Looking to finance your home? The 65000 income mortgage is the perfect option for you. With competitive interest rates and no down payment, this loan offers borrowers a secure and reliable way to purchase their dream home. Furthermore, it can provide extra financial flexibility with flexible repayment terms.

Table Of Content:

- I Make $65,000 a Year. How Much House Can I Afford? - Bundle

- I Make $65,000 a Year How Much House Can I Afford?

- How much mortgage can I afford making $65000 a year? - Quora

- How Much House Can I Afford If I Make $65,000 a Year?

- How Much House Can I Afford? - Home Affordability Calculator ...

- Best Places to Live on a $65,000 Salary - 2022 Edition - SmartAsset

- $65000 Income Tax Calculator 2021 - Massachusetts - Forbes Advisor

- Mortgage Qualifier Calculator - How Much Can You Afford?

- I Make $70,000 a Year. How Much House Can I Afford? The Answer

- Monthly Payment on a $65,000 Personal Loan

1. I Make $65,000 a Year. How Much House Can I Afford? - Bundle

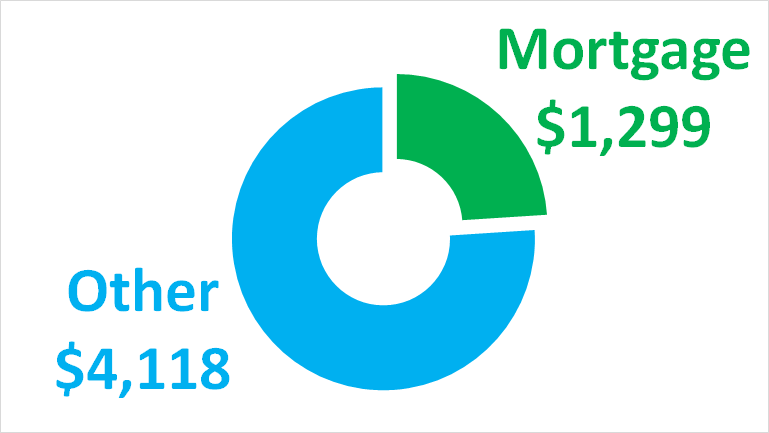

https://bundleloan.com/blog/i-make-65000-a-year-how-much-house-can-i-afford/ Your mortgage payment for a $195,000 house will be $1,299. ... We base your home price on a mortgage payment that is 24% of your monthly income.

Your mortgage payment for a $195,000 house will be $1,299. ... We base your home price on a mortgage payment that is 24% of your monthly income.

2. I Make $65,000 a Year How Much House Can I Afford?

https://mortgage-calculator.net/i-make-65000-a-year-how-much-house-can-i-afford.php

If you make $65,000, your monthly income would be $5,416.67, and 28% of $5,416.67 is $1,516.67. The 28% rule states that one should not make mortgage payments ...

3. How much mortgage can I afford making $65000 a year? - Quora

https://www.quora.com/How-much-mortgage-can-I-afford-making-65000-a-year

A rough guesstimate is that you could afford about 1/4 of your salary for a mortgage payment including taxes & insurance. So roughly between $1,200 & $1,300 per ...

4. How Much House Can I Afford If I Make $65,000 a Year?

https://online-calculator.org/how-much-house-can-i-afford-if-i-make-65000-a-year

Annual Income: · Monthy Debt: · Down Payment: · Loan Terms: · Interest Rate: · Property Tax (Yearly): · Home Insurance (Yearly): · HOA Fees (Monthly):

5. How Much House Can I Afford? - Home Affordability Calculator ...

https://www.hsh.com/how-much-house-can-i-afford.html

6. Best Places to Live on a $65,000 Salary - 2022 Edition - SmartAsset

https://smartasset.com/data-studies/best-places-to-live-on-a-65000-salary-2022 Jun 15, 2022 ... SmartAsset examined data for 104 cities to uncover where median earners thrive based on income, employment, housing costs and more.

Jun 15, 2022 ... SmartAsset examined data for 104 cities to uncover where median earners thrive based on income, employment, housing costs and more.

7. $65000 Income Tax Calculator 2021 - Massachusetts - Forbes Advisor

https://www.forbes.com/advisor/income-tax-calculator/massachusetts/65000/ If you make $65000 in Massachusetts, what will your salary after tax be? Our income tax and paycheck calculator can help you understand your take home pay.

If you make $65000 in Massachusetts, what will your salary after tax be? Our income tax and paycheck calculator can help you understand your take home pay.

8. Mortgage Qualifier Calculator - How Much Can You Afford?

https://www.mortgageloan.com/calculator/mortgage-qualifying-calculator

How much can you afford? This maximum qualifier calculator will allow you to calculate how much of a home you can afford based on your annual income.

9. I Make $70,000 a Year. How Much House Can I Afford? The Answer

https://www.homelight.com/blog/buyer-i-make-70000-a-year-how-much-house-can-i-afford/ 2 days ago ... But if you have no debt, you can stretch up to 40% of your take-home income, which will be devoting about $1,812 to your mortgage payment.

2 days ago ... But if you have no debt, you can stretch up to 40% of your take-home income, which will be devoting about $1,812 to your mortgage payment.

10. Monthly Payment on a $65,000 Personal Loan

https://wallethub.com/answers/pl/monthly-payment-on-65000-personal-loan-2140763822/ Sep 10, 2021 ... The monthly payment on a $65,000 loan ranges from $888 to $6,530, depending on the APR and how long the loan lasts.

Sep 10, 2021 ... The monthly payment on a $65,000 loan ranges from $888 to $6,530, depending on the APR and how long the loan lasts.

How much of a down payment do I need to make?

No down payment is required when applying for the 65000 income mortgage; however you may be required to pay closing costs.

Are there any fees associated with the loan?

There are no additional fees or charges associated with the loan; however borrowers are responsible for paying an origination fee at closing.

What type of interest rate will I receive?

Competitive fixed-rate and adjustable-rate mortgages are available with this loan - both offering competitive interest rates that will not change over the life of the loan.

How long will it take to close on my loan?

Loan processing times vary depending on the borrower’s credit score, debt-to-income ratio, and other factors; however most loans take anywhere from 30–45 days to close.

Is preapproval necessary in order to apply for the loan?

Preapproval is not required but recommended as it can help streamline the application process, providing a clear indication of what kind of loan you qualify for and how much you can borrow.

Conclusion:

The 65000 income mortgage is an excellent option for those looking to purchase a home without having to pay a large down payment or incur any additional fees or charges. With competitive interest rates and flexible repayment terms, this mortgage solution provides borrowers with secure financing that meets their needs.