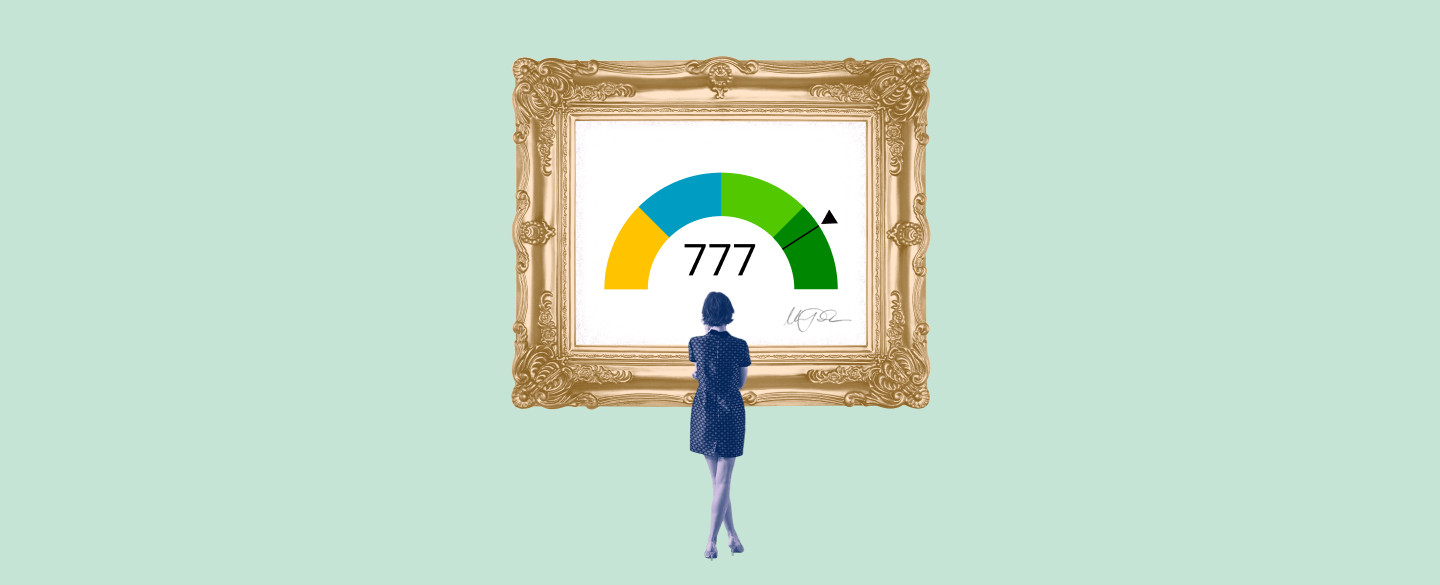

A FICO score of 777 is considered to be an excellent credit score. It is a reflection of your overall financial health and indicates that you are responsible with your money. A high score can help you save money on interest rates, get approved for loans, and receive better deals from lenders.

Table Of Content:

- 777 Credit Score: Is it Good or Bad?

- 777 Credit Score: What Does It Mean? | Credit Karma

- Is a 777 Credit Score Good? Plus How to Get It & More

- Is 777 a good credit score? | Lexington Law

- 777 Credit Score: Is it Good or Bad? (Approval Odds)

- 777 Credit Score (+ #1 Way To Improve It )

- 777 Credit Score: Good or Bad? | Credit Card & Loan Options

- 777 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 777 Credit Score - Is it Good or Bad? What does it mean in 2022?

- What Is A Good Credit Score? | Equifax®

1. 777 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/777-credit-score/ Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 777 FICO® Score is above the average credit score.

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 777 FICO® Score is above the average credit score.

2. 777 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/777 May 19, 2021 ... A 777 credit score is considered a very good or excellent credit score by many lenders. Here's what it means to have excellent credit, ...

May 19, 2021 ... A 777 credit score is considered a very good or excellent credit score by many lenders. Here's what it means to have excellent credit, ...

3. Is a 777 Credit Score Good? Plus How to Get It & More

https://wallethub.com/credit-score-range/777-credit-score/

A 777 credit score is not a good credit score; it's an excellent one. A credit score of 777 should qualify you for most loans, credit cards and other lines ...

4. Is 777 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/777 Oct 11, 2021 ... The FICO credit score model gives consumers a score between 300 and 850. As your score increases, you go up in credit score ranges. The ranges ...

Oct 11, 2021 ... The FICO credit score model gives consumers a score between 300 and 850. As your score increases, you go up in credit score ranges. The ranges ...

5. 777 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/777-credit-score/ Is 777 a good credit score? FICO scores range from 300 to 850. As you can see below, a 777 credit score is considered Very Good.

Is 777 a good credit score? FICO scores range from 300 to 850. As you can see below, a 777 credit score is considered Very Good.

6. 777 Credit Score (+ #1 Way To Improve It )

https://www.creditglory.com/credit-score/777-credit-score

7. 777 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/777/ Nov 11, 2021 ... Your credit score is a number representing your creditworthiness. A 777 score is considered very good, and it'll get you the very best loan and ...

Nov 11, 2021 ... Your credit score is a number representing your creditworthiness. A 777 score is considered very good, and it'll get you the very best loan and ...

8. 777 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/777-credit-score/ A 777 credit score is considered an excellent credit score. If you have a score in this range (FICO score 750 – 850), you're almost certain to be approved ...

A 777 credit score is considered an excellent credit score. If you have a score in this range (FICO score 750 – 850), you're almost certain to be approved ...

9. 777 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/excellent-credit/777/ Having a 777 credit score is great and some may even say excellent. This is a very high credit score and it shows that you care about the items that you have ...

Having a 777 credit score is great and some may even say excellent. This is a very high credit score and it shows that you care about the items that you have ...

10. What Is A Good Credit Score? | Equifax®

https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score/

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such ...

What is a FICO Score?

A FICO score is a three-digit number ranging from 300 to 850 that represents an individual’s creditworthiness. The higher the score, the more likely an individual is to be approved for loans or other financial products.

How Is A FICO Score Calculated?

A FICO Score is calculated using a specific formula that takes into account factors such as payment history, amounts owed, length of credit history, new credit applications, and types of credit used.

How Does Having a High FICO Score Benefit Me?

Having a high FICO score can benefit you in many ways. It may enable you to qualify for lower interest rates on loans, get approved for mortgages and other credit products more easily, and gain access to better deals from lenders and creditors.

What Are The Consequences Of Having a Low Credit Score?

Having a low credit score can impede your ability to obtain financing or other products as well as lead to higher interest rates when borrowing money. Additionally, some employers may check your credit scores as part of their background checks before offering you employment.

How Can I Maintain A High FICO Score?

Maintaining a high FICO Score requires responsible financial management practices such as making timely payments towards debts, avoiding late payments on bills or accounts, limiting the amount of debt taken on each month, and not applying for too much new credit at once.

Conclusion:

A high FICO score can open up additional opportunities and save you money in the long run by helping unlock lower interest rates on loans and higher quality deals offered by creditors. If your current score isn't where you want it to be yet, with consistent effort over time it's possible to increase it significantly.