When a pilot applies for life insurance, he is looking for coverage to protect his family in the event of an untimely death. They need assurance that their financial needs will still be taken care of. Life insurance gives these families the peace of mind knowing they’ll be okay, even if something unexpected happens to their loved one who was providing for them.

Table Of Content:

- WFG 4 - 5 Flashcards | Quizlet

- a pilot applies for life insurance. the insurer approves the application ...

- Life underwriting Flashcards | Quizlet

- When Pilots Apply for Life Insurance - AVweb

- What All Pilots Should Know When Applying For Life Insurance

- SkyWest Airlines » Careers

- Applying for Life Insurance as a Pilot in Canada [2022] | Protect Your ...

- INSURANCE CODE CHAPTER 1101. LIFE INSURANCE

- Eligibility & FAQs

- SkyWest Airlines » Pilot Jobs

1. WFG 4 - 5 Flashcards | Quizlet

https://quizlet.com/562198175/wfg-4-5-flash-cards/

a pilot applies for life insurance. the insurer approves the application with a $10 additional monthly premium modification due to the risk involved. the ...

2. a pilot applies for life insurance. the insurer approves the application ...

https://brainly.com/question/25771180![]() Dec 1, 2021 ... a pilot applies for life insurance. the insurer approves the application with a $10 additional monthly premium modification due to the risk ...

Dec 1, 2021 ... a pilot applies for life insurance. the insurer approves the application with a $10 additional monthly premium modification due to the risk ...

3. Life underwriting Flashcards | Quizlet

https://quizlet.com/598546748/life-underwriting-flash-cards/

A pilot applies for life insurance. The insurer approves the application with a $10 additional monthly premium modification due to the risk involved.

4. When Pilots Apply for Life Insurance - AVweb

https://www.avweb.com/ownership/when-pilots-apply-for-life-insurance/ The key to applying for life insurance as a pilot is to have an agent that is experienced with assisting pilots. Remember that your agent is the link between ...

The key to applying for life insurance as a pilot is to have an agent that is experienced with assisting pilots. Remember that your agent is the link between ...

5. What All Pilots Should Know When Applying For Life Insurance

https://www.piclife.com/pdfs/What_All_Pilots_Should_Know.pdf

factor and the hobby of flying can dramatically affect your ability to gain affordable insurance. Applying for life insurance as a pilot can often lead to a ...

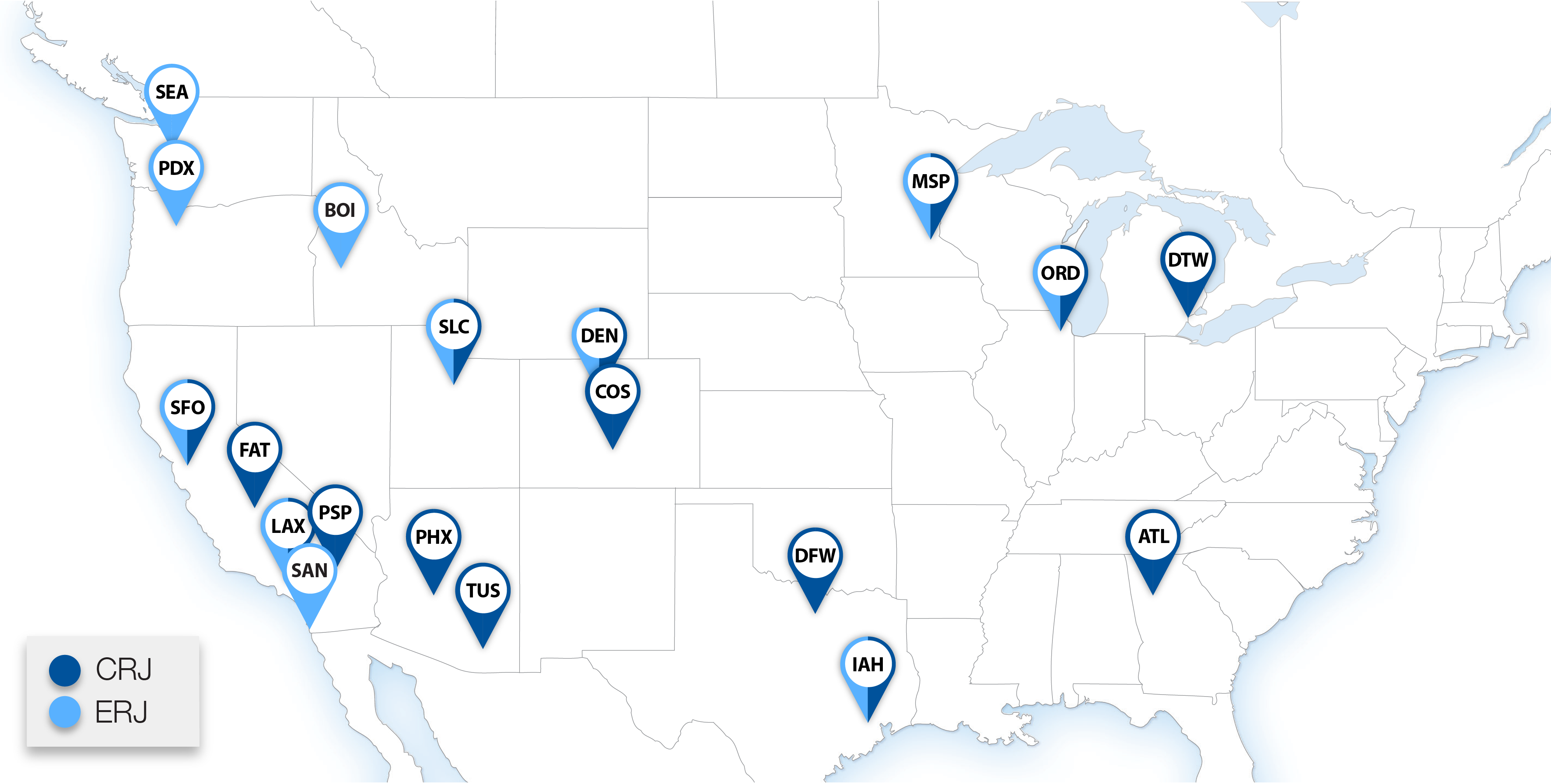

6. SkyWest Airlines » Careers

https://www.skywest.com/skywest-airline-jobs/ When applying for a position at SkyWest, we recommend you always start at ... SkyWest provides all eligible full-time employees with life insurance at no ...

When applying for a position at SkyWest, we recommend you always start at ... SkyWest provides all eligible full-time employees with life insurance at no ...

7. Applying for Life Insurance as a Pilot in Canada [2022] | Protect Your ...

https://protectyourwealth.ca/applying-for-life-insurance-pilot-in-canada/![Applying for Life Insurance as a Pilot in Canada [2022] | Protect Your ...](https://protectyourwealth.ca/wp-content/uploads/2022/02/Apllying-for-life-insurance-as-a-pilot.png) Apr 19, 2022 ... That being said, every life insurance company has its own policies in place and being a pilot may cause higher premiums and risk your approval.

Apr 19, 2022 ... That being said, every life insurance company has its own policies in place and being a pilot may cause higher premiums and risk your approval.

8. INSURANCE CODE CHAPTER 1101. LIFE INSURANCE

https://statutes.capitol.texas.gov/Docs/IN/htm/IN.1101.htm

This subchapter applies to a life insurance policy: (1) issued or delivered in this state; or. (2) issued by a life insurance company organized under the ...

9. Eligibility & FAQs

https://www.chicago.gov/city/en/sites/resilient-communities-pilot/home/faqs.html The application period for the Chicago Resilient Communities pilot has closed. ... and employees are not eligible to apply or be selected for the pilot.

The application period for the Chicago Resilient Communities pilot has closed. ... and employees are not eligible to apply or be selected for the pilot.

10. SkyWest Airlines » Pilot Jobs

https://www.skywest.com/skywest-airline-jobs/career-guides/pilot-jobs SkyWest Airlines pilots have more opportunity, exposure, and access than any ... American and Alaska – SkyWest offers the best quality of life for pilots.

SkyWest Airlines pilots have more opportunity, exposure, and access than any ... American and Alaska – SkyWest offers the best quality of life for pilots.

What are some common life insurance policies pilots should consider?

Common life insurance policies that pilots should consider include term life insurance, whole life insurance, and universal life insurance. Term life coverage is best for those who need protection during a specific time frame while whole and universal provide coverage throughout your lifetime with the option to accumulate cash value over time.

Does gender play a role in determining premium rates?

Gender does play a role in determining premium rates as generally female applicants pay less than male applicants. That being said, other factors such as age, health status, lifestyle habits, and location can also have an impact on premium rates.

What happens if I don’t pay my premiums?

If you don’t pay your premiums the policy may lapse or be canceled depending on the terms of the contract. A lapse could also cause any death benefits due to become limited or unavailable altogether depending on state law and individual policies. Additionally, any cash value accumulated in the policy may be lost once it has lapsed.

Are there any additional costs associated with my policy?

Additional costs associated with a policy may include administrative fees charged by your insurer when managing your account or taxes imposed by federal and/or state governments which vary from jurisdiction to jurisdiction. In any case, these additional costs will clearly identified upon purchase allowing you to plan for them accordingly.

Is there an age limit for applying for life insurance?

Generally speaking yes, applicants must meet certain age requirements before they can qualify for coverage. The exact age limits depend on which type of policy you are interested in purchasing since not all types are available to everyone; however typically people between 18-65 years old are eligible for most policies.[ END] Conclusion: When shopping around for the right type of life insurance coverage pilots have many options based off their specific needs and budget considerations. Ultimately making sure they understand all relevant details regarding cost and eligibility prior to signing up is essential so that both parties (the pilot and insurer) know what's expected throughout the duration of the policy agreement.

Conclusion:

When shopping around for the right type of life insurance coverage pilots have many options based off their specific needs and budget considerations. Ultimately making sure they understand all relevant details regarding cost and eligibility prior to signing up is essential so that both parties (the pilot and insurer) know what's expected throughout the duration of the policy agreement.