accounting for nfts. Get the update accounting for nfts. Check the bellow calculator with convert accounting for nfts.

Table Of Content:

- NFTs come with big valuation challenges - Journal of Accountancy

- PwC releases report on nonfungible tokens: PwC

- Accounting for NFTs | Centri

- Accounting for NFTs - 5 Things to Consider

- NFTs Are Continuing To Cause Accounting Issues, Even After Tax ...

- More U.S. Companies Wade Into NFTs Despite Lack of Accounting ...

- Corporates using NFTs

- Accounting for NFT and Cryptocurrency Donations

- Accounting Spotlight — The Metaverse — Accounting ...

- Non-Fungible Tokens (NFTs): Legal, tax and accounting ...

1. NFTs come with big valuation challenges - Journal of Accountancy

https://www.journalofaccountancy.com/news/2021/jul/nft-nonfungible-token-valuation-challenges.html Jul 15, 2021 ... For the creator of an NFT, there is no GAAP standard that specifies the accounting when the asset is created and whether to capitalize or ...

Jul 15, 2021 ... For the creator of an NFT, there is no GAAP standard that specifies the accounting when the asset is created and whether to capitalize or ...

2. PwC releases report on nonfungible tokens: PwC

https://www.pwc.com/us/en/services/tax/library/pwc-releases-report-on-nonfungible-tokens.html PwC recently released its report on Non-Fungible Tokens (NFTs): Legal, tax and accounting considerations you need to know, which covers the sparse guidance ...

PwC recently released its report on Non-Fungible Tokens (NFTs): Legal, tax and accounting considerations you need to know, which covers the sparse guidance ...

3. Accounting for NFTs | Centri

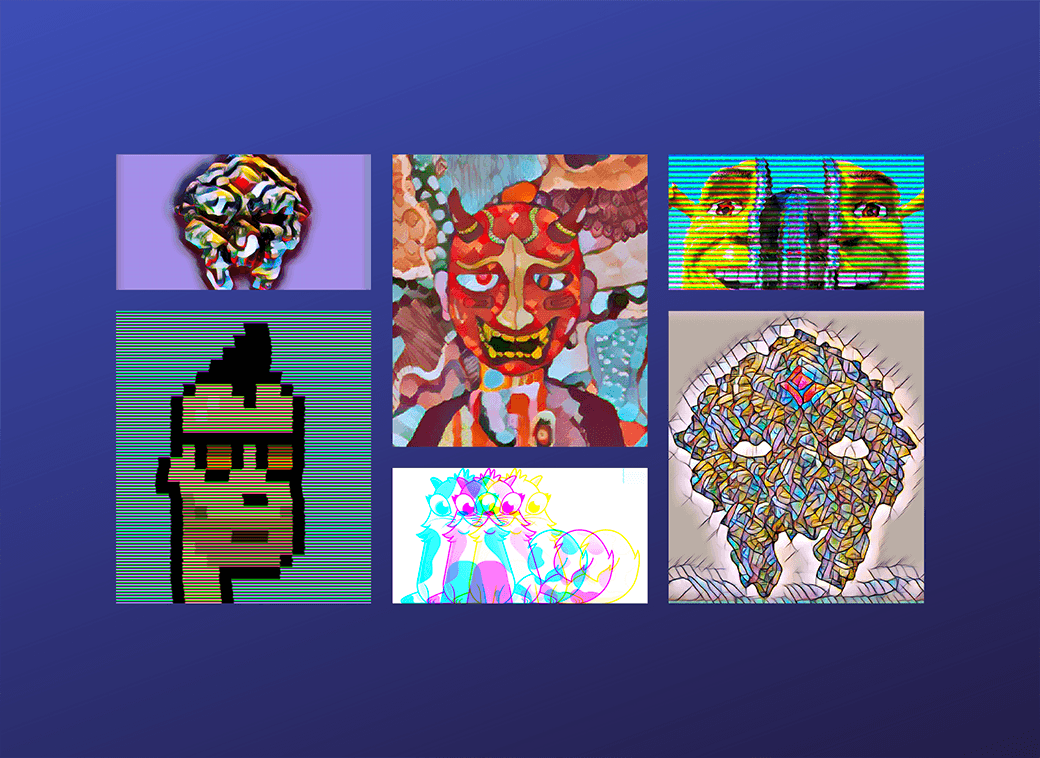

https://centriconsulting.com/news/accounting-for-nfts/![]() Jan 20, 2022 ... NFTs (or “non-fungible tokens”) are a special kind of digital asset in which each token is unique, representing different forms of media that ...

Jan 20, 2022 ... NFTs (or “non-fungible tokens”) are a special kind of digital asset in which each token is unique, representing different forms of media that ...

4. Accounting for NFTs - 5 Things to Consider

https://blog.gilded.finance/how-to-account-for-nfts-5-things-to-consider/ Mar 29, 2021 ... 2. What is the accounting treatment for NFTs? ... Since there is no crypto-specific authoritative accounting guidance in the marketplace, the ...

Mar 29, 2021 ... 2. What is the accounting treatment for NFTs? ... Since there is no crypto-specific authoritative accounting guidance in the marketplace, the ...

5. NFTs Are Continuing To Cause Accounting Issues, Even After Tax ...

https://www.forbes.com/sites/seansteinsmith/2022/04/24/nfts-are-continuing-to-cause-accounting-issues-even-after-tax-season/ Apr 24, 2022 ... Non-fungible tokens (NFTs) might be seen by some as just the latest fad or iteration of cryptoassets that need to be contended with, but there ...

Apr 24, 2022 ... Non-fungible tokens (NFTs) might be seen by some as just the latest fad or iteration of cryptoassets that need to be contended with, but there ...

6. More U.S. Companies Wade Into NFTs Despite Lack of Accounting ...

https://www.wsj.com/articles/more-u-s-companies-wade-into-nfts-despite-lack-of-accounting-rules-11647855001

Mar 21, 2022 ... More U.S. companies are investing in nonfungible tokens even though there are no specific accounting rules or disclosure requirements for ...

7. Corporates using NFTs

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/audit/us-corporates-using-nfts-how-nfts-might-fit-your-business-pov.pdfIt's also important to give full attention to how NFT design decisions may impact tax and accounting questions—and to loop those corporate functions into the ...

8. Accounting for NFT and Cryptocurrency Donations

https://www.cohnreznick.com/insights/accounting-for-nft-and-cryptocurrency-donations Sep 15, 2021 ... An NFT is a digital method of proving ownership of a unique and usually digital asset, with ownership encryption tracked on a blockchain, a ...

Sep 15, 2021 ... An NFT is a digital method of proving ownership of a unique and usually digital asset, with ownership encryption tracked on a blockchain, a ...

9. Accounting Spotlight — The Metaverse — Accounting ...

https://dart.deloitte.com/USDART/home/publications/deloitte/accounting-spotlight/metaverse-accounting-considerations-related-nonfungible-tokens

Jun 21, 2022 ... One effective medium for transacting in a digital world is nonfungible tokens (NFTs), units of data stored and transferred on a digital ledger ( ...

10. Non-Fungible Tokens (NFTs): Legal, tax and accounting ...

https://www.pwchk.com/en/research-and-insights/fintech/nfts-legal-tax-accounting-considerations-dec2021.html Non-fungible tokens (NFTs) are unique and non-interchangeable digital assets stored on a blockchain. The rise of NFTs this year has surprised people in not ...

Non-fungible tokens (NFTs) are unique and non-interchangeable digital assets stored on a blockchain. The rise of NFTs this year has surprised people in not ...

Conclusion:

Finally, that is all about accounting for nfts. You reached at the last stage of this article. Hope you will get the right information about NFTs come with big valuation challenges - Journal of Accountancy.