A debit card is a payment card that facilitates the transfer of funds from a customer's bank to another account for the purpose of purchasing goods or services. Debit cards are secure, convenient and quick means to complete point-of-sale transactions.

Table Of Content:

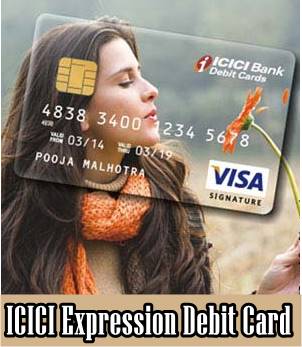

- Expressions Debit Cards - Personalized Debit Card - ICICI Bank

- ICICI Expression Debit Card - Benefits, Annual Fee, Charges | Fincash

- Features and Benefits - Expressions Debit Card

- Is ICICI's Expressions Debit Card free? - Quora

- NRE Expression Debit Card

- ICICI Bank Expressions Debit Card- Features and Benefits-Design ...

- Design Your Own Debit Card - Debit Card Designs - ICICI Bank

- Express Yourself

- How to validate Visa Card number using Regular Expression ...

- Expressions on Card - FirstBank Nigeria

1. Expressions Debit Cards - Personalized Debit Card - ICICI Bank

https://www.icicibank.com/Personal-Banking/cards/Consumer-Cards/Debit-Card/expressions-card/expression-card.html![]() Expressions Debit Card ... The pompous creatures out there who say Love me or leave me, say it again. The modest ones, here's to your dignity. The norm-breakers, ...

Expressions Debit Card ... The pompous creatures out there who say Love me or leave me, say it again. The modest ones, here's to your dignity. The norm-breakers, ...

2. ICICI Expression Debit Card - Benefits, Annual Fee, Charges | Fincash

https://www.fincash.com/l/pf/icici-expression-debit-card 5 days ago ... This ICICI Debit Card is where you have the liberty to choose the design printed on your card. The images are approved by the bank and upon ...

5 days ago ... This ICICI Debit Card is where you have the liberty to choose the design printed on your card. The images are approved by the bank and upon ...

3. Features and Benefits - Expressions Debit Card

https://www.icicibank.com/Personal-Banking/cards/Consumer-Cards/Debit-Card/expressions-card/features.html Exclusive Features and Benefits of Expressions Card · A unique feature which protects your Debit Card against unauthorized purchases on loss, theft or ...

Exclusive Features and Benefits of Expressions Card · A unique feature which protects your Debit Card against unauthorized purchases on loss, theft or ...

4. Is ICICI's Expressions Debit Card free? - Quora

https://www.quora.com/Is-ICICIs-Expressions-Debit-Card-free

No !! The ICICI Bank Expressions Debit Card can be availed for at a joining fee of Rs. 499/- (Plus Goods and Service Tax ) only.

5. NRE Expression Debit Card

https://www.icicibank.com/Personal-Banking/cards/Consumer-Cards/Debit-Card/expressions-card/nre-expressions-debit-card.html NRE Expressions Debit Card · High Withdrawal Limit and Transaction Limit · Exclusive dining offers through ICICI Bank Culinary Treats programme · Complimentary ...

NRE Expressions Debit Card · High Withdrawal Limit and Transaction Limit · Exclusive dining offers through ICICI Bank Culinary Treats programme · Complimentary ...

6. ICICI Bank Expressions Debit Card- Features and Benefits-Design ...

https://indialends.com/debit-cards/icici-bank-expressions-debit-card The ICICI Bank Expressions Debit card is one of the unique debit cards of ICICI Bank. It offers you the flexibility to design your card own.

The ICICI Bank Expressions Debit card is one of the unique debit cards of ICICI Bank. It offers you the flexibility to design your card own.

7. Design Your Own Debit Card - Debit Card Designs - ICICI Bank

https://www.icicibank.com/Personal-Banking/cards/Consumer-Cards/Debit-Card/expressions-card/design-gallery.html Now, personalizing your own Debit Card comes handy. Pick from a gallery of more than 100 designs and we will incorporate the same on your new Expressions ...

Now, personalizing your own Debit Card comes handy. Pick from a gallery of more than 100 designs and we will incorporate the same on your new Expressions ...

8. Express Yourself

https://www.bankofamerica.com/content/pdf/en_us/Affinity_Banking_Programs_June_2018.pdfaccount, consider getting a custom debit card that ... of debit cards that bear the name of an ... is offered and serviced by Bank of America.

9. How to validate Visa Card number using Regular Expression ...

https://www.geeksforgeeks.org/how-to-validate-visa-card-number-using-regular-expression/

Feb 15, 2021 ... How to validate Visa Card number using Regular Expression · It should be 13 or 16 digits long, new cards have 16 digits and old cards have 13 ...

10. Expressions on Card - FirstBank Nigeria

https://www.firstbanknigeria.com/personal/cards/debit-cards/expressions-on-card/ FirstBank Expressions on Card gives you the freedom to create a unique look and feel for your bank card. You get to select any picture (from an existing bank- ...

FirstBank Expressions on Card gives you the freedom to create a unique look and feel for your bank card. You get to select any picture (from an existing bank- ...

How do debit cards work?

Debit cards use funds available in the customers' bank accounts and allow customers to make payments directly from those accounts. The customer enters their PIN code into the point of sale machine, which verifies it against an online database. Once verified, the transaction is processed and the money is deducted from the customer’s account.

What are the benefits of using a debit card?

Debit cards offer several advantages over other payment methods such as cash or check payments. They provide a secure and convenient way to pay, avoiding the need to carry large amounts of cash around with you. Additionally, they can often be used with online retailers; many websites accept debit cards as a form of payment.

Are there any fees associated with using a debit card?

Some banks may charge an additional fee when using your debit card overseas, but this will usually depend on which bank you use and the type of account you have with them. Check with your bank for more information about these fees before travelling abroad.

Is my personal information secure when using my debit card?

Yes – when using your debit card, your personal information is never shared with merchants, so transactions remain secure and private. In addition to this, banks have taken extra steps to protect their customers’ financial details by introducing chip-and-pin technology on their debit cards. This makes it much harder for data thieves to access your sensitive financial information because each chip contains its own unique code that must be correctly entered into a point-of-sale machine in order for a purchase to be processed successfully.

Can I use my debit card if I am travelling abroad?

Yes – most banks allow their customers to use their debit cards abroad as long as they are notified in advance, although there may be additional charges associated with doing so depending on where you are going and your specific bank terms & conditions. However, it is important that you inform your bank before leaving otherwise transactions could be declined due to discrepancies between registered details held by banking institutions across different countries.

Conclusion:

Debit cards offer users a safe and convenient way to make payments quickly and securely while offering peace of mind that personal financial details remain private. Many banks also provide additional levels of security such as chip-and-pin technology which ensures that only authorized purchases can be made through validating user credentials at points-of-sale devices worldwide.