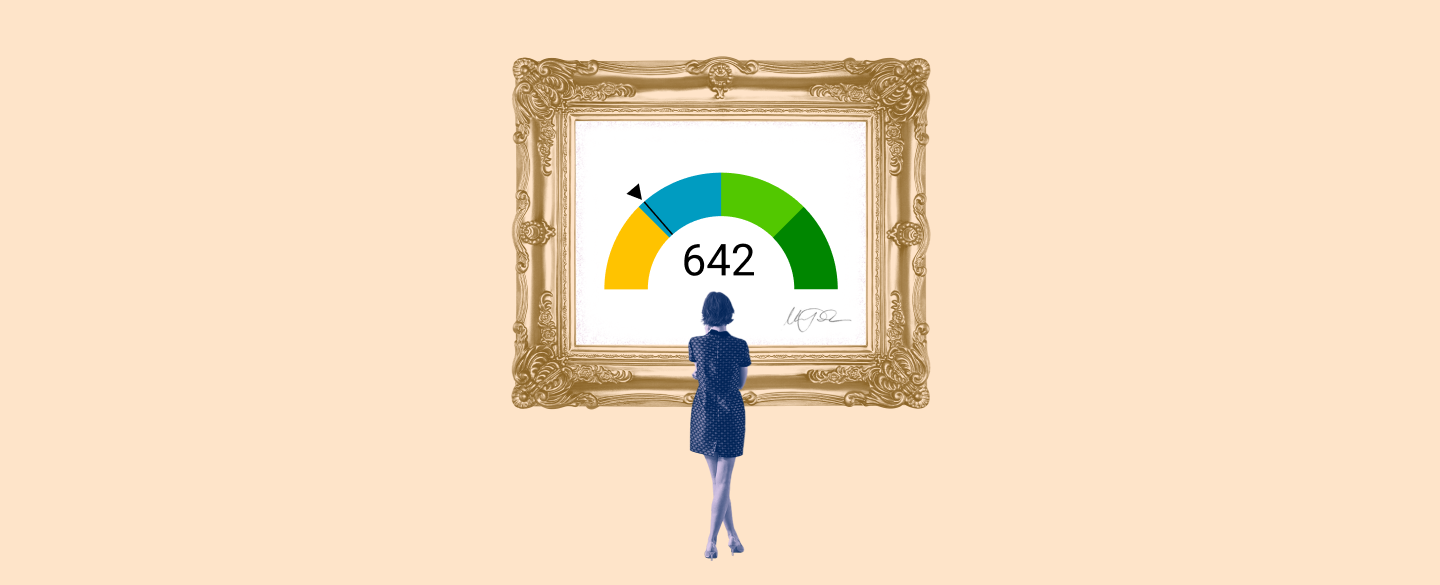

A credit score is an indicator that determines the risk of a borrower defaulting on a loan. The higher the score, the lower the risk and more likely lenders are to approve you for credit. A 642 credit score puts you in “Fair” territory when it comes to your overall borrowing capacity and is considered a good starting point for people with limited or no credit history.

Table Of Content:

- 642 Credit Score: Is it Good or Bad?

- Is 642 a Good Credit Score? What It Means, Tips & More

- 642 Credit Score: What Does It Mean? | Credit Karma

- Is 642 a good credit score? | Lexington Law

- 642 Credit Score (+ #1 Way To Fix It )

- 642 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 642 Credit Score – Is it Good or Bad? How to Improve Your 642 ...

- 642 Credit Score - Is it Good or Bad? What does it mean in 2022?

- 642 Credit Score: Good or Bad? | Credit Card & Loan Options

- 642 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 642 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/642-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 642 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 642 FICO® Score is below the average credit score.

2. Is 642 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/642-credit-score/

A 642 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 642 credit score isn't "bad," ...

3. 642 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/642 Apr 30, 2021 ... A 642 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 642 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. Is 642 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/642 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

5. 642 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/642-credit-score

Jul 1, 2022 ... A 642 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 642 Credit Score. Lenders ...

6. 642 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/642-credit-score-mortgage/

If your credit score is a 642 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

7. 642 Credit Score – Is it Good or Bad? How to Improve Your 642 ...

https://www.creditrepairexpert.org/642-credit-score/ How to Improve Your 642 FICO Score. Before you can do anything to increase your 642 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 642 FICO Score. Before you can do anything to increase your 642 credit score, you need to identify what part of it needs to be improved, ...

8. 642 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/poor-credit/642/ A credit score of 642 is considered poor, however, it will still get you an auto-loan, some types of credit cards, a home loan and even a personal loan, ...

A credit score of 642 is considered poor, however, it will still get you an auto-loan, some types of credit cards, a home loan and even a personal loan, ...

9. 642 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/642/ Nov 9, 2021 ... A credit score of 642 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. In FICO ...

Nov 9, 2021 ... A credit score of 642 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. In FICO ...

10. 642 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/642-credit-score/ A 642 credit score is considered as “poor” score. While people with the 642 FICO score won't have as much trouble getting loans as those with lower credit, ...

A 642 credit score is considered as “poor” score. While people with the 642 FICO score won't have as much trouble getting loans as those with lower credit, ...

What kind of interest rate can I expect with a 642 credit score?

Depending on your debt-to-income ratio, type of loan, and other factors, borrowers with a 642 credit score may qualify for an interest rate between 5% and 18%. It's important to shop around and compare different offers before committing in order to get the best rate available.

Does having a 642 credit score mean I won't be approved for loans?

No. Having a 642 credit score indicates that lenders view you as someone who has some capacity to repay their debt obligations as long as other criteria are met such as income, employment history etc. However, it could mean that you pay higher interest rates than someone with better score.

How can I improve my 642 credit score?

Improving your 642 credit score requires creating healthy financial habits. Pay all of your bills on time, every month; reduce your balances by paying off debts; keep old accounts open; make sure positive information is being reported about you; avoid applying for too many new accounts or taking out new debts unnecessarily.

How long does it take to build up a 642 credit score?

It depends on various factors such as how much debt you have managed so far and if negative items appear on your report that need correcting first. If you have already established one or two lines of revolving credits since the last year or two then this can help increase your overall rating quickly but if not then it may take some time depending how consistently you pay off any new debt incurred over time.

Can my spouse's good credit help me improve my 642 credit score?

Yes - Your spouse's good credit may be able to help offset yours due to something known as "piggybacking" which means using their good payment history to help bolster yours. Piggybacking should be used judiciously however since this could have negative repercussions related to joint financial responsibility which might arise from disputes later down the line.

Conclusion:

A 642 Credit Score is considered ‘Fair’ by most lenders and can indicate manageable levels of debt repayment ability making it ideal for those starting out in life financially or trying to rebuild their scores after mistakes made in previous years. Building up this level from scratch will require patience and dedication but ultimately it can still prove successful in helping obtain better loan terms than previously seen before.