It is not easy to invest in the stock market and make a profit. That’s why investing in a custom index fund can be so advantageous. A custom index fund allows investors to diversify their investments as they are built from multiple stocks, which reduces the risk of individual stock selection. Plus, with a custom index fund you can have access to stocks that may otherwise be too hard for individuals to purchase.

Table Of Content:

- Custom Indexing: The Next Evolution of Index Investing | O ...

- Custom-Built Index Funds: Are You the Right Customer? | The ...

- Custom-Built Index Funds—Are You the Right Customer? | FINRA.org

- Your Own Custom Index Fund

- Schwab Personalized Indexing | Charles Schwab

- Watch Out, ETFs. Here Comes Custom Indexing. | Barron's

- NORTHERN TRUST WORLD CUSTOM ESG EQUITY INDEX FUND

- Investor Bulletin: Smart Beta, Quant Funds and other Non ... - SEC.gov

- Custom indexes - MSCI

- Fund Managers With $935 Billion See ESG-Fueled Custom Index ...

1. Custom Indexing: The Next Evolution of Index Investing | O ...

https://www.osam.com/Commentary/custom-indexing-the-next-evolution-of-index-investing

Standard indexes are “one size fits all.” Like standard indexes, Custom Indexes also invest and rebalance according to a defined methodology. But with Custom ...

2. Custom-Built Index Funds: Are You the Right Customer? | The ...

https://www.fool.com/investing/2018/09/25/custom-built-index-funds-are-you-the-right-custome.aspx Sep 25, 2018 ... Custom-built indexes might use criteria that an active fund manager would consider. For example, the index might include components based on ...

Sep 25, 2018 ... Custom-built indexes might use criteria that an active fund manager would consider. For example, the index might include components based on ...

3. Custom-Built Index Funds—Are You the Right Customer? | FINRA.org

https://www.finra.org/investors/insights/custom-built-index-funds

Aug 23, 2018 ... Custom-built indexes might use criteria that an active fund manager would consider. For example, the index might include components based on ...

4. Your Own Custom Index Fund

https://www.obermatt.com/en/investing/custom-index.html

A personalized or do-it-yourself index is similar to a standard index: It is a basket of stocks that have been selected based on common investment criteria.

5. Schwab Personalized Indexing | Charles Schwab

https://www.schwab.com/direct-indexing Going beyond traditional index investing, like through exchange-traded funds (ETFs) and mutual funds, direct indexing allows you to own individual stocks that ...

Going beyond traditional index investing, like through exchange-traded funds (ETFs) and mutual funds, direct indexing allows you to own individual stocks that ...

6. Watch Out, ETFs. Here Comes Custom Indexing. | Barron's

https://www.barrons.com/articles/watch-out-etfs-here-comes-custom-indexing-51616090219

7. NORTHERN TRUST WORLD CUSTOM ESG EQUITY INDEX FUND

https://cdn.northerntrust.com/pws/nt/documents/funds/intl/factsheets/northern-trust-world-custom-esg-equity-index-fund-srw01-shc-eur-en.pdfJun 30, 2022 ... The Fund seeks to closely match the risk and return characteristics of the MSCI World Custom ESG Index. (Index). It is a custom Index calculated ...

8. Investor Bulletin: Smart Beta, Quant Funds and other Non ... - SEC.gov

https://www.sec.gov/oiea/investor-alerts-and-bulletins/ib_smartbeta

Aug 6, 2018 ... Instead of tracking market indexes, non-traditional index funds track custom-built indexes to select the fund's investments.

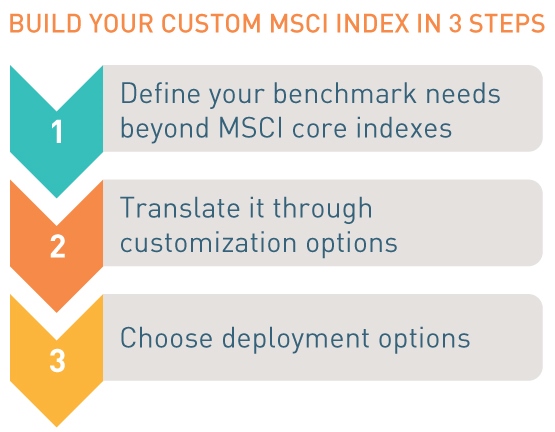

9. Custom indexes - MSCI

https://www.msci.com/custom-indexes Our custom indexes apply the same index construction, maintenance discipline, data reliability, global service and support that institutional investors have ...

Our custom indexes apply the same index construction, maintenance discipline, data reliability, global service and support that institutional investors have ...

10. Fund Managers With $935 Billion See ESG-Fueled Custom Index ...

https://www.bloomberg.com/news/articles/2021-10-20/fund-managers-with-935-billion-see-esg-fueled-custom-index-boom Oct 20, 2021 ... Fund Managers With $935 Billion See ESG-Fueled Custom Index Boom. An industry survey indicates that 70% of global pension funds and ...

Oct 20, 2021 ... Fund Managers With $935 Billion See ESG-Fueled Custom Index Boom. An industry survey indicates that 70% of global pension funds and ...

What is a Custom Index Fund?

A custom index fund is an investment portfolio that combines the holdings of multiple stock markets into a single investment strategy. This creates a diversified portfolio that contains both large-cap and small-cap stocks from around the globe. The goal of this type of fund is to provide investors with long-term capital appreciation with minimal risk.

Who should invest in a Custom Index Fund?

Custom index funds are generally best suited for those who are looking for long-term growth potential with low risk. They are also ideal for those who want access to specific types of stocks without having to purchase each one individually.

How do I know which Custom Index Fund to choose?

Before investing in any type of fund it is important to research and understand your goals and risk tolerance. It is also important to analyze past performance data, fees, and other factors when deciding on an investment product. It's always recommended that you speak to a financial advisor before making any decision about investing in an index fund or any other type of security.

Conclusion:

Investing in a custom index fund can be a great way for investors to diversify their portfolios and increase their returns while reducing overall risk exposure. With careful research and analysis, individuals can find the right customized index funds that best fit their financial goals and risk profile. By doing so, they will maximize returns while minimizing losses.