Cherry Financing is an online company that provides debt consolidation loan options for individuals with low credit scores. The goal of the company is to make it easier and more cost-effective for consumers to pay off their debts and improve their financial situation. This review will evaluate Cherry Financing's features, customer service, and other aspects to help you decide if it's the right solution for you.

Table Of Content:

- Patients - Cherry Payment Plans

- Cherry, LLC. | Better Business Bureau® Profile

- How Does Cherry Work? - Cherry Payment Plans

- Cherry Payment Plans - Home | Facebook

- FAQ - Cherry Payment Plans

- Cherry Credits Reviews | Glassdoor

- Working at CHERRY Companies: Employee Reviews | Indeed.com

- The Cherry Payment Plan - Flexible payments for any budget.

- Cherry Creek Mortgage Review 2022 | Bankrate

- State Credits & Incentives : Cherry Bekaert

1. Patients - Cherry Payment Plans

https://withcherry.com/patients/ No Hard Credit Checks. No Hidden Costs or Fees. Applying does not impact your credit score! ... Here are some reviews from our happy patients.

No Hard Credit Checks. No Hidden Costs or Fees. Applying does not impact your credit score! ... Here are some reviews from our happy patients.

2. Cherry, LLC. | Better Business Bureau® Profile

https://www.bbb.org/us/ca/san-francisco/profile/financial-services/cherry-llc-1116-898942 BBB accredited since 7/31/2019. Financial Services in San Francisco, CA. See BBB rating, reviews, complaints, request a quote & more.

BBB accredited since 7/31/2019. Financial Services in San Francisco, CA. See BBB rating, reviews, complaints, request a quote & more.

3. How Does Cherry Work? - Cherry Payment Plans

https://withcherry.com/how-does-cherry-work/ Cherry performs a soft credit check, so applying will not harm your credit score ... Please review and check that you have all the eligibility requirements.

Cherry performs a soft credit check, so applying will not harm your credit score ... Please review and check that you have all the eligibility requirements.

4. Cherry Payment Plans - Home | Facebook

https://www.facebook.com/withCherryUS/

5. FAQ - Cherry Payment Plans

https://withcherry.com/faq/ A soft credit check (this will not hurt a borrower's credit score) is conducted on each application to determine approval amounts/contract type as well as ...

A soft credit check (this will not hurt a borrower's credit score) is conducted on each application to determine approval amounts/contract type as well as ...

6. Cherry Credits Reviews | Glassdoor

https://www.glassdoor.com/Reviews/Cherry-Credits-Reviews-E470592.htm Apr 25, 2022 ... Friendly environment and fun environment. Flexible working hours. Office is clean and yet messy enough to feel homely. Management are ...

Apr 25, 2022 ... Friendly environment and fun environment. Flexible working hours. Office is clean and yet messy enough to feel homely. Management are ...

7. Working at CHERRY Companies: Employee Reviews | Indeed.com

https://www.indeed.com/cmp/Cherry-Companies/reviews

Reviews from CHERRY Companies employees about CHERRY Companies culture, ... Credit Collections Assistant (Former Employee) - Houston, TX - May 21, 2021 ...

8. The Cherry Payment Plan - Flexible payments for any budget.

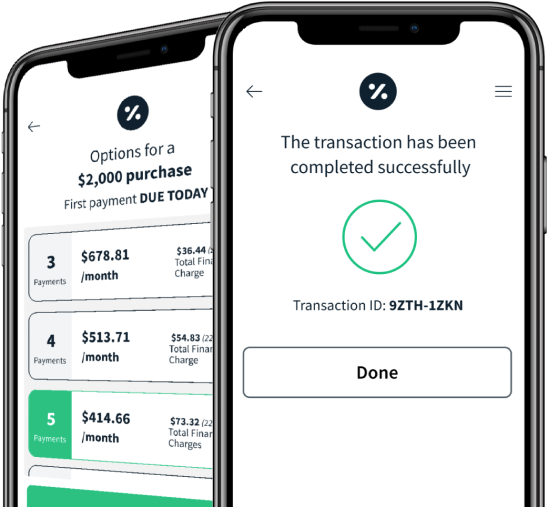

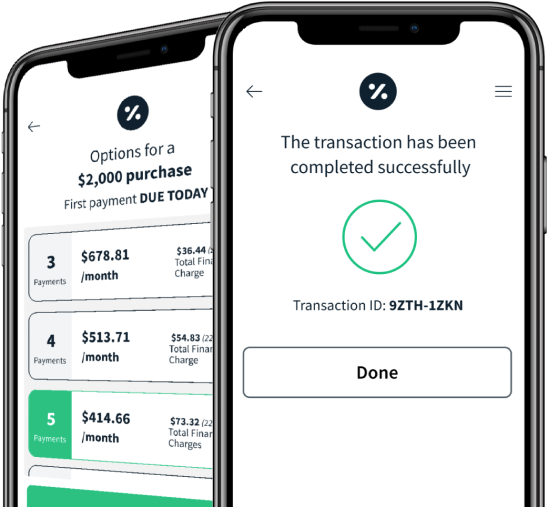

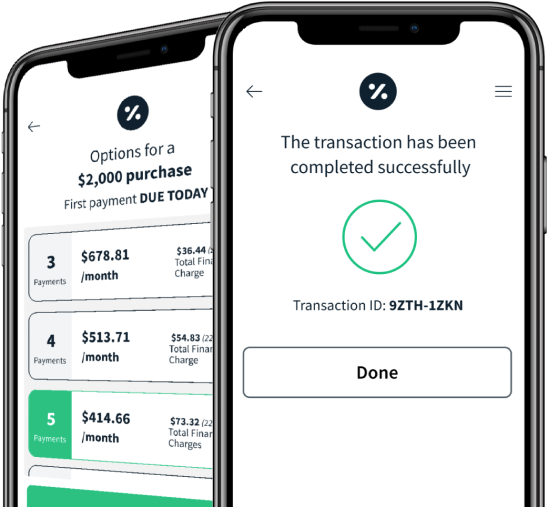

https://estrellaaesthetics.com/payment-plan/ Cherry qualifies patients for up to $5000.00 · There is no hard credit check · Cherry offers zero percent financing options*.

Cherry qualifies patients for up to $5000.00 · There is no hard credit check · Cherry offers zero percent financing options*.

9. Cherry Creek Mortgage Review 2022 | Bankrate

https://www.bankrate.com/mortgages/reviews/cherry-creek-mortgage/

Luke and Tony took care of my refinance and offered end to end support to make sure everything was taken care of with my loan. I was impressed with their great ...

10. State Credits & Incentives : Cherry Bekaert

https://www.cbh.com/services/tax/tax-credits-incentives-advisory/state-credit-incentives/ State Credit Reviews. Many tax credits are statutory, low-risk opportunities that are often overlooked. Such tax credits include both above-the-line benefits ...

State Credit Reviews. Many tax credits are statutory, low-risk opportunities that are often overlooked. Such tax credits include both above-the-line benefits ...

What services does Cherry Financing provide?

Cherry Financing offers a range of loan products designed to help customers consolidate their existing debts into one lower-interest rate loan. These loans are tailored to meet the individual needs of each customer, allowing them to save money on interest payments over time.

How is Cherry Financing different from other debt consolidation services?

Unlike other debt consolidation services, Cherry Financing offers a variety of loan products that provide flexible repayment terms and no fees or hidden costs. Additionally, their customer service team is available 24/7 to answer any questions customers may have regarding their loan products.

Does Cherry Financing offer any guarantees?

Yes, Cherry Financing offers a satisfaction guarantee. If customers are not happy with their loan product within the first seven days, they can return it for a full refund without any penalties or fees.

Are there any eligibility requirements I need to meet in order to get a loan from Cherry Financing?

Yes, in order to qualify for a loan from Cherry Financing customers must be 18 or older and have an income source such as Social Security Income or employment income. In addition, applicants must also have valid identification documents such as a driver’s license or passport and live in one of the states where Cherry Financing operates (Florida, Georgia, South Carolina).

Conclusion:

In conclusion, Cherry Financing can be an effective solution for those looking for ways to reduce their overall debt burden while avoiding expensive fees and long-term contracts. With its flexible repayment plans and satisfaction guarantee policies, customers have the peace of mind knowing that their financial situation will be improved with this reliable lender.