Cash App is a popular mobile payment and money transfer service. You can use the Cash App to pay bills, send and receive money, and even shop online. But what if you don't have enough funds available in your account? Can you overdraft a Cash App card?

Table Of Content:

- How To Borrow Money on Cash App

- Cash App Support Negative Balance

- Can you overdraft Cash App? - All you need to know

- Square's Cash App tests new feature allowing users to borrow up to ...

- Can You Overdraft Cash App (Plus Better Alternatives)

- How to borrow money from Cash App in 2022 | finder.com

- Cash App on Twitter: "Just a friendly reminder that there are ...

- Can You Overdraft Cash App And How Much Would That Cost You?

- Can I overdraft my cash app card at gas pump? - Bob Cut Magazine

- Can You Overdraft Cash App Card? How to Fix Overdraft Cash App ...

1. How To Borrow Money on Cash App

https://www.gobankingrates.com/banking/technology/cash-app-borrow/ 6 days ago ... Whether you have an activated Cash Card; Your Cash App usage history; Your credit history. TechCrunch noted that loans funded quickly and ...

6 days ago ... Whether you have an activated Cash Card; Your Cash App usage history; Your credit history. TechCrunch noted that loans funded quickly and ...

2. Cash App Support Negative Balance

https://cash.app/help/us/en-us/11061-negative-balance A restaurant may put a temporary hold on your account when you ask for the check, then process it later with the tip included. If there aren't enough funds in ...

A restaurant may put a temporary hold on your account when you ask for the check, then process it later with the tip included. If there aren't enough funds in ...

3. Can you overdraft Cash App? - All you need to know

https://www.guidelinelaw.com/can-you-overdraft-cash-app/ Because the overdraft feature of Cash App is automatic, it only applies when you are making a payment at ...

Because the overdraft feature of Cash App is automatic, it only applies when you are making a payment at ...

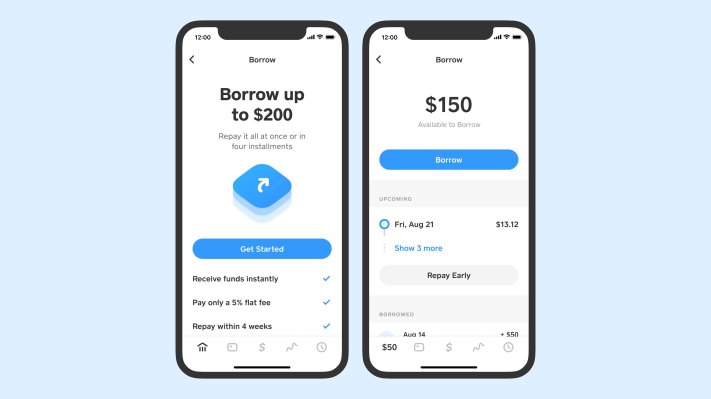

4. Square's Cash App tests new feature allowing users to borrow up to ...

https://techcrunch.com/2020/08/12/square-cash-app-borrowing/ Aug 12, 2020 ... If you don't pay off the loan after four weeks, you'll get an additional one-week grace period, then Square and Cash App will start adding 1.25% ...

Aug 12, 2020 ... If you don't pay off the loan after four weeks, you'll get an additional one-week grace period, then Square and Cash App will start adding 1.25% ...

5. Can You Overdraft Cash App (Plus Better Alternatives)

https://topmobilebanks.com/blog/can-you-overdraft-cash-app/ Jun 2, 2022 ... You can go into Cash App overdraft by accident or intentionally by borrowing up to $200. The borrowing feature isn't available to anyone though ...

Jun 2, 2022 ... You can go into Cash App overdraft by accident or intentionally by borrowing up to $200. The borrowing feature isn't available to anyone though ...

6. How to borrow money from Cash App in 2022 | finder.com

https://www.finder.com/cash-app-borrow Apr 29, 2022 ... Fees and details · Maximum withdrawal: $200 · Terms: 4 weeks · Cost: 5% flat fee · Other fees: 1.25% late fee — charged per week after 1-week grace ...

Apr 29, 2022 ... Fees and details · Maximum withdrawal: $200 · Terms: 4 weeks · Cost: 5% flat fee · Other fees: 1.25% late fee — charged per week after 1-week grace ...

7. Cash App on Twitter: "Just a friendly reminder that there are ...

https://twitter.com/cashapp/status/976889296996192256?lang=en Mar 22, 2018 ... Just a friendly reminder that there are absolutely no overdraft fees with the Cash App and Cash Card! ... Are you able to use an ATM to withdraw ...

Mar 22, 2018 ... Just a friendly reminder that there are absolutely no overdraft fees with the Cash App and Cash Card! ... Are you able to use an ATM to withdraw ...

8. Can You Overdraft Cash App And How Much Would That Cost You?

https://www.thegigcity.com/can-you-overdraft-cash-app/ May 7, 2022 ... You can overdraft or borrow money from your Cash App account. This typically happens automatically when your current account balance is not ...

May 7, 2022 ... You can overdraft or borrow money from your Cash App account. This typically happens automatically when your current account balance is not ...

9. Can I overdraft my cash app card at gas pump? - Bob Cut Magazine

https://bobcutmag.com/2022/03/10/can-i-overdraft-my-cash-app-card-at-gas-pump/ Mar 10, 2022 ... In the Cash App, only payments are accepted. It is possible to overdraft in several instances with Cash App. Essentially, that's an automatic ...

Mar 10, 2022 ... In the Cash App, only payments are accepted. It is possible to overdraft in several instances with Cash App. Essentially, that's an automatic ...

10. Can You Overdraft Cash App Card? How to Fix Overdraft Cash App ...

https://reallyneedcash.com/can-you-overdraft-cash-app-card/ Jun 9, 2022 ... Yes, you can in fact overdraft a Cash App card. Since Cash App Card have no line of credit attached to them, it typically has no overdraft fee.

Jun 9, 2022 ... Yes, you can in fact overdraft a Cash App card. Since Cash App Card have no line of credit attached to them, it typically has no overdraft fee.

What is Overdraft on a Cash App Card?

Overdrafting on a Cash App card means that you are using more money than you have available in your account. The extra money will be taken out of your bank account or from another linked account, such as a debit or credit card.

Is it Possible to Have an Overdraft with the Cash App Card?

Yes, it is possible to overdraft with the Cash App Card. When you attempt to make a purchase with your Cash App Card that exceeds the balance available in your account, an overdraft fee will be assessed by the issuing financial institution.

What are the Fees Associated with Overdrafts on the Cash App Card?

Most banks charge between $30-$35 for each overdraft transaction when using a Cash App Card. Some banks may also charge additional fees for each day that an overdraft remains outstanding on your account.

How Can I Avoid Overdraft Charges with my Cash App Card?

The best way to avoid any overdraft fees is to make sure that you have enough money in your account before making any purchases using your cash app card. Additionally, some banks provide notifications when accounts become close to being overdrafted so users can take action accordingly.

Conclusion:

While having access to quick funds through the use of a cash app card can provide convenience for its users, it is important to remember that there may be associated fees and charges when attempting to spend beyond what’s available in their accounts. Knowing all associated costs beforehand and being mindful of spendings habits can help prevent any unforeseen charges from occurring!