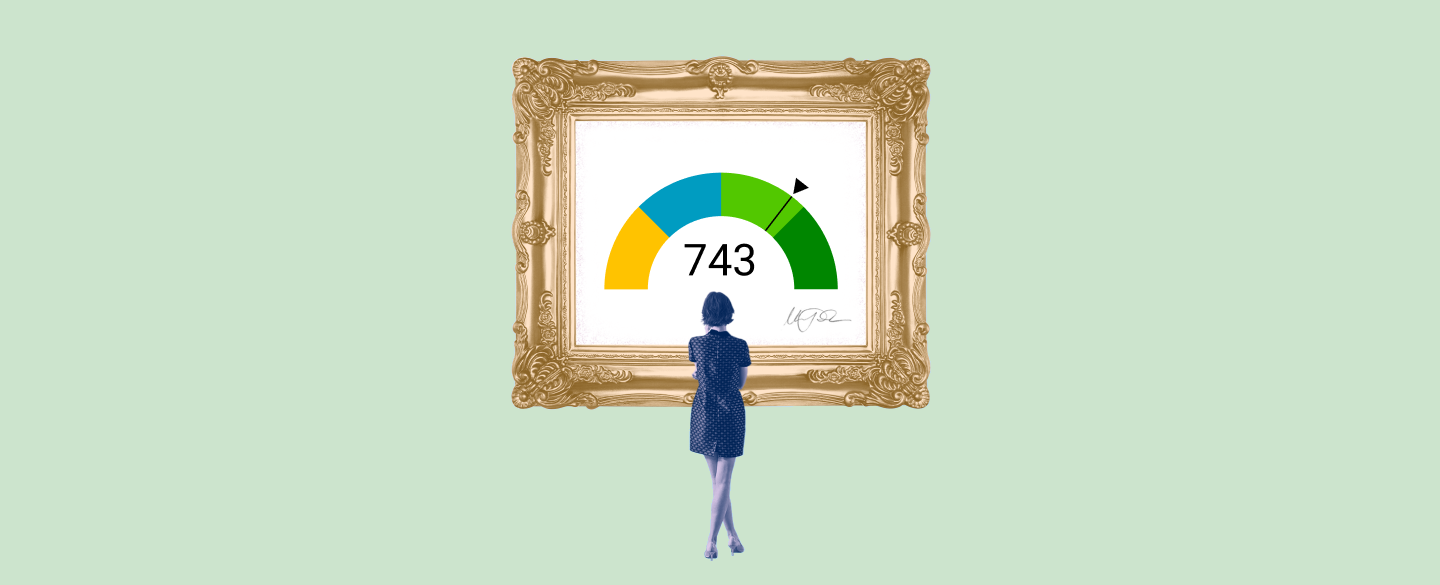

A FICO score of 743 is a great credit score to have! It falls within the good credit range and typically qualifies for competitive interest rates, making it easier to get approved for loans or other forms of credit from lenders.

Table Of Content:

- 743 Credit Score: Is it Good or Bad?

- 743 Credit Score: What Does It Mean? | Credit Karma

- 743 Credit Score

- 743 Credit Score: Is it Good or Bad? (Approval Odds)

- 743 Credit Score (+ #1 Way To Improve It )

- 743 Credit Score: Good or Bad? | Credit Card & Loan Options

- 743 Credit Score - Is it Good or Bad? What does it mean in 2022?

- 743 Credit Score – Is it Good or Bad? How to Improve Your 743 ...

- What Credit Score is Needed to Buy a House? | SmartAsset.com

- What's Considered a Good Credit Score? | TransUnion

1. 743 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/743-credit-score/ Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 743 FICO® Score is above the average credit score.

Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 743 FICO® Score is above the average credit score.

2. 743 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/743 Apr 2, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

Apr 2, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

3. 743 Credit Score

https://wallethub.com/credit-score-range/743-credit-score/

A 743 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. 743 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/743-credit-score/ Is 743 a good credit score? FICO scores range from 300 to 850. As you can see below, a 743 credit score is considered Very Good.

Is 743 a good credit score? FICO scores range from 300 to 850. As you can see below, a 743 credit score is considered Very Good.

5. 743 Credit Score (+ #1 Way To Improve It )

https://www.creditglory.com/credit-score/743-credit-score

Jul 1, 2022 ... A 743 FICO® Score is considered “Very Good”. Mortgage, auto, and personal loans are easy to get with a 743 Credit Score. Lenders like to do ...

6. 743 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/743/ Nov 11, 2021 ... A credit score of 743 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 743 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

7. 743 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/good-credit/743/ Having a 743 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy ...

Having a 743 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy ...

8. 743 Credit Score – Is it Good or Bad? How to Improve Your 743 ...

https://www.creditrepairexpert.org/743-credit-score/ How to Improve Your 743 FICO Score. Before you can do anything to increase your 743 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 743 FICO Score. Before you can do anything to increase your 743 credit score, you need to identify what part of it needs to be improved, ...

9. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

10. What's Considered a Good Credit Score? | TransUnion

https://www.transunion.com/blog/credit-advice/whats-considered-a-good-credit-score Dec 10, 2021 ... A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit ...

Dec 10, 2021 ... A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit ...

What is the FICO scoring system?

The FICO scoring system helps lenders assess a borrower’s credit risk by taking into account various factors such as payment history, amount owed, length of credit history, types of credit, and recent new credit applications. A score between 300-850 is calculated with higher scores indicating lower credit risk.

What does a FICO score of 743 indicate?

A FICO score of 743 indicates that you have good credit and are likely to qualify for favorable interest rates on your loan applications.

What should I do if I want to raise my FICO score?

To improve your FICO score, you may want to pay off any outstanding debts, avoid taking out too many loans at once or keep your balances low on any existing accounts. Additionally, regularly check your credit report to make sure there are no inaccuracies that could be negatively impacting your score.

How will a higher FICO score help me?

Having a higher FICO score makes it easier for you to obtain loans at competitive interest rates, potentially saving you money in the long run. Having a better rate can also make it easier for you to pay off loans in the future.

Does having a 743 Fico Score guarantee loan approval?

No, having a 743 Fico Score doesn't guarantee loan approval since each lender has their own criteria when evaluating applicants. However, with such a high score you stand more chances than others with lower scores may have.

Conclusion:

Having an excellent FICO Score of 743 is great news! This means that lenders view you as being more likely to repay any debt that you take out on time and will often give more favorable terms than those with lower scores can get. By continuing to keep up with regular payments and remain on top of managing your finances responsibly, you can maintain this excellent standing and benefit from its advantages for years to come.