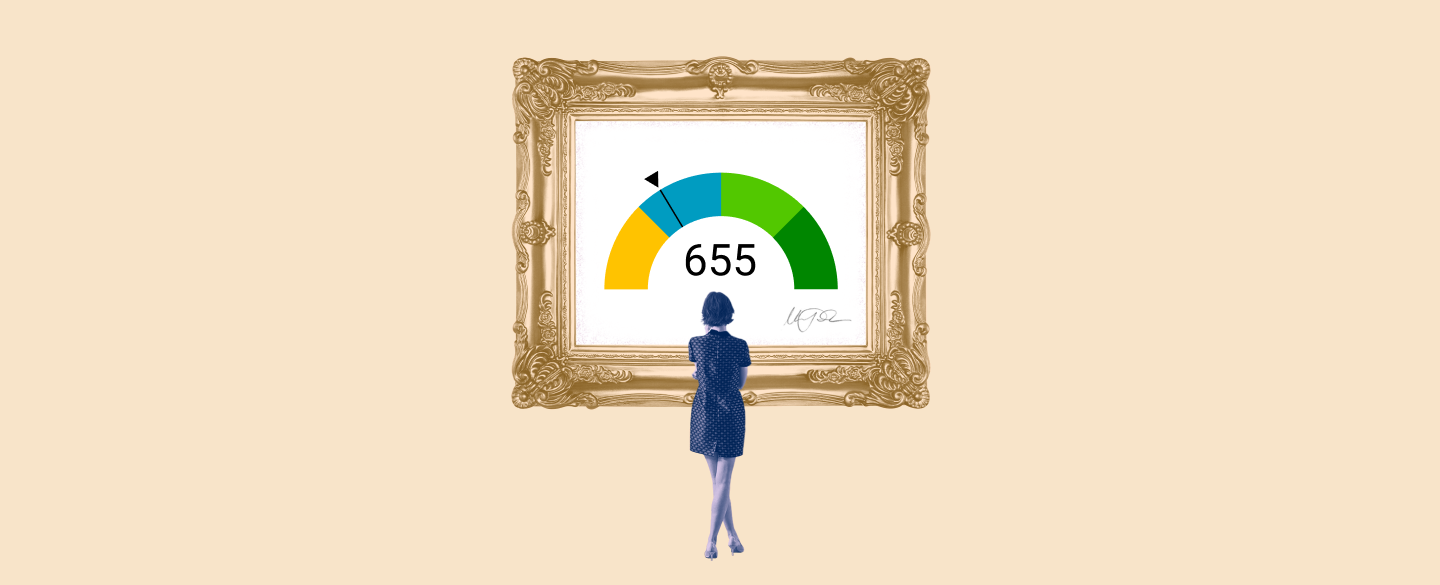

Are you looking for more information about a FICO Score of 655? Your FICO Score can tell you a lot about your creditworthiness and financial stability. This guide will provide you with an introduction to the meaning of a 655 FICO Score, as well as some frequently asked questions and answers related to this score range.

Table Of Content:

- 655 Credit Score: Is it Good or Bad?

- Is 655 a Good Credit Score? What It Means, Tips & More

- 655 Credit Score: What Does It Mean? | Credit Karma

- 655 Credit Score (+ #1 Way To Fix It )

- Is 655 a good credit score? | Lexington Law

- 655 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 655 Credit Score: Good or Bad? | Credit Card & Loan Options

- 655 Credit Score: Is it Good or Bad? (Approval Odds)

- 655 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 655 Credit Score - Is it Good or Bad? What does it mean in 2022?

1. 655 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/655-credit-score/ A FICO® Score of 655 places you within a population of consumers whose credit may be seen as Fair. Your 655 FICO® Score is lower than the average U.S. credit ...

A FICO® Score of 655 places you within a population of consumers whose credit may be seen as Fair. Your 655 FICO® Score is lower than the average U.S. credit ...

2. Is 655 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/655-credit-score/

A 655 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 655 credit score isn't "bad," ...

3. 655 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/655 Apr 30, 2021 ... A 655 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 655 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. 655 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/655-credit-score

5. Is 655 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/655 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

6. 655 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/655-credit-score-mortgage/

FHA Loan with 655 Credit Score ... FHA loans only require that you have a 580 credit score, so with a 655 FICO, you can definitely meet the credit score ...

7. 655 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/655/ Nov 9, 2021 ... A credit score of 655 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. In FICO ...

Nov 9, 2021 ... A credit score of 655 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. In FICO ...

8. 655 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/655-credit-score/ Is 655 a good credit score? FICO scores range from 300 to 850. As you can see below, a 655 credit score is considered Fair.

Is 655 a good credit score? FICO scores range from 300 to 850. As you can see below, a 655 credit score is considered Fair.

9. 655 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/655-credit-score/ A credit score of 655 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

A credit score of 655 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

10. 655 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/fair-credit/655/ On the bright side, a credit score of 655 is not the end of the world. Typically, it is individuals with scores lower than 630 (the 'poor' FICO range) who have ...

On the bright side, a credit score of 655 is not the end of the world. Typically, it is individuals with scores lower than 630 (the 'poor' FICO range) who have ...

What does a 655 FICO Score mean?

A 655 FICO Score is generally considered to be good credit. It means that lenders may view you as being financially responsible and they are more likely to consider approving you for certain types of loans and other credit products, although approval is not guaranteed.

Does everyone have the same FICO Score range?

No, everyone’s FICO Score range is unique based on their individual credit history. Various factors such as payment history, how much debt one has, and length of credit history can all play into what your score range may look like.

What types of loans might I be eligible for with a 655 FICO Score?

With a score in the good range, you may qualify for almost any type of loan, including personal loans, mortgages, car loans, student loans, business funding etc. However, it is important to keep in mind that lenders review many different factors when determining loan eligibility aside from just your credit score.

Is my score always in the same range?

Depending on any changes or updates made to your credit report over time (paying off debts or opening new accounts) your score could change as well. It’s important to stay on top of any changes that may affect your financial health so that you know what kind of offers you are eligible for at any given time.

Conclusion:

With a 655 FICO Score rating you are more likely than not to be eligible for certain types of loans and other lending products depending on what else is affecting your overall financial standing in the eyes of lenders. It’s important to stay up-to-date with any recent changes that may have an impact on your ability to receive offers from potential creditors.