Debts and money owed can easily pile up when you're not careful with your finances, but it is important to face them head on and work towards paying them off. Whether you need help managing existing debts or assistance negotiating new ones, there are plenty of options available for getting those loans under control.

Table Of Content:

- DEBTS OR MONEY OWED - 9 Letters - CodyCross answers

- Debts or money owed - CodyCross Answers All Levels

- Debts or money owed - CodyCross » Qunb

- Debts or money owed - CodyCross Answers Cheats and Solutions

- Debt Definition

- Debts or money owed Answers - CodyCrossAnswers.org

- Treasury Offset Program

- Dealing with Debt | USAGov

- Debt Management Services

- New York State offset programs

1. DEBTS OR MONEY OWED - 9 Letters - CodyCross answers

https://ultimatesuccesspuzzle.com/crossword/-/Debts+or+money+owed/ Debts or money owed — Puzzles Crossword Clue · An obligation, debt or responsibility owed to someone. · A handicap that holds something back, a drawback, someone ...

Debts or money owed — Puzzles Crossword Clue · An obligation, debt or responsibility owed to someone. · A handicap that holds something back, a drawback, someone ...

2. Debts or money owed - CodyCross Answers All Levels

http://codycrossanswers.com/debts-or-money-owed/ Mar 20, 2017 ... AdvertisementHere are all the Debts or money owed answers. CodyCross is an addictive game developed by Fanatee.

Mar 20, 2017 ... AdvertisementHere are all the Debts or money owed answers. CodyCross is an addictive game developed by Fanatee.

3. Debts or money owed - CodyCross » Qunb

https://www.realqunb.com/debts-or-money-owed-codycross/ Debts or money owed – CodyCross. CodyCross: Crossword Puzzles an amazing funny and intellectual word game. In case if ...

Debts or money owed – CodyCross. CodyCross: Crossword Puzzles an amazing funny and intellectual word game. In case if ...

4. Debts or money owed - CodyCross Answers Cheats and Solutions

http://codycrossanswers.net/debts-or-money-owed/

Mar 19, 2017 ... Find out Debts or money owed Answers. CodyCross is a famous newly released game which is developed by Fanatee.

5. Debt Definition

https://www.investopedia.com/terms/d/debt.asp/investing13-5bfc2b8f46e0fb0026016f4d.jpg) Debt is anything owed by one party to another. Examples of debt include amounts owed on credit cards, car loans, and mortgages. What Is the Legal Definition of ...

Debt is anything owed by one party to another. Examples of debt include amounts owed on credit cards, car loans, and mortgages. What Is the Legal Definition of ...

6. Debts or money owed Answers - CodyCrossAnswers.org

https://codycrossanswers.org/debts-or-money-owed-answers Debts or money owed Answers This page will help you find all of CodyCross Answers of All the Levels. Through the Cheats and Solutions you will find on this ...

Debts or money owed Answers This page will help you find all of CodyCross Answers of All the Levels. Through the Cheats and Solutions you will find on this ...

7. Treasury Offset Program

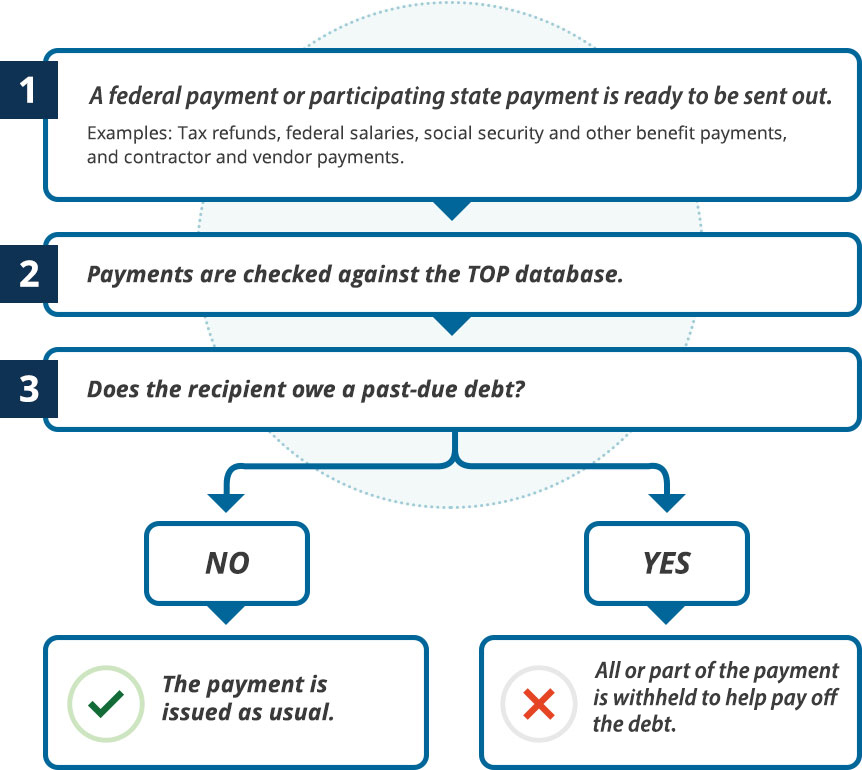

https://fiscal.treasury.gov/top/ Oct 21, 2021 ... TOP matches people and businesses who owe delinquent debts with money that federal agencies are paying (for example, a tax refund).

Oct 21, 2021 ... TOP matches people and businesses who owe delinquent debts with money that federal agencies are paying (for example, a tax refund).

8. Dealing with Debt | USAGov

https://www.usa.gov/debt May 6, 2022 ... This includes money owed on personal credit card accounts, auto loans, medical bills, and mortgages. The FDCPA does not cover debts incurred ...

May 6, 2022 ... This includes money owed on personal credit card accounts, auto loans, medical bills, and mortgages. The FDCPA does not cover debts incurred ...

9. Debt Management Services

https://fiscal.treasury.gov/dms/ Nov 4, 2021 ... Debt Management Services (DMS) helps federal agencies and state governments collect debt (the money owed to them). Did you get a notice from a ...

Nov 4, 2021 ... Debt Management Services (DMS) helps federal agencies and state governments collect debt (the money owed to them). Did you get a notice from a ...

10. New York State offset programs

https://www.tax.ny.gov/enforcement/collections/nys-offset-programs.htm

Feb 10, 2022 ... We may apply your money to debt you owe to: the Tax Department,; another New York State agency (such as the Office of Temporary Disability ...

What happens if I don't pay my debts?

If you fail to honour your debt obligations, then the creditor has the right to take legal action against you. This could involve submitting a lawsuit and seeking court orders forcing you to pay what is owed. In extreme cases, they may even be granted permission by a judge to seize and attempt to liquidate assets in order to satisfy the debt.

How can I negotiate a payment plan with my creditors?

A payment plan is an agreement between you and your creditor where you agree upon specific terms for repaying your debt. This could involve setting up a repayment schedule with reduced interest rates or other predetermined conditions such as waiving late fees. It is important that both parties agree upon this arrangement before any funds are exchanged.

How can I protect my credit rating?

Making payments on time is an effective way of preserving your credit score while also gradually reducing the amount of debt that you owe. Other tactics include applying for consolidation loans, which combine multiple debts into one smaller loan with potentially lower interest rates. Finally, it might also be worth considering consumer credit counseling services as they can provide expert advice on budgeting and financial planning strategies.

What are some ways I can get help managing my debts?

The first step is often creating an accurate budget and tracking all your expenses so that there’s more of an understanding of where your limited resources are going each month. There are also online resources available that connect individuals in need of debt relief with experienced professionals who specialize in resolving various types of financial problems, including overly burdensome debt loads.

Conclusion:

Dealing with persistent debts can feel overwhelming at times but having access to the necessary resources gives you a better chance at overcoming them successfully; whether it be through negotiation or finding alternative solutions such as consulting experts in personal finance management. Take the time to explore all the available options and find out which approach works best for you!