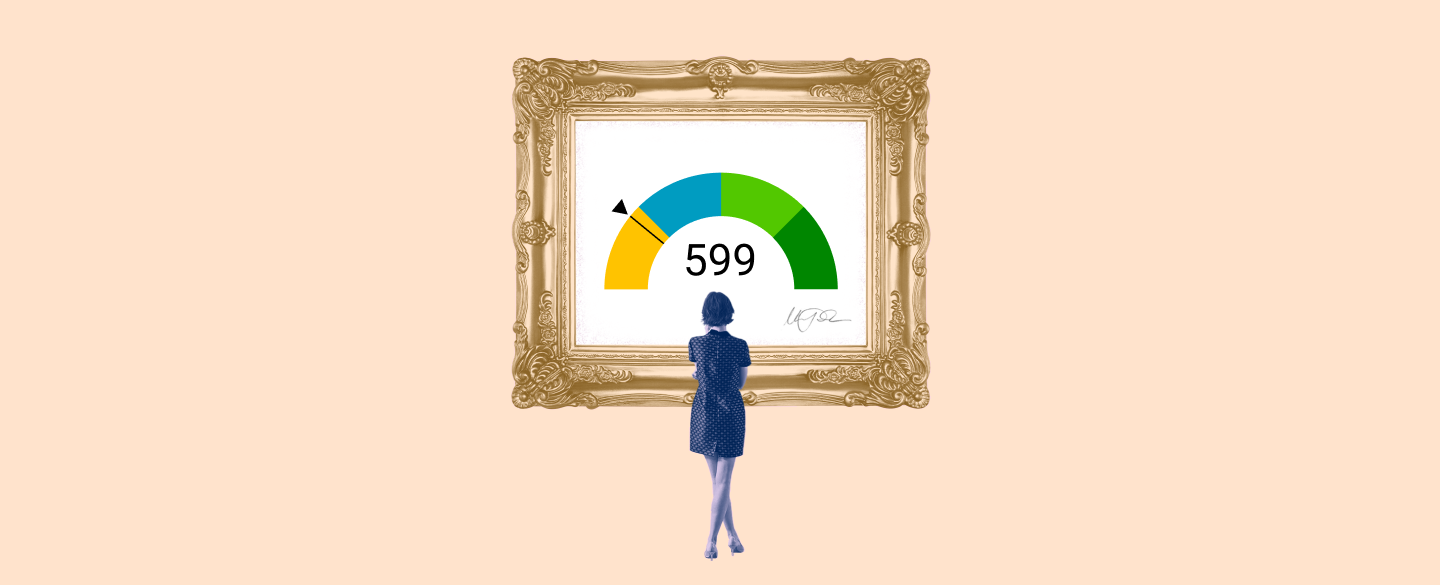

Your credit score is a powerful indicator of your financial health. It represents how reliable you are when it comes to taking out loans and paying them back. If your credit score falls below 600, it is an early red flag that lenders may view you as being less trustworthy than someone with a higher credit score. A credit score of 599 places you at the lower end of the range; however, there are still a few steps you can take to improve your financial situation and improve your credit score.

Table Of Content:

- 599 Credit Score: Is it Good or Bad?

- 599 Credit Score: What Does It Mean? | Credit Karma

- Is 599 a Good Credit Score? Rating, Loans & How to Improve

- Is a 599 credit score good for a car loan? | Jerry

- Is 599 a good credit score? | Lexington Law

- 599 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 599 Credit Score (+ #1 Way To Fix It )

- 599 Credit Score: Good or Bad? | Credit Card & Loan Options

- Best Auto Loan Rates With a Credit Score of 590 to 599

- Is a Fair Credit Score (580 to 669) Good or Bad? | Self.inc

1. 599 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/599-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 599 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 599 FICO® Score is below the average credit score.

2. 599 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/599 Apr 30, 2021 ... A 599 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 599 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. Is 599 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/599-credit-score/

A credit score of 599 isn't “good.” It's not even “fair.” Rather, a 599 credit score is actually considered “bad,” according to the standard 300 to 850 ...

4. Is a 599 credit score good for a car loan? | Jerry

https://getjerry.com/questions/is-a-599-credit-score-good-for-a-car-loan![]() Feb 25, 2022 ... Way to go on the new job! On the credit scale of 300 to 850, a credit score of 599 is considered fair, but it still may be to get approval for a ...

Feb 25, 2022 ... Way to go on the new job! On the credit scale of 300 to 850, a credit score of 599 is considered fair, but it still may be to get approval for a ...

5. Is 599 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/599 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

6. 599 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/599-credit-score-mortgage-lenders-of-2018/ The most common type of loan available to borrowers with a 599 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, ...

The most common type of loan available to borrowers with a 599 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, ...

7. 599 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/599-credit-score

8. 599 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/599/ Nov 9, 2021 ... 599 is a below-average credit score. It's considered “fair” or “poor” by every major credit scoring model. Scores in this range are high ...

Nov 9, 2021 ... 599 is a below-average credit score. It's considered “fair” or “poor” by every major credit scoring model. Scores in this range are high ...

9. Best Auto Loan Rates With a Credit Score of 590 to 599

https://finmasters.com/best-auto-loan-rates-credit-score-590-to-599/ The average interest rate for a new car loan with a credit score of 590 to 599 is 10.87%. Most dealerships will advertise plenty of incentives for buying a new ...

The average interest rate for a new car loan with a credit score of 590 to 599 is 10.87%. Most dealerships will advertise plenty of incentives for buying a new ...

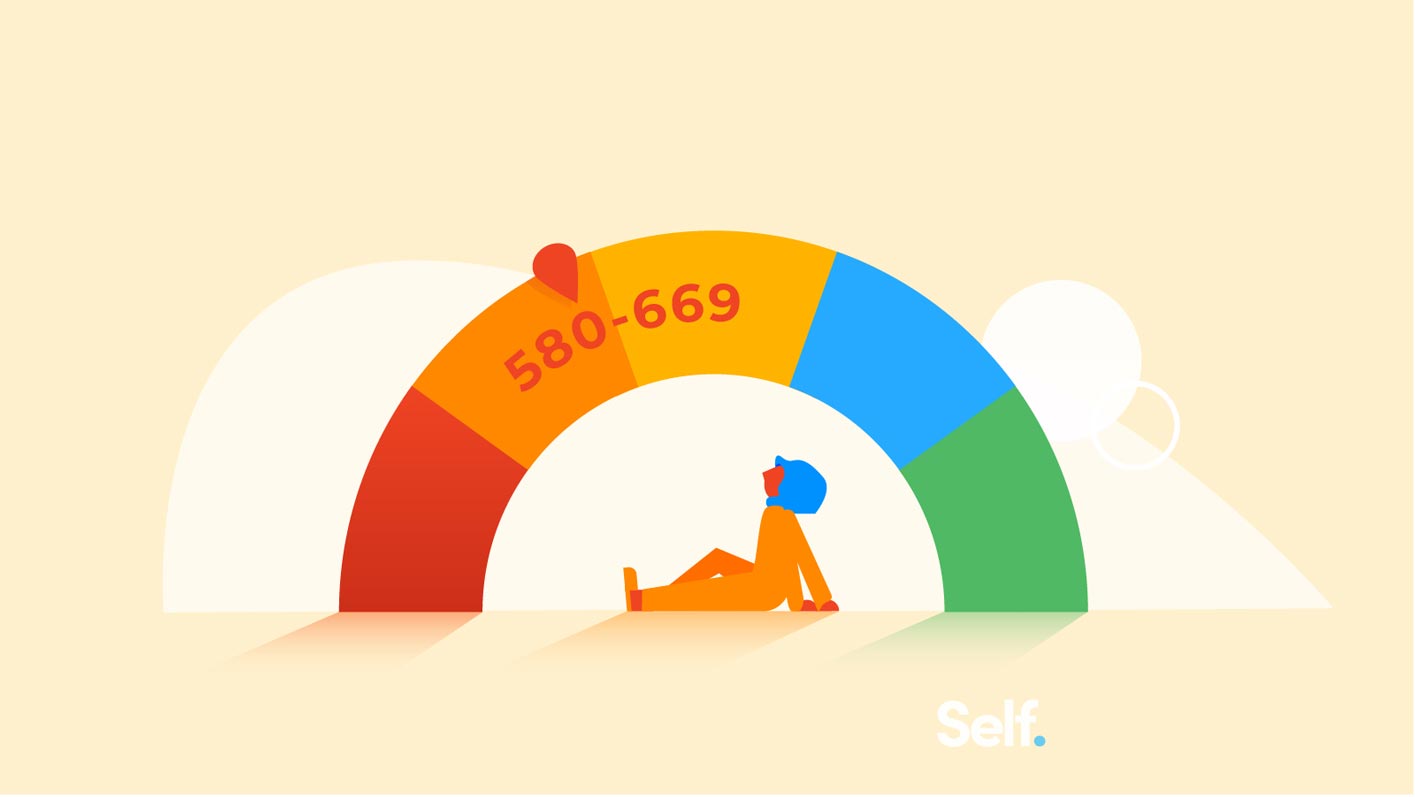

10. Is a Fair Credit Score (580 to 669) Good or Bad? | Self.inc

https://www.self.inc/info/fair-credit-scores-580-669/ While 580 to 599 might seem like a pretty large range, it's considered the bottom end of the Fair range of FICO scores, ...

While 580 to 599 might seem like a pretty large range, it's considered the bottom end of the Fair range of FICO scores, ...

What factors affect my credit score?

Several different factors have an influence on your overall credit score, including payment history, utilization ratio, length of your credit history, type of accounts used and recent inquiries or applications for new lines of credit. Payment history is one of the most important factors and accounts for 35% of your score. Making timely payments on all accounts will have a positive impact on improving overall scores.

How long does it take to improve my credit score?

Improving your credit can take time depending on what you’re trying to accomplish. Minor changes such as consolidating debt or raising the limit on an existing line of credit should result in quicker improvements than more drastic measures like opening a new loan or closing out old accounts. Typically, small actions taken over time will lead to consistent and successful improvement in scores over six months or more.

What action can I take to improve my 599 credit score?

There are several steps that may help increase your 599 score including making sure all bills are paid on time each month, reducing any excessive balances across accounts and keeping any new applications for additional lines of credits at a minimum. Additionally, monitoring reports regularly for errors or inaccurate information is also recommended so corrections can be made as needed.

Conclusion:

Your situation is not hopeless—taking sensible steps towards improving your financial standing can lead to gradual improvements in both short-term stability and long-term success with completing goals such as owning a home or buying a car with much better terms down the road.