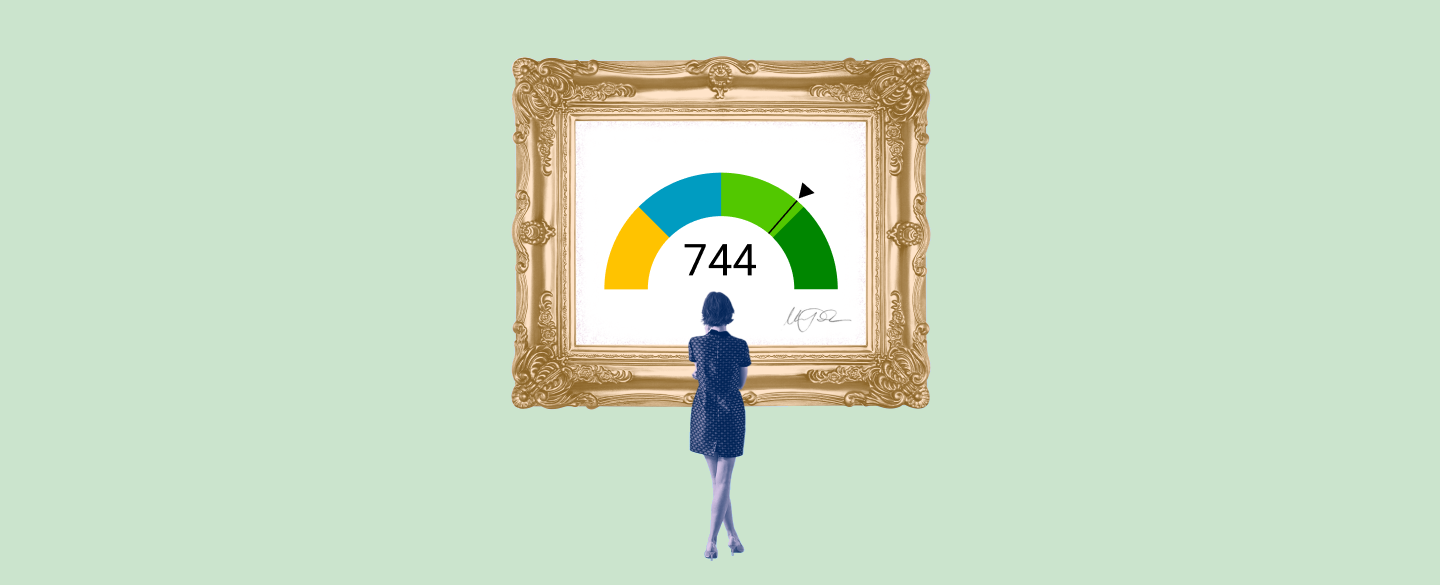

Are you looking to purchase a home with a 744 credit score? You may be wondering what kind of mortgage rate you can expect. Fortunately, with a 744 credit score, you can get access to some of the best mortgage rates on the market. In this article, we will provide an explanation of the typical mortgage rate for a 744 credit score and answer some commonly asked questions about mortgages with this credit score.

Table Of Content:

- 744 Credit Score: Is it Good or Bad?

- 744 Credit Score: What Does It Mean? | Credit Karma

- 744 Credit Score

- Is 744 a good credit score? | Lexington Law

- 744 Credit Score (+ #1 Way To Improve It )

- What Credit Score is Needed to Buy a House? | SmartAsset.com

- 744 Credit Score: Is it Good or Bad? (Approval Odds)

- The credit score you need to take out a mortgage

- 744 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 744 a Good Credit Score? | Fiscal Tiger

1. 744 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/744-credit-score/ Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 744 FICO® Score is above the average credit score.

Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 744 FICO® Score is above the average credit score.

2. 744 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/744 Mortgage rates for good credit. Your credit scores are just one factor to consider when you're looking to get a ...

Mortgage rates for good credit. Your credit scores are just one factor to consider when you're looking to get a ...

3. 744 Credit Score

https://wallethub.com/credit-score-range/744-credit-score/

What Does a 744 Credit Score Get You? ; Best Mortgage Rate, NO ; Auto Loan with 0% Intro Rate, MAYBE ; Lowest Auto Insurance Premium, NO ; Best Personal Loan Rate ...

4. Is 744 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/744 Oct 11, 2021 ... Your 744 credit score will likely get you an average interest rate of 2.36 percent on a 30-year loan. In comparison, if you had credit in ...

Oct 11, 2021 ... Your 744 credit score will likely get you an average interest rate of 2.36 percent on a 30-year loan. In comparison, if you had credit in ...

5. 744 Credit Score (+ #1 Way To Improve It )

https://www.creditglory.com/credit-score/744-credit-score

6. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house While a specific credit score doesn't guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, let's ...

While a specific credit score doesn't guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, let's ...

7. 744 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/744-credit-score/ Therefore, you should qualify for the best interest rates available. See Also: 12 Best Personal Loans for Good Credit. Can I get a home loan with a credit score ...

Therefore, you should qualify for the best interest rates available. See Also: 12 Best Personal Loans for Good Credit. Can I get a home loan with a credit score ...

8. The credit score you need to take out a mortgage

https://www.cnbc.com/2019/07/15/median-credit-score-mortgage.html Jul 15, 2019 ... The median credit score for mortgages taken out this year sits at 759, ... While you can likely qualify for a home loan with a rate lower ...

Jul 15, 2019 ... The median credit score for mortgages taken out this year sits at 759, ... While you can likely qualify for a home loan with a rate lower ...

9. 744 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/744/ Nov 11, 2021 ... A high score can also save you money on services like insurance. However, if you want the very best rates and terms on your loans and credit ...

Nov 11, 2021 ... A high score can also save you money on services like insurance. However, if you want the very best rates and terms on your loans and credit ...

10. Is 744 a Good Credit Score? | Fiscal Tiger

https://www.fiscaltiger.com/how-good-is-a-credit-score-of-744/ Jun 7, 2021 ... Mortgage loans can help individuals with 744 credit scores secure property of all sizes. While you may not be in line for the best-available ...

Jun 7, 2021 ... Mortgage loans can help individuals with 744 credit scores secure property of all sizes. While you may not be in line for the best-available ...

How long does it take to get approved for a 744 credit score mortgage loan?

The amount of time it takes to get approved depends largely on the individual’s financial situation and the speed at which their lender processes applications; however, most applicants should expect approval within two weeks or less from start to finish.

Conclusion:

If you have been considering purchasing a home but want to know what rates are available based off of your 744 credit score then hopefully this article has provided some helpful information on average mortgage interest rates and potential associated costs and qualifications involved in obtaining one. Remember that everyone's financial situation is different so always consider talking to an experienced lender in order to review all options available before making any decisions regarding financing your next home purchase.