Secured cost is a type of financing structure in which money is advanced to an individual or business for a specific purpose, and the borrower agrees to repay the amount of money plus interest over an agreed-upon period of time. Unlike traditional financing structures, secured costs are backed by some sort of collateral, such as real estate or other high-value assets. This form of financing is considerably less risky for lenders than unsecured loans, since the lender can recoup their losses if the borrower defaults on their loan.

Table Of Content:

- ConstructSecure Inc.

- Construct Secure Safety Program | Third-Party Safety Programs

- ConstructSecure Inc.

- Contracting Partner Pricing – Highwire Support Center

- Contracting Partner Benefits & FAQs | Highwire

- AWS Well-Architected - Build secure, efficient cloud applications

- ConstructSecure Pricing 2022

- The High Cost and Diminishing Returns of a Border Wall | American ...

- ConstructSecure Reviews and Pricing 2022

- Estimating the true cost — and worth — of Trump's border wall

1. ConstructSecure Inc.

https://app.constructsecure.com/intelsupplier

How much does the assessment cost? ... Single Client and single trade type: $750. Renewal: Renewal is once a year on the anniversary of your initial enrollment.

2. Construct Secure Safety Program | Third-Party Safety Programs

https://www.uscompliancesystems.com/construct-secure-safety-program The Construct Secure Safety Program is included at NO Additional Cost with Every All-In-One Safety Program System.Here's how it works:You Order Your Safety ...

The Construct Secure Safety Program is included at NO Additional Cost with Every All-In-One Safety Program System.Here's how it works:You Order Your Safety ...

3. ConstructSecure Inc.

https://app.constructsecure.com/bond

BOND Brothers utilizes ConstructSecure to provide prequalification and safety ... offers its subcontractor members far exceeds the membership costs.

4. Contracting Partner Pricing – Highwire Support Center

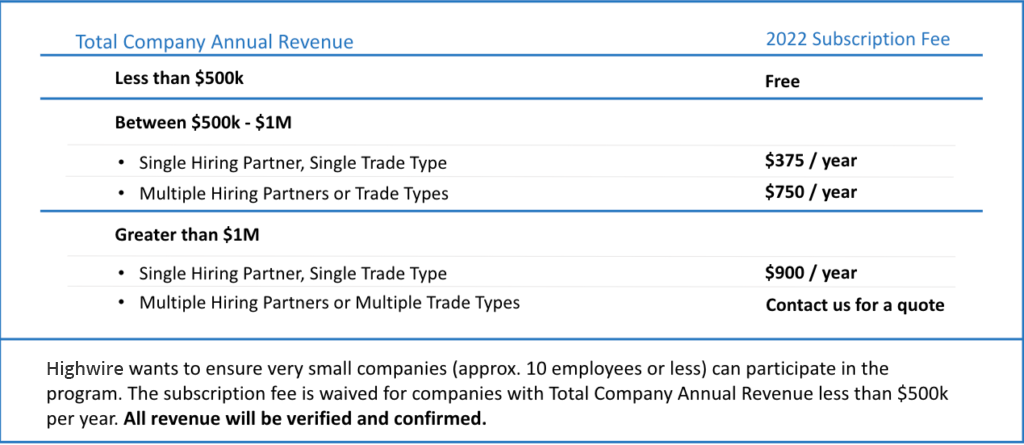

https://help.highwire.com/hc/en-us/articles/360048554151-Contracting-Partner-Pricing Apr 20, 2022 ... Highwire Annual Subscription Highwire is the Partner Elevation Platform for builders and owners of capital projects. The world's most...

Apr 20, 2022 ... Highwire Annual Subscription Highwire is the Partner Elevation Platform for builders and owners of capital projects. The world's most...

5. Contracting Partner Benefits & FAQs | Highwire

https://www.highwire.com/resources/contracting-partners ConstructSecure is now Highwire ... How much does the assessment cost? ... Is the application secure enough to protect my financial statements?

ConstructSecure is now Highwire ... How much does the assessment cost? ... Is the application secure enough to protect my financial statements?

6. AWS Well-Architected - Build secure, efficient cloud applications

https://aws.amazon.com/architecture/well-architected/ Built around six pillars—operational excellence, security, reliability, performance efficiency, cost optimization, and sustainability—AWS Well-Architected ...

Built around six pillars—operational excellence, security, reliability, performance efficiency, cost optimization, and sustainability—AWS Well-Architected ...

7. ConstructSecure Pricing 2022

https://www.trustradius.com/products/constructsecure/pricing

8. The High Cost and Diminishing Returns of a Border Wall | American ...

https://www.americanimmigrationcouncil.org/research/cost-of-border-wall Sep 6, 2019 ... After the passage of the Secure Fence Act, the government attempted to seize private property for purposes of constructing border barriers ...

Sep 6, 2019 ... After the passage of the Secure Fence Act, the government attempted to seize private property for purposes of constructing border barriers ...

9. ConstructSecure Reviews and Pricing 2022

https://sourceforge.net/software/product/ConstructSecure/ConstructSecure is available for Cloud. Audience. Enterprises in need of a dynamic risk mitigation solution to secure applications and mitigate risk across all ...

10. Estimating the true cost — and worth — of Trump's border wall

https://www.cnbc.com/2015/10/09/this-is-what-trumps-border-wall-could-cost-us.html Jan 26, 2017 ... We are using that money to utilize other technology to create a secure border.” Who foots the bill? On the campaign trail Trump's immigration ...

Jan 26, 2017 ... We are using that money to utilize other technology to create a secure border.” Who foots the bill? On the campaign trail Trump's immigration ...

What collateral does secured cost require?

Secured cost requires some sort of collateral as part of the financing agreement. This could be any asset with sufficient value to adequately cover the loan amount, such as real estate or a vehicle. If the borrower fails to make payments on their loan, the lender can then seize the asset as repayment.

What are the advantages of secured cost?

Secured cost has many advantages for both borrowers and lenders. For borrowers, it often allows them access to funds that wouldn’t be otherwise available due to poor credit history or lack of other assets. For lenders, it reduces risk because they have some sort of collateral if needed during repayment. Additionally, secured cost generally comes with lower interest rates than unsecured loans since there is less risk involved for lenders.

What happens if I default on my secured cost loan?

If you default on your secured cost loan, the lender can seize your collateral as repayment (as outlined in your financing agreement). Depending on state laws and regulations surrounding foreclosure proceedings, you may also need to pay additional fees associated with repossessing your asset(s).

How do I know if secured cost is right for me?

Before deciding whether or not secured cost is right for your situation, consider all options carefully and consult with financial professionals if needed. As with any form of borrowing money, make sure you understand all terms and conditions associated with your loan agreement before signing anything officially. Additionally, double check that you will be able to repay back all money owed within an agreed-upon timeframe before taking out a secured cost loan.

Conclusion:

Secured costs offer a viable option for borrowers who wish to access funds but may not have perfect credit scores or other assets at their disposal. Before taking out a secure cost loan, carefully consider all terms and conditions attached and ensure that you understand all associated risks should you fail to make payments back in full before they are due. Doing so will help protect both parties involved in this type of financial transaction.