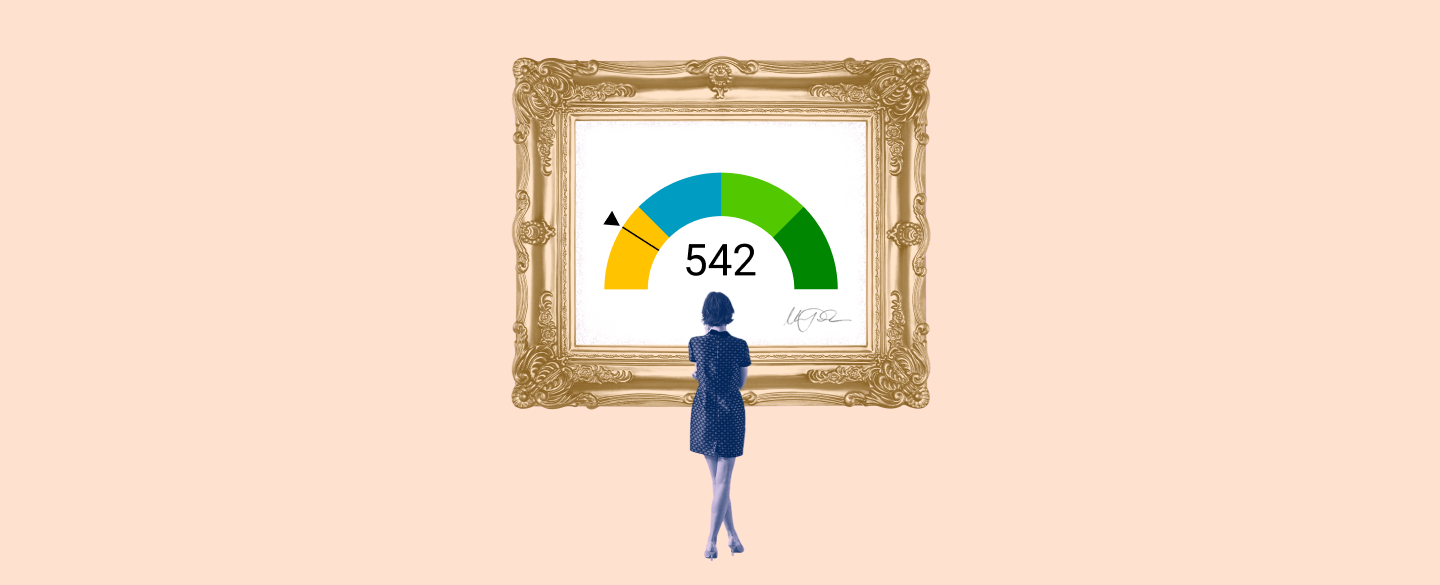

Your credit score is a key indicator of your financial health. A 542 credit score falls within the "poor" credit range, making it difficult for you to access loans and other types of credit. Although this isn't ideal, there are steps you can take to improve your credit score and finances in the long run.

Table Of Content:

- 542 Credit Score: Is it Good or Bad?

- 542 Credit Score: What Does It Mean? | Credit Karma

- 542 Credit Score: Good or Bad, Loan Options & Tips

- 542 Credit Score (+ #1 Way To Fix It )

- 542 Credit Score: Is it Good or Bad? How do I Improve it?

- 542 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- Is 542 a good credit score? | Lexington Law

- 542 Credit Score: Good or Bad? | Credit Card & Loan Options

- 542 Credit Score – Is it Good or Bad? How to Improve Your 542 ...

- Car loan interest rates with 542 credit score in 2022

1. 542 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/542-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 542 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 542 FICO® Score is significantly below the average credit score.

2. 542 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/542 May 4, 2021 ... A 542 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

May 4, 2021 ... A 542 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. 542 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/542-credit-score/

A 542 credit score is classified as "bad" on the standard 300-to-850 scale. It is 158 points away from being a “good” credit score, which many people use as ...

4. 542 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/542-credit-score

Jun 11, 2022 ... Is 542 a Good Credit Score? ... A 542 FICO® Score is considered “Poor”. It means you've had past payment problems, including collection accounts, ...

5. 542 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/542-credit-score

A 542 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

6. 542 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/542-credit-score-mortgage/ These lenders offer an opportunity to get an FHA loan with a 542 credit score (or anywhere in the 500-579 credit range). If you would like some assistance ...

These lenders offer an opportunity to get an FHA loan with a 542 credit score (or anywhere in the 500-579 credit range). If you would like some assistance ...

7. Is 542 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/542 Oct 11, 2021 ... A score under 580 (such as 542 ) usually falls into the “very poor” category. Having a 542 score likely means you've had a history of poor ...

Oct 11, 2021 ... A score under 580 (such as 542 ) usually falls into the “very poor” category. Having a 542 score likely means you've had a history of poor ...

8. 542 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/542/

Nov 8, 2021 ... 542 is a bad credit score. It's rated as “poor” by every major credit scoring model. Scores in this range make it difficult to get a ...

9. 542 Credit Score – Is it Good or Bad? How to Improve Your 542 ...

https://www.creditrepairexpert.org/542-credit-score/ Before you can do anything to increase your 542 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to…

Before you can do anything to increase your 542 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to…

10. Car loan interest rates with 542 credit score in 2022

https://creditscoregeek.com/bad-credit/542/auto/ Getting your FICO score up from 542 to 600 would get you to around a 13.7% rate and spare you near $610. Have a Question? Name: E-mail:.

Getting your FICO score up from 542 to 600 would get you to around a 13.7% rate and spare you near $610. Have a Question? Name: E-mail:.

What is a poor credit score?

A poor credit score is usually considered to be any score below 580 on the FICO scale. Scores in this range indicate that you're a high risk borrower and may have missed or made late payments on debts in the past.

How can I improve my 542 credit score?

Improving your 542 credit score requires time and dedication but it is possible! Start by paying all bills on time from now on, reducing how much debt you owe and keeping old accounts open even if they have a zero balance. You should also make sure to check your credit report regularly for errors that could be dragging down your score.

What type of loans or credit will I qualify for with my 542 credit score?

It depends on what type of lender you are applying with, but generally speaking most lenders will consider a 542 credit score as too risky for a loan or line of credit. That said, some less traditional lenders such as online lenders may still approve a loan at higher interest rates than usual due to the higher risk involved in lending to someone with a poor credit history.

How long does it take to rebuild my 542 credit score?

Rebuilding your 542 credit score takes time but it is possible! Generally speaking, it takes about three months to start seeing an improvement in your scores after making changes such as paying bills on time and reducing debt. But keep in mind that repairing bad credit takes longer so it may take up to two years before you reach an acceptable level of borrowing capacity again.

Are there any tips that could help me raise my 542 Credit Score faster?

Yes! Start by focusing on using less than 30% of available lines-of-credit each month (or 10% if you have particularly low scores) and paying off at least the minimum payments every month - doing more than this if possible would help even more! Additionally, increasing your total available lines-of-credit can give an immediate boost provided there is enough space between balances owed and available funds (i.e., having $500 available when only owing $300). Finally, removing any negative items from your report such as charge-offs or collections within 6 months could result in some drastic improvements relatively quickly.

Conclusion:

While having a 542 Credit Score may seem daunting at first, there are ways to gradually repair and improve your financial standing over time by making smart decisions around spending habits and repayment strategies over time. By taking advantage of the tips mentioned above alongside regularly monitoring their progress along the way - anyone should be able to begin rebuilding their financial health before they know it!