The 60 30 10 rule investing is an investment strategy where you divide your money into three categories: 60% on stocks, 30% on bonds, and 10% in a cash reserve. This strategy allows for diversification, reducing risk of losses while still providing opportunity to make decent returns. By distributing the portfolio across different types of investments, you can limit exposure to any one sector or type of security.

Table Of Content:

- How Does The 60 30 10 Rule Work For Budgeting? | Clever Girl ...

- 18: The 10-30-60 Rule Shows The Huge Multiplier Effect Of Investing

- The 60-30-10 Rule Of Investing | Seeking Alpha

- 60/30/10 Rule Budget Explained (and Can It Make You Rich ...

- 60 30 10 Rule Budget - Just Start Investing

- Is Warren Buffett's 90/10 Asset Allocation Sound?

- 60:30:10 Rule Video | FMG Wealth Strategists

- What Is the 50/20/30 Budget Rule? How It Works

- The 50/30/20 Rule of Thumb for Budgeting

- The 60-30-10 Rule. The Secret to Career Success. | The Way Of ...

1. How Does The 60 30 10 Rule Work For Budgeting? | Clever Girl ...

https://www.clevergirlfinance.com/blog/60-30-10-rule-budget/ Oct 25, 2021 ... With this budget, you will use 60% of your take-home pay to build your savings, invest, or pay off debt. · Next up, you will spend 30% on your ...

Oct 25, 2021 ... With this budget, you will use 60% of your take-home pay to build your savings, invest, or pay off debt. · Next up, you will spend 30% on your ...

2. 18: The 10-30-60 Rule Shows The Huge Multiplier Effect Of Investing

https://donezra.com/18-the-10-30-60-rule-shows-the-huge-multiplier-effect-of-investing/

The first is that, if 10 cents saved ultimately creates a dollar of withdrawals, overall that's a multiplier effect that gives the original savings 10 times as ...

3. The 60-30-10 Rule Of Investing | Seeking Alpha

https://seekingalpha.com/article/4431903-the-60-30-10-rule-of-investing May 28, 2021 ... Let's move to the second step in our color-theory inspired 60-30-10 rule. The financials are the secondary color or texture. In a room, it would ...

May 28, 2021 ... Let's move to the second step in our color-theory inspired 60-30-10 rule. The financials are the secondary color or texture. In a room, it would ...

4. 60/30/10 Rule Budget Explained (and Can It Make You Rich ...

https://www.bosssinglemama.com/60-30-10-rule-budget/ 60% of your take-home income goes to saving and investing to further your ...

60% of your take-home income goes to saving and investing to further your ...

5. 60 30 10 Rule Budget - Just Start Investing

https://www.juststartinvesting.com/60-30-10-rule-budget/ Nov 30, 2021 ... By allocating 60% of your income into savings, you become more flexible with your finances. The remaining 30 and 10% are split into needs and ...

Nov 30, 2021 ... By allocating 60% of your income into savings, you become more flexible with your finances. The remaining 30 and 10% are split into needs and ...

6. Is Warren Buffett's 90/10 Asset Allocation Sound?

https://www.investopedia.com/articles/personal-finance/121815/buffetts-9010-asset-allocation-sound.asp/GettyImages-849890764-0160b14211c94645b31e93fcad87e916.jpg) The rule of thumb advisors have traditionally urged investors to use, in terms of the percentage of stocks an investor should have in ...

The rule of thumb advisors have traditionally urged investors to use, in terms of the percentage of stocks an investor should have in ...

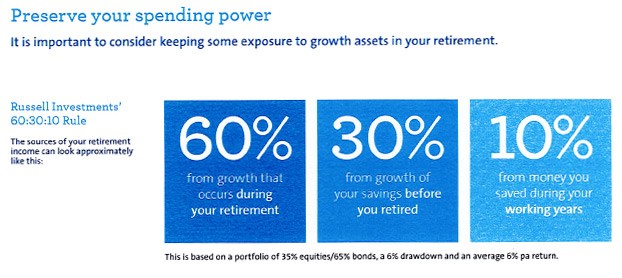

7. 60:30:10 Rule Video | FMG Wealth Strategists

https://fmgws.com.au/blog/603010-rule-video/ Dec 1, 2015 ... What is the '60:30:10 Rule'? ... We believe that a successful strategy starts with a plan and an full understanding of your objectives. One of the ...

Dec 1, 2015 ... What is the '60:30:10 Rule'? ... We believe that a successful strategy starts with a plan and an full understanding of your objectives. One of the ...

8. What Is the 50/20/30 Budget Rule? How It Works

https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp/GettyImages-483822321-fdd7a727e3bd40a5bbed22d7b46179e7.jpg) Learn about Elizabeth Warren's 50/20/30 budget rule; a simple and effective ... Finally, try to allocate 20% of your net income to savings and investments.

Learn about Elizabeth Warren's 50/20/30 budget rule; a simple and effective ... Finally, try to allocate 20% of your net income to savings and investments.

9. The 50/30/20 Rule of Thumb for Budgeting

https://www.thebalance.com/the-50-30-20-rule-of-thumb-453922:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg) The 50/30/20 rule is an easy way to allocate your money among wants, needs, ... follows: 70% to living expenses, 20% to debt payments, and 10% to savings.

The 50/30/20 rule is an easy way to allocate your money among wants, needs, ... follows: 70% to living expenses, 20% to debt payments, and 10% to savings.

10. The 60-30-10 Rule. The Secret to Career Success. | The Way Of ...

https://jordialemany.wordpress.com/the-60-30-10-rule-the-secret-to-career-success/ This means that if you wish to extend your working hours, you should not spend more than 10% of your spare time at work, even less doing things that no-body ...

This means that if you wish to extend your working hours, you should not spend more than 10% of your spare time at work, even less doing things that no-body ...

What happens if my stock investments decline?

By diversifying your investment portfolio with bonds and cash reserves, you can control your potential losses if stocks experience a downturn. Bond investments are generally considered safer than equities, but they usually also produce smaller returns. Cash reserves provide immediate liquidity if needed.

How often should I review my investments?

It’s important to review your portfolio at least once a year to make sure it is still properly allocated according to the 60-30-10 rule and that no changes need to be made due to changing market conditions or personal goals.

Does the 60 30 10 Rule work for all types of investors?

Yes, the 60-30-10 rule works well for both beginner and experienced investors who are trying to create a balanced portfolio that reduces risk without sacrificing potential returns. The rule gives you the flexibility to adjust the percentages as needed depending on your personal preferences and goals.

Is this strategy only suitable for long-term investments?

No, although this strategy was designed primarily with long-term growth in mind, it can also be used for short-term investing too; however, there will likely be fewer returns from any bond holdings unless held over longer periods or until maturity.

How much money do I need to invest using this strategy?

The amount required depends on how much you’re comfortable investing and how aggressive or conservative you want your allocations to be – anything from $500 upwards can work with this strategy. You may need more capital initially if you plan on buying individual stocks or ETFs rather than index funds.

Conclusion:

The 60 30 10 Rule is a simple yet effective approach when it comes to designing your own portfolio as it helps diversify risk by spreading out your money among different asset classes while still offering potential returns. It’s important to conduct regular reviews of your investments in order to ensure performance remains within expectations based on current market trends and risk tolerances.