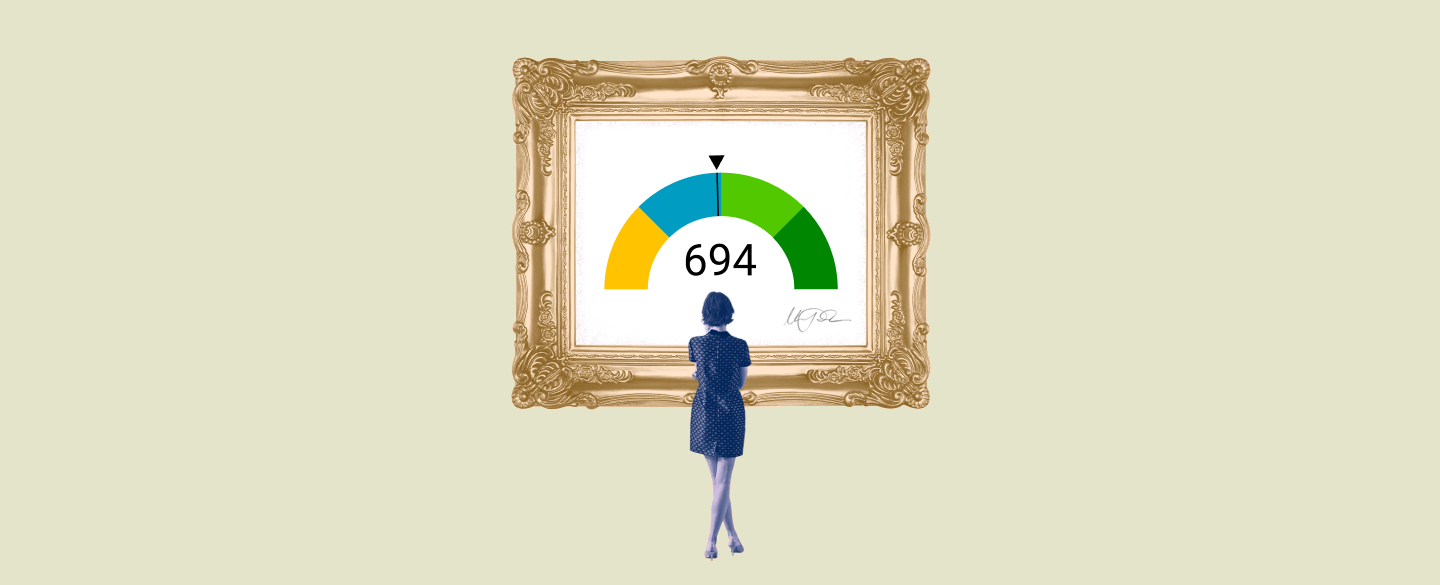

A credit score of 694 is considered to be a good credit score. Generally, people with a score of 694 or higher are eligible for most types of credit products such as loans and cards. This score indicates that the individual has a solid track record when it comes to managing their credit and finances.

Table Of Content:

- 694 Credit Score: Is it Good or Bad?

- Is 694 a good credit score? | Lexington Law

- Is 694 a Good Credit Score? What It Means, Tips & More

- 694 Credit Score: What Does It Mean? | Credit Karma

- Is a 694 credit score okay for a car loan? | Jerry

- 694 Credit Score (+ #1 Way To Improve it )

- 694 Credit Score: Is it Good or Bad? (Approval Odds)

- What Credit Score is Needed to Buy a House? | SmartAsset.com

- Average National VantageScore® Credit Score Continues to ...

- 694 Credit Score – Is it Good or Bad? How to Improve Your 694 ...

1. 694 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/694-credit-score/ A 694 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 694 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

2. Is 694 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/694 Oct 11, 2021 ... If you have a credit score of 694, you might be asking yourself, “is 694 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 694, you might be asking yourself, “is 694 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

3. Is 694 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/694-credit-score/

A credit score of 694 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

4. 694 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/694 Apr 30, 2021 ... A 694 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 694 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

5. Is a 694 credit score okay for a car loan? | Jerry

https://getjerry.com/questions/is-a-694-credit-score-okay-for-a-car-loan![]() Feb 23, 2022 ... A 694 credit score is considered good, meaning that you'll qualify for a fairly good interest rate on most car loans.

Feb 23, 2022 ... A 694 credit score is considered good, meaning that you'll qualify for a fairly good interest rate on most car loans.

6. 694 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/694-credit-score

7. 694 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/694-credit-score/ FICO scores range from 300 to 850. As you can see below, a 694 credit score is considered Good. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 694 credit score is considered Good. Credit Score, Credit Rating, % of population.

8. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

9. Average National VantageScore® Credit Score Continues to ...

https://vantagescore.com/press_releases/average-national-vantagescore-credit-score-continues-to-increase-to-694-up-six-points-from-early-pandemic-levels/ Average National VantageScore® Credit Score Continues to Increase to 694; Up Six Points from Early Pandemic Levels. May 25, 2021 ...

Average National VantageScore® Credit Score Continues to Increase to 694; Up Six Points from Early Pandemic Levels. May 25, 2021 ...

10. 694 Credit Score – Is it Good or Bad? How to Improve Your 694 ...

https://www.creditrepairexpert.org/694-credit-score/ Before you can do anything to increase your 694 credit score, you need to identify what part of it needs to be ... How to Improve Your 694 FICO Score.

Before you can do anything to increase your 694 credit score, you need to identify what part of it needs to be ... How to Improve Your 694 FICO Score.

What type of loan can I get with a 694 credit score?

With a 694 credit score, you may be eligible for most types of loans including auto loans, mortgages, personal loans, and student loans. Your eligibility will depend in part on your income and other factors such as your debt-to-income ratio.

How does my credit score impact my ability to get approved for a loan?

Your credit score plays an important role when it comes to loan approval. Lenders look at your credit history and assess the risk associated with providing you with financing based on how well you have managed your finances in the past. A higher credit score indicates that you are more likely to pay back the loan on time and therefore presents less risk to the lender.

Is it possible to improve my 694 credit score?

Yes, it is possible to improve your 694 credit score by working towards building better financial habits such as paying bills on time, reducing debts, and avoiding taking out too many loans or lines of credit at once. Additionally, you can contact the three major reporting bureaus (Experian, Equifax, TransUnion) directly to dispute any errors or inaccuracies found in their reports.

What other benefits come with having a good credit score?

Having a good credit score provides several benefits including access to lower interest rates from lenders which can help save money over time when borrowing money. Additionally, having good credit can also secure better terms from landlords when applying for rental housing as well as improve chances for employment if employers check prospective candidates' scores during the hiring process.

Conclusion:

A high credit score is beneficial for many reasons and having a 694 or higher scores puts individuals in prime position to take advantage of these opportunities. To keep this high rating and reap its rewards, however, individuals must make sure they continue managing their credits responsibly and make payments on time whenever possible.