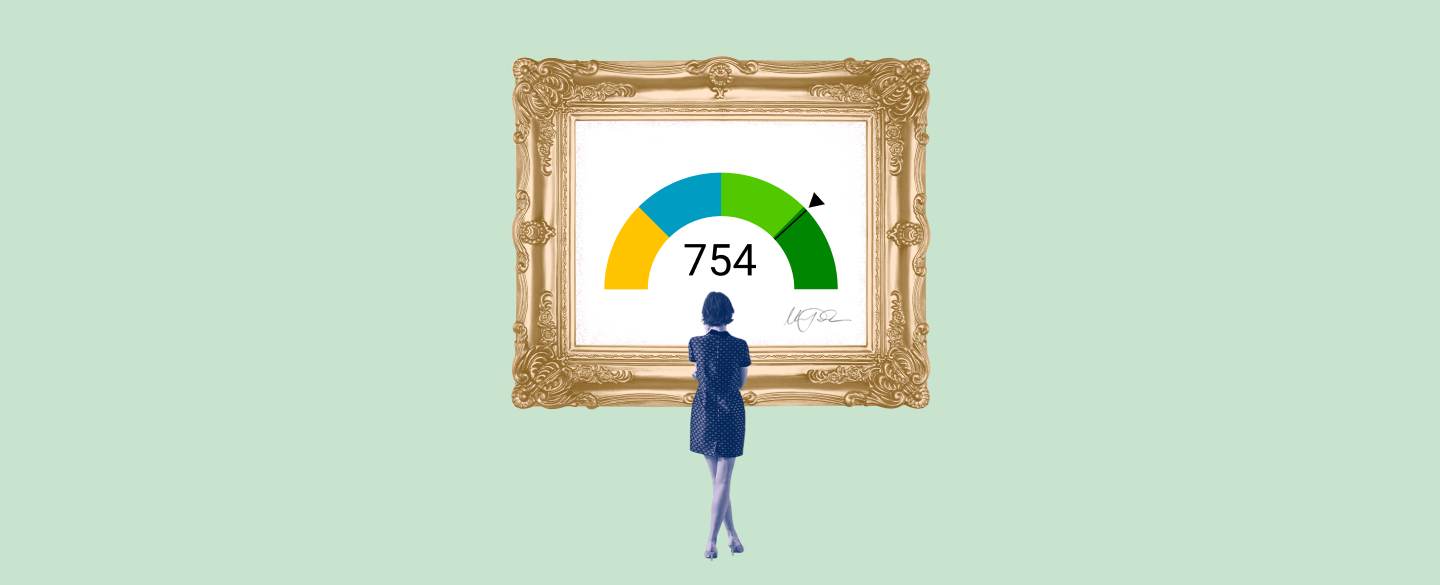

A 754 credit score is a good indicator of financial health and can open the door to many potential benefits. A 754 credit score generally falls within the "good" range. People with this score are less likely to struggle to pay their bills on time and are considered more trustworthy borrowers by lenders. Having a 754 credit score means you’re well qualified for most forms of borrowing, including mortgages and car loans.

Table Of Content:

- 754 Credit Score: Is it Good or Bad?

- 754 Credit Score: What Does It Mean? | Credit Karma

- Is a 754 Credit Score Good? Plus How to Get It & More

- Is 754 a good credit score? | Lexington Law

- 754 Credit Score: Is it Good or Bad? (Approval Odds)

- 754 Credit Score (+ #1 Way To Improve It )

- 754 Credit Score: Good or Bad? | Credit Card & Loan Options

- 754 Credit Score – Is it Good or Bad? How to Improve Your 754 ...

- 754 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- What Is A Good Credit Score? | Equifax®

1. 754 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/754-credit-score/ Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 754 FICO® Score is above the average credit score.

Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 754 FICO® Score is above the average credit score.

2. 754 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/754 May 19, 2021 ... A very good or excellent credit score can mean you're more likely to be approved for good offers and rates when it comes to mortgages, auto ...

May 19, 2021 ... A very good or excellent credit score can mean you're more likely to be approved for good offers and rates when it comes to mortgages, auto ...

3. Is a 754 Credit Score Good? Plus How to Get It & More

https://wallethub.com/credit-score-range/754-credit-score/

A 754 credit score is not a good credit score; it's an excellent one. A credit score of 754 should qualify you for most loans, credit cards and other lines ...

4. Is 754 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/754 Oct 11, 2021 ... The FICO credit score model gives consumers a score between 300 and 850. As your score increases, you go up in credit score ranges. The ranges ...

Oct 11, 2021 ... The FICO credit score model gives consumers a score between 300 and 850. As your score increases, you go up in credit score ranges. The ranges ...

5. 754 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/754-credit-score/ FICO scores range from 300 to 850. As you can see below, a 754 credit score is considered Very Good. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 754 credit score is considered Very Good. Credit Score, Credit Rating, % of population.

6. 754 Credit Score (+ #1 Way To Improve It )

https://www.creditglory.com/credit-score/754-credit-score

Jul 1, 2022 ... A 754 FICO® Score is considered “Very Good”. Mortgage, auto, and personal loans are easy to get with a 754 Credit Score. Lenders like to do ...

7. 754 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/754/ Nov 11, 2021 ... A credit score of 754 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 754 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

8. 754 Credit Score – Is it Good or Bad? How to Improve Your 754 ...

https://www.creditrepairexpert.org/754-credit-score/ How to Improve Your 754 FICO Score. Before you can do anything to increase your 754 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 754 FICO Score. Before you can do anything to increase your 754 credit score, you need to identify what part of it needs to be improved, ...

9. 754 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/754-credit-score/ A 754 credit score is considered an excellent credit score. If you have a score in this range (FICO score 750 – 850), you're almost certain to be approved ...

A 754 credit score is considered an excellent credit score. If you have a score in this range (FICO score 750 – 850), you're almost certain to be approved ...

10. What Is A Good Credit Score? | Equifax®

https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score/

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such ...

How is a 754 Credit Score calculated?

Your credit score is calculated using data from your credit report. This includes factors like payment history, loan balances, total debts, age of accounts, types of accounts, and more. The FICO algorithm uses this information to come up with a 3-digit number between 300 and 850 which reflects your overall financial health.

What kind of loans can I qualify for with a 754 Credit Score?

With a 754 credit score, you are well positioned to be approved for most conventional loan types such as mortgages and car loans. You may also qualify for personal loans or other more specialized types of borrowing depending on your current income and other factors.

Are there any risks associated with having a 754 Credit Score?

It's important to remember that even though having a 754 credit score opens the door to many potential benefits, it's still important to approach any type of borrowing responsibly. Always read terms and conditions carefully before taking out any form of debt.

How can I improve my 754 Credit Score?

To build an even better credit profile you should focus on making all repayments on time each month and keeping total loan balances low relative to available limits. Having multiple forms of credit (including both revolving and installment) as well as maintaining older accounts can also be beneficial in improving your 754 credit score.

Conclusion:

Having a high credit score like a 754 is incredibly valuable in today's world as it provides access to many potential benefits when seeking financing. However, it's essential to remain financially responsible when using these advantages. With the right knowledge and practices, anyone can maintain or even improve their financial standing over time.