Is it Good or Bad? How to Improve Your 701 ...

- Car loan interest rates with 701 credit score in 2022

- 701 Credit Score: Good or Bad? | Credit Card & Loan Options

1. Going higher than this credit score is a 'waste of time,' expert says

https://www.cnbc.com/2018/10/09/going-higher-than-this-credit-score-is-a-waste-of-time-expert-says.html Oct 9, 2018 ... FICO scores range from 300 to 850. While anything below 650 is considered problematic, a score of 700 or above is prime. Once you hit 700 “you ...

Oct 9, 2018 ... FICO scores range from 300 to 850. While anything below 650 is considered problematic, a score of 700 or above is prime. Once you hit 700 “you ...

2. 701 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/701-credit-score/ A 701 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 701 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

3. 701 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/701 Apr 1, 2021 ... A 701 credit score is considered a good credit score by many lenders. ... “Good” score range identified based on 2021 Credit Karma data. A credit ...

Apr 1, 2021 ... A 701 credit score is considered a good credit score by many lenders. ... “Good” score range identified based on 2021 Credit Karma data. A credit ...

4. 701 Credit Score

https://wallethub.com/credit-score-range/701-credit-score/

A 701 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

5. Is 701 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/701 Oct 11, 2021 ... If you have a credit score of 701, you might be asking yourself, “is 701 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 701, you might be asking yourself, “is 701 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

6. 701 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/701-credit-score

7. 701 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/701-credit-score/ Is 701 a good credit score? FICO scores range from 300 to 850. As you can see below, a 701 credit score is considered Good.

Is 701 a good credit score? FICO scores range from 300 to 850. As you can see below, a 701 credit score is considered Good.

8. 701 Credit Score – Is it Good or Bad? How to Improve Your 701 ...

https://www.creditrepairexpert.org/701-credit-score/ How to Improve Your 701 FICO Score. Before you can do anything to increase your 701 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 701 FICO Score. Before you can do anything to increase your 701 credit score, you need to identify what part of it needs to be improved, ...

9. Car loan interest rates with 701 credit score in 2022

https://creditscoregeek.com/good-credit/701/auto/ Find out what auto loan rates your 701 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 701.

Find out what auto loan rates your 701 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 701.

10. 701 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/701/ Nov 11, 2021 ... A credit score of 701 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 701 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

What does a credit score of 701 mean?

A credit score of 701, which falls in the ‘good’ range, indicates that the individual is responsible with their finances and pays back their loans on time. This makes them eligible for better terms when applying for new loans or financial services.

What are some factors that can affect a credit score?

Various factors such as late payments, high balances on existing loans/credit cards, using too much available credit etc. can have an effect on an individual's credit score. It is important to make sure these factors are taken into consideration in order to maintain a good credit score.

Are there any risks associated with having a low credit score?

Yes, having a low credit score can make it difficult to get approved for new lines of credits or other financial services such as mortgages, insurance, etc. This means that such individuals could end up paying higher rates or have limited access to funds when they need them most.

Is it possible to improve my credit rating?

Yes, you can take steps such as making timely payments on all your outstanding bills and debts, keeping your balances low on existing accounts etc., in order to improve your overall credit rating over time.

Conclusion:

Having a good credit score of 701 makes you financially responsible while also giving you access to better terms when applying for new loans or other financial services. However, it is important to always keep track of your personal finances by checking your reports regularly and taking proactive steps in order to improve your overall financial health.