Why Budget Planners Is Necessary?

Best budget planners are essential for managing personal finances and tracking money. They provide detailed and comprehensive views of one’s financial situation, enabling sound financial decisions to be made. Budget planners allow individuals to set clear goals for their money, track progress in reaching those goals, identify areas where more funds could be saved or invested, compare actual expenses with planned ones, and make accurate adjustments to ensure that spending remains within the allocated budget. Additionally, using a budget planner allows users to develop better control over their spending habits as they can review their past purchases as well as forecast upcoming expenditures accurately.

Our Top Picks For Best Budget Planners

Best Budget Planners Guidance

Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook to Manage Your Money Effectively, Undated Finance Planner/Account Book, Start Anytime, 1 Year Use, A5, Rose

Budgeting and money management can often be overwhelming, but the Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook is here to help make it a simple process. This undated finance planner allows you to start at any time and provides enough space for a full year’s use. Developed with premium quality in mind, the budget organizer contains 100gsm paper and a strong metal and lay-flat twin-wire binding, ensuring that ink leakage, erase fraying and shade issues will never be of concern while using it.

This budget planner includes a range of unique features that make it easy to ensure your financial goals are met. With a variety of sections such as financial goals, financial strategy, savings, debts, monthly budget review and more, this planner allows you to perfectly tailor it to your specific needs. The 12 monthly pages include a budget section to plan and track your daily expenses and an end of month review which lets you reflect on your accomplishments and consider ways to improve for the following month. Furthermore, the planner even includes a pocket inside to store loose bits such as bills and receipts.

There is also a Christmas budget section to track your holiday needs and a yearly summary to easily manage large changes or investments. To make it easy

Common Questions on Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook to Manage Your Money Effectively, Undated Finance Planner/Account Book, Start Anytime, 1 Year Use, A5, Rose

• How often should the Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook be used?The Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook should be used on a monthly basis, in order to effectively manage your money.

• What size is the Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook?

The Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook is sized A5.

• How long is the Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook intended for use?

The Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook is designed for one year of use, however it can be started at any point.

• What colour is the Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook?

The Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook is available in a rose colour.

• Does the Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook have any other features?

Yes, the Budget Planner – Monthly Finance Organizer with Expense Tracker Notebook also

Why We Like This

• 1. Help you manage your money effectively with financial goals, financial strategy, savings, debts, daily expenses, monthly budget, and monthly budget review.• 2. 12 month undated budget planner to set monthly goals and budget, track daily expenses and review monthly budget.• 3. Premium quality with 100gsm paper, sturdy and flexible cover, strong metal and lay flat twin wire binding, inner pocket to store loose items and colorful trapezoid on each edge of planner.• 4. User manual with filled examples for quick start and easy tracking.• 5. Guaranteed satisfaction with effective money management.

Additional Product Information

| Color | Rose |

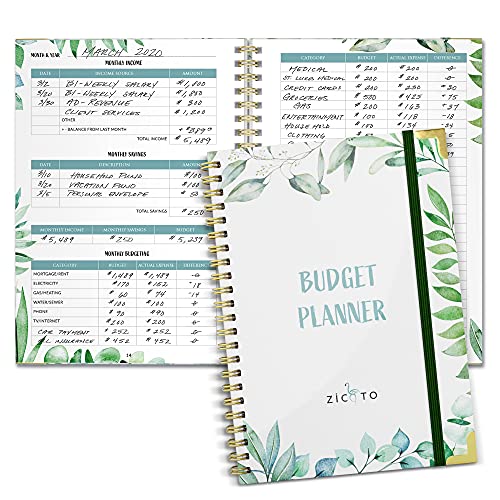

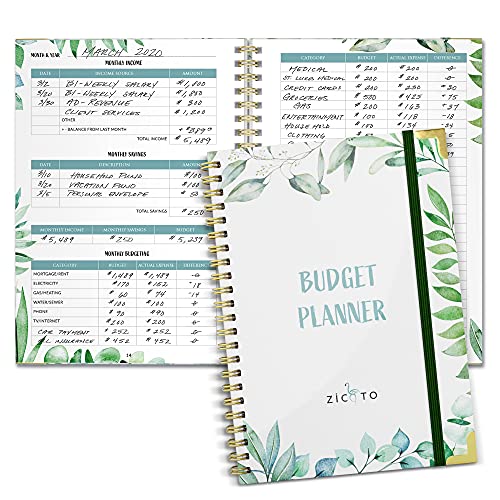

Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2022-2023 Monthly Money Budgeting Book That Manages Your Finances Effectively

The ZICOTO Greenery Monthly Money Budgeting Book is the perfect way to make the most of your finances! This 12-month budgeting planner enables you to review each area of your monetary flow and track your daily expenses and savings with ease. The hardcover book contains a wealth of features; an elastic band, two sticker sheets and motivational quotes on each page to keep you focused on achieving your financial goals!

The 2022-23 budget book is undated so you can start anytime and thanks to its small (A5) size, it fits perfectly in your bag and can go with you wherever you go; all you have to do is set achievable objectives for yourself and plan precisely how to reach them.

ZICOTO’s Budget Tracker allows you to create strategies and action plans that can help you climb up towards financial freedom. Its intuitive design and expansive range of functions make planning your finances a pleasure and keep you on track no matter how busy your life gets.

Take control of your finances and get the most out of your money with the ZICOTO Greenery Monthly Money Budgeting Organizer – the ultimate aid for budget planners, aiming for financial success.

Common Questions on Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2022-2023 Monthly Money Budgeting Book That Manages Your Finances Effectively

• What type of information is collected to help manage your finances?The Financial Organizer with Expense Tracker Notebook collects information related to income, expenses, goals, and investments in order to help users better manage their finances.

• How often can I use the Budget Planner?

The Monthly Money Budgeting Book can be used every month for 12 months to help track finances effectively.

• What kind of budgeting tips does the Budget Planner offer?

The Budget Planner offers tips on budgeting for emergency situations, setting financial goals, reducing debt, and more.

• Does the Budget Planner come with helpful charts and graphs?

Yes, the Budget Planner includes charts and graphs to make it even easier to track monthly expenses and plan long-term expenses.

• Is there a mobile app to access the Budget Planner?

No, the Budget Planner is only available in book form.

Why We Like This

• 1. 12 Month Financial Organizer with Expense Tracker Notebook for 2022 2023• 2. Achieve Financial Goals and Monitor Monthly Income, Savings, Debts & Daily Expenses• 3. Start Any Time – Perfect Size for Any Bag• 4. Gorgeous and Functional Hard Cover Design• 5. Includes Stickers, How To’s & Motivational Quotes for Focus and Goal Setting

Additional Product Information

| Color | Green |

| Height | 8.35 Inches |

| Length | 5.51 Inches |

Budget Planner – Budget Book, 12 Month Undated Expense Tracker Notebook, 6.1″ x 8.3″, Financial Organizer/Account Book/Bill Organizer, with Stickers, Pocket and Elastic Closure, Manages Your Finances Effectively

The Budget Planner – Budget Book is a 12-month, undated expense tracker notebook designed to effectively manage your finances. It measures 6.1″ x 8.3″, and features a hardcover with round corners, strong twin-wire binding, inner pocket, budget stickers, and an elastic closure that keeps everything organized and together. The planner contains multiple content pages to help you track your financial goals, strategies, monthly plans, expenses, budgets, debt, payments, bill due, cash flow, holidays spending, saving trackers, and summary of the year. With its multiple content pages and effective organization, this budget book allows you to effectively manage your finances and create achievable goals. It also allows you to develop monthly habits and come up with action plans to save your unreasonable expenses and make the most out of your money. This budget planner is the perfect tool to help you stay organized and on top of your finances.

Common Questions on Budget Planner – Budget Book, 12 Month Undated Expense Tracker Notebook, 6.1″ x 8.3″, Financial Organizer/Account Book/Bill Organizer, with Stickers, Pocket and Elastic Closure, Manages Your Finances Effectively

• How does the Budget Planner – Budget Book help manage finances?The Budget Planner – Budget Book is a 12 month undated expense tracker notebook designed to help manage finances effectively. It comes with financial organizers, account books, bill organizers, stickers, pockets and an elastic closure to keep track of your expenses and budget.

• What is the size of the Budget Planner – Budget Book?

The Budget Planner – Budget Book is 6.1″ x 8.3″.

• What features are included in the Budget Planner – Budget Book?

The Budget Planner – Budget Book comes with financial organizers, account books, bill organizers, stickers, pockets and an elastic closure to keep track of your expenses and budget.

• Is the Budget Planner – Budget Book undated?

Yes, the Budget Planner – Budget Book is an undated 12 month expense tracker notebook.

• How often should I use the Budget Planner – Budget Book?

The Budget Planner – Budget Book should be used on a monthly basis to help track your expenses and budget.

Why We Like This

• 1.Durable hardcover with round corners and a strong twin wire binding.• 2.Multiple content pages with financial goals, monthly plans, expense trackers, saving trackers, debt trackers, and more.• 3.Monthly tracker to record 12 month monthly plans and budgets.• 4.Inner pocket and budget stickers for added convenience.• 5.Elastic closure to keep the budget planner secure.

Clever Fox Budget Planner – Undated – Expense Tracker Notebook. Monthly Budgeting Journal, Finance Planner & Accounts Book to Take Control of Your Money. Start Anytime. A5 Size Black Hardcover

Are you looking to take control of your finances? With the Clever Fox Budget Planner you can become an expert at personal finance, budget and expense tracking. A simple and effective plan will help you set and achieve financial goals, and get insight on how to manage your money more efficiently.

This hardcover organizer is designed with sophistication and practicality in mind. Its A5 size is perfect for portability, and the vegan leather cover features an elastic band, pen holder and pocket for bills and receipts. The rich 120gsm non-bleed paper allows for thorough writing and comes together with 86 bonus stickers and a detailed user guide.

Begin your journey towards financial freedom by setting your monthly goals and designing your monthly spending plan! Use the predefined expense categories to track your expenses, review where your money went at the end of each month and spot any bad spending habits. Make progress: keep track of all your day-to-day transactions and monitor your savings and debt. Plus, there are 2 pages dedicated to Christmas budgeting and 2 pages for an annual summary to track your results throughout the year.

We guarantee that this budget book will help you keep your finances organized, or you will get your money back! If you are not happy with

Common Questions on Clever Fox Budget Planner – Undated – Expense Tracker Notebook. Monthly Budgeting Journal, Finance Planner & Accounts Book to Take Control of Your Money. Start Anytime. A5 Size Black Hardcover

• Is the Clever Fox Budget Planner hardcover?Yes, the Clever Fox Budget Planner is a hardcover notebook, making it durable and long-lasting.

• Does the Clever Fox Budget Planner offer monthly budgeting tracking?

Yes, the Clever Fox Budget Planner offers monthly budgeting tracking to help you take control of your money.

• What size is the Clever Fox Budget Planner?

The Clever Fox Budget Planner is A5 size.

• Is there an incentive to start using the Clever Fox Budget Planner?

Yes, you can start using the Clever Fox Budget Planner at anytime and there is no deadline, so it’s easy to begin budgeting right away.

• Is the Clever Fox Budget Planner customizable?

Yes, the Clever Fox Budget Planner is easily customizable to help you track your spending and keep on budget.

Why We Like This

• 1. Help you take control of your money and achieve your financial goals• 2. Stay on track and focused with monthly goals and budgeting/reviewing• 3. Elegant, smart, and practical personal finance with predefined expense categories• 4. High quality vegan leather hardcover with an elastic band, pen holder, pocket for bills and receipts, and bookmarks• 5. Guaranteed to keep your finance organized or your money back

Additional Product Information

| Color | Black |

Clever Fox Budget Planner & Monthly Bill Organizer With Pockets. Expense Tracker Notebook, Budgeting Journal and Financial Planner Budget Book to Control Your Money. Large Size (8″ x 9.5″) – Turquoise

Are you ready to take charge of your financial life and achieve your goals? If that’s the case, then you need the Clever Fox Budget Planner & Monthly Bill Organizer With Pockets. This nifty expense tracker and financial planner can help you keep track of all your household monthly budgeting & personal finance needs as well as stay focused and on track to set and achieve your financial goals.

Made from high-quality leatherette hardcover and thick, no-bleed 120gsm paper with sturdy spiral binding, this large (8″ x 9.5″) budget book also comes with 12 pockets for bills and receipts. It has 2 pages for setting financial goals, 2 pages for strategy and tactics, 12 months’ worth of 8 pages and 1 pocket each, 4 pages for tracking savings, 4 pages for debt tracking, 2 pages for holiday budgeting, 2 pages for regular bill tracking, and 2 pages for annual summary. To learn more quickly, clever fox also offers an additional free 2 pages of 226 stickers and a quick start user manual with filled examples!

Whether you’re looking to manage everyday expenses, save for a rainy day or prepare for retirement, this personal finance planner makes it easy to be on top of your money and

Common Questions on Clever Fox Budget Planner & Monthly Bill Organizer With Pockets. Expense Tracker Notebook, Budgeting Journal and Financial Planner Budget Book to Control Your Money. Large Size (8″ x 9.5″) – Turquoise

• Why should I use Clever Fox Budget Planner & Monthly Bill Organizer?The Clever Fox budget planner and monthly bill organizer is an easy-to-use tool to help you take control of your finances. The budget planner includes pockets for organizing bills, receipts and other important documents, a customizable budget section with detailed monthly tracking, and a financial planning notebook for long-term goals and budgeting plans. It also features helpful budgeting tips and financial advice, so you can make informed decisions and reach your financial goals.

Why We Like This

• 1. Take control of your money and achieve your financial goals with the Clever Fox Budget Planner & Monthly Bill Organizer with pockets.• 2. Stay on track and focused, set monthly goals and create a budget to help manage all your household monthly budgeting and personal finance in one place.• 3. Premium quality, convenient pockets, large size, gift packaging and bonuses included.• 4. Track your day to day spending and store paper bills and receipts in the pockets.• 5. Guaranteed to keep your finances organized or your money back.

Additional Product Information

| Color | Turquoise |

Benefits of Budget Planners

The best budget planners can be an invaluable tool when it comes to managing your finances. A budget planner helps you track your expenses, categorize them so they are easy to understand, and gives you insight into how much money is going out and where it is coming from. This type of software also allows you to set goals for the future as well as helping with short-term spending goals that must be managed within a specific timeframe like saving for retirement or paying off debt.

Budget planners provide a user-friendly platform where users can input information about their income and various expenses on a regular basis in order to monitor their financial situation more accurately over time. Many systems also allow users access from multiple devices if desired allowing convenience no matter what the location or even during travel times when internet connection may not be available . By having all data stored conveniently in one place , this allows for easier analysis once patterns start appearing so changes can quickly take place if needed depending on expectations vs reality results , thus ensuring better control over personal funds

Furthermore , using software programs such as these have many other benefits beyond just tracking numbers because they encourage people stay accountable by being able impact decision making based directly off actual values instead of just guesses which may lead individuals down paths leading unneccesary risks while trying accomplish objectives without proper preparation (i)e incorrect assumptions regarding variable values leading potential losses that would otherwise been avoided completely had planned correctly

Overall , Planning wisely using effective methods will always result positive outcomes versus shooting blindly hoping errors cost nothing; therein lies power possessing best Budget Planners – Easy automated Tracking & predictions Without breaking bank …

Buying Guide for Best Budget Planners

Types of Budget Planners

When it comes to budget planners, there are a few different types you can choose from. These include paper planners, budgeting apps and spreadsheets. Each type has its own advantages and disadvantages, so it’s important to choose the one that best fits your needs and budget.

Paper Planners: Paper planners are usually the most affordable option when it comes to budget planning. They also make it easy for you to keep track of your spending as you can simply write down all of your purchases in the planner. However, paper planners are not the most efficient option as they require manual tracking and upkeep, which can be time consuming.

Budgeting Apps: Budgeting apps are convenient for tracking expenses on the go. They also allow you to quickly categorize expenses and set up reminders for upcoming payments. The downside is that some of these apps require a subscription fee, so they may not be ideal for those on a strict budget.

Spreadsheets: Spreadsheets provide an easy way to keep track of your spending in an organized manner. They allow you to customize categories and inputs, making them ideal for those who want more control over their finances. However, they do require some technical knowledge in order to set up and use properly.

Features To Consider

When selecting a budget planner, there are a few features that you should consider in order to get the most out of your purchase:

• Cost – Make sure that you’re getting the best value for your money by comparing prices between different options.

• Ease Of Use – You want something that is straightforward and user-friendly so that tracking your spending isn’t too complicated or time consuming.

• Customization – Look for something that allows you to set up custom categories or inputs so that tracking is tailored to meet your needs.

• Security – Ensure that any data stored in the planner is secure and encrypted if possible. This is especially important if you will be storing sensitive financial information like account numbers or payment details online.

Best Budget Planners

Here are some of our top picks when it comes to budget planners:

• Mvelopes (App): Mvelopes provides users with an easy-to-use interface along with helpful features such as customizable categories, unlimited envelopes, automatic bill pay reminders, and more! It has both free and paid subscription options available depending on how much functionality you need from the app.

• YNAB (App): YNAB stands for “You Need A Budget” which should give you an idea of what this app is all about! It offers users an easy-to-use interface along with helpful features such as customizable categories, goal setting tools, debt repayment trackers, bill pay reminders and more! It also has both free and paid subscription plans available depending on what level of functionality you need from the app.

• Excel Spreadsheet Template (Spreadsheet): If you’re looking for a more basic option than apps or software programs then consider using Excel spreadsheet templates instead! These templates allow users to create their own customized spreadsheets using formulas which can then be used as a personal budget tracker!

Frequently Asked Question

What features should be considered when choosing a budget planner?

When choosing a budget planner, it is important to consider the following features: 1. Ease of Use: An intuitive and user-friendly interface is essential for a budget planner. Look for an app that is easy to navigate and understand. 2. Automation: Automated features like automatic categorization of expenses and recurring payments can be helpful for staying on top of your budget. 3. Goal-Setting: Setting financial goals can help you stay on track with your budget. Look for a budget planner that allows you to set goals and track progress. 4. Reports: Reports and charts can help you visualize your spending and savings. Look for a budget planner that offers detailed reports. 5. Security: It is important to consider the security of your data when choosing a budget planner. Make sure the app has the necessary measures in place to protect your information. 6. Integrations: Some budget planners integrate with your bank accounts and other financial services, making it easier to keep track of your finances. 7. Cost: Finally, consider the cost of the budget planner. Some are free, while others are subscription-based. Make sure you choose a budget planner that fits within your budget.

What budget saving techniques does the budget planner offer?

The budget planner offers a variety of budget saving techniques, including: 1. Tracking your spending: Keeping a detailed record of your income and expenses can help you identify areas where you can cut back and save money. 2. Setting a budget: Setting a budget for yourself and sticking to it helps ensure that you don’t overspend. 3. Tracking progress: Tracking your progress can help you stay on top of your budget and make better decisions. 4. Setting savings goals: Setting savings goals can help you stay focused on your budget and motivate you to save. 5. Automating savings: Setting up automatic transfers from your checking account to your savings account can help you save without thinking about it. 6. Prioritizing needs: Making sure to prioritize your needs over your wants can help you stay within your budget. 7. Shopping around: Shopping around for the best deals can help you save money on purchases.

What access does the planer provide to users?

The planer provides users with access to various features that can help them manage their time, organize their tasks, create projects, and track their progress. It also provides users with access to different tools and resources to help them stay on top of their tasks and make sure they are reaching their goals. Additionally, the planer can provide users with insights into their performance, enabling them to make better decisions about how to manage their time and complete tasks.

Conclusion

Thank you for taking the time to consider Best budget planners; we hope we have provided enough information to convince you that it is the right product for your needs. Our budget planner has established itself as one of the most reliable, efficient and affordable ways to manage your finances in a way that ensures they remain secure.

Best budget planners gives you total control over how much you are spending in different areas, while also providing detailed analysis and reports that help you make informed decisions about future spending and saving habits. The user-friendly interface makes it easy to keep track of where your money goes – day by day, month by month or year by year. As well as allowing users to specify specific budgets for each account or category making managing multiple accounts easier.

Ultimately, Best budget planners provides an essential tool for any individual or business looking to maximize their financial success through effective planning and careful monitoring of their finances.