Cash App, a digital money-transfer service from Square, Inc., recently introduced an overdraft limit. This feature allows users to set their own limit on spending and helps protect their accounts against accidental overspending.

Table Of Content:

- Cash App Support Negative Balance

- Cash App Borrow: Cash App's Newest Loan Feature ...

- Square's Cash App tests new feature allowing users to borrow up to ...

- Can You Overdraft Cash App (Plus Better Alternatives)

- Can you overdraft Cash App? - All you need to know

- Overdraft Protection – Wells Fargo

- Can You Overdraft Cash App Card? How to Fix Overdraft Cash App ...

- Cash App on Twitter: "Just a friendly reminder that there are ...

- Overdraft Protection & Overdraft Services | Wells Fargo

- Cash App Overdraft: Understand When Cash App Balance Go ...

1. Cash App Support Negative Balance

https://cash.app/help/us/en-us/11061-negative-balance Charges that appear on your account long after a purchase and secondary charges like tips can push your balance into the negative.

Charges that appear on your account long after a purchase and secondary charges like tips can push your balance into the negative.

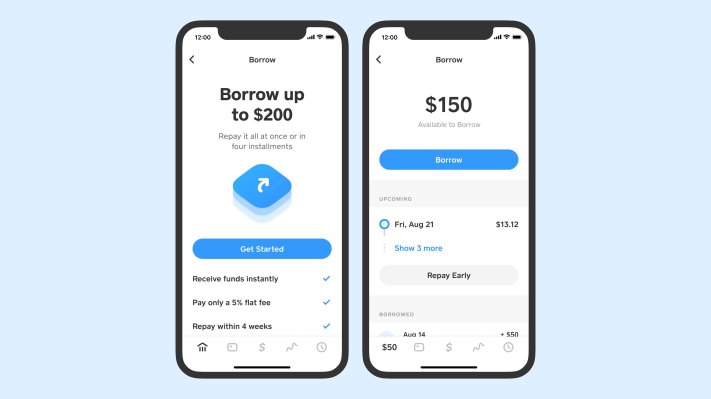

2. Cash App Borrow: Cash App's Newest Loan Feature ...

https://www.gobankingrates.com/banking/technology/cash-app-borrow/ Jul 20, 2022 ... Having access to a Cash App short-term loan would make it possible to borrow money when you're in a pinch. Here's what to consider before ...

Jul 20, 2022 ... Having access to a Cash App short-term loan would make it possible to borrow money when you're in a pinch. Here's what to consider before ...

3. Square's Cash App tests new feature allowing users to borrow up to ...

https://techcrunch.com/2020/08/12/square-cash-app-borrowing/ Aug 12, 2020 ... Cash App, the peer-to-peer payments service from Square, is giving select users a way to get short-term loans. The company said it's only ...

Aug 12, 2020 ... Cash App, the peer-to-peer payments service from Square, is giving select users a way to get short-term loans. The company said it's only ...

4. Can You Overdraft Cash App (Plus Better Alternatives)

https://topmobilebanks.com/blog/can-you-overdraft-cash-app/ Jun 2, 2022 ... The max overdraft limit is $200. To get any overdraft, you have to deposit at least $20. One Finance also has much better interest rates than ...

Jun 2, 2022 ... The max overdraft limit is $200. To get any overdraft, you have to deposit at least $20. One Finance also has much better interest rates than ...

5. Can you overdraft Cash App? - All you need to know

https://www.guidelinelaw.com/can-you-overdraft-cash-app/ Apr 7, 2022 ... Can you overdraft Cash App at the ATM? ... No, your Cash App Card is a debit card, which means you can only spend as much as you have in your Cash ...

Apr 7, 2022 ... Can you overdraft Cash App at the ATM? ... No, your Cash App Card is a debit card, which means you can only spend as much as you have in your Cash ...

6. Overdraft Protection – Wells Fargo

https://www.wellsfargo.com/credit-cards/features/overdraft-protection/

Protect yourself against unexpected overdrafts and bounced checks by linking your Wells ... If your available cash advance credit limit is less than $25, ...

7. Can You Overdraft Cash App Card? How to Fix Overdraft Cash App ...

https://reallyneedcash.com/can-you-overdraft-cash-app-card/ Jun 9, 2022 ... Yes, you can in fact overdraft a Cash App card. Since Cash App Card have no line of credit attached to them, it typically has no overdraft fee.

Jun 9, 2022 ... Yes, you can in fact overdraft a Cash App card. Since Cash App Card have no line of credit attached to them, it typically has no overdraft fee.

8. Cash App on Twitter: "Just a friendly reminder that there are ...

https://twitter.com/cashapp/status/976889296996192256?lang=en Mar 22, 2018 ... Nope! Cash Card does not have overdraft as a feature.

Mar 22, 2018 ... Nope! Cash Card does not have overdraft as a feature.

9. Overdraft Protection & Overdraft Services | Wells Fargo

https://www.wellsfargo.com/checking/overdraft-services/

Mobile deposit is only available through the Wells Fargo Mobile® app. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile ...

10. Cash App Overdraft: Understand When Cash App Balance Go ...

https://quickutilities.net/blog/cash-app-overdraft May 27, 2022 ... Through a Cash App card one can spend money from whatever balance is available in a Cash App account. Even one can cash out money in accordance ...

May 27, 2022 ... Through a Cash App card one can spend money from whatever balance is available in a Cash App account. Even one can cash out money in accordance ...

What is the Cash App overdraft limit?

The Cash App overdraft limit allows users to set their own cap on spending and helps protect them against accidental overspending. Users can specify their own personal limit ranging from $0-$250 that will prevent them from being charged additional fees as a result of an overdraft.

Is it possible to remove the Cash App overdraft limit?

Yes, a user can choose to opt out of the overdraft protection provided by setting the limit. However, if they do so they may be subject to additional fees if they accidentally spend more than their current balance.

How does this feature help protect users?

By setting a cap on their spending, users are able to take control of their payment experience and ensure that there are no surprises when it comes to paying fees or interest payments as a result of an unexpected expense or overdraft. This helps them stay within budget and avoid any additional costs due to cash flow mismanagement.

Conclusion:

The Cash App's new overdraft limit is a great way for users to take control of their finances and ensure they don't face any unexpected fees due to unintentional overspending. Not only does it protect them financially but also provides peace of mind knowing that all transactions are tracked accurately within the app and that any mistake won't come with a heavy price tag attached.