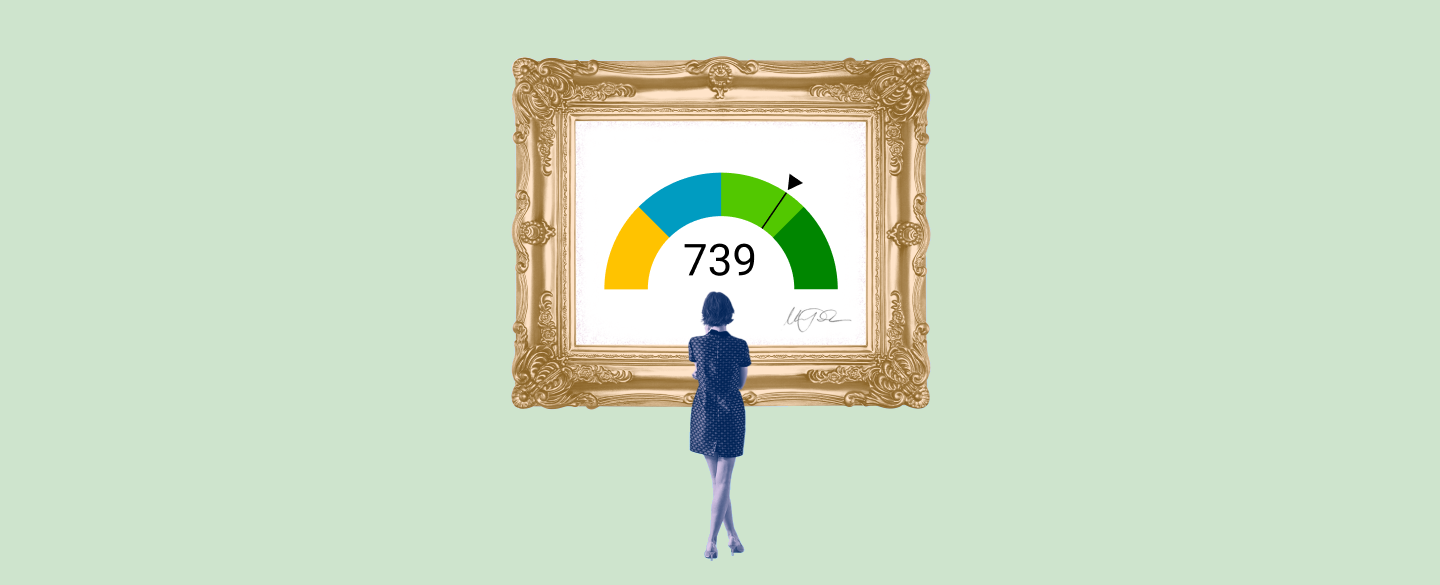

Are you considering taking up an auto loan? Then a credit score of 739 is your best bet! A 739 credit score auto loan offers the right combination of affordability, convenience, and flexibility. It's one of the most accessible auto loans on the market, and it can save you thousands in interest over time.

Table Of Content:

- 739 Credit Score: Is it Good or Bad?

- Best Auto Loan Rates With a Credit Score of 730 to 739

- 739 Credit Score: What Does It Mean? | Credit Karma

- 739 Credit Score

- Car loan interest rates with 739 credit score in 2022

- 739 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 739 Credit Score (+ #1 Way To Improve it )

- 739 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 739 a good credit score? | Lexington Law

- What is a Good Credit Score to Buy a Car? - Self. Credit Builder.

1. 739 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/739-credit-score/ 35% Individuals with a 739 FICO® Score have credit portfolios that include auto loan and 40% have a mortgage loan. Recent applications. When you apply for a ...

35% Individuals with a 739 FICO® Score have credit portfolios that include auto loan and 40% have a mortgage loan. Recent applications. When you apply for a ...

2. Best Auto Loan Rates With a Credit Score of 730 to 739

https://finmasters.com/best-auto-loan-rates-credit-score-730-to-739/ The average interest rate for a new car loan with a credit score of 730 to 739 is 3.56%. Most dealerships will advertise plenty of incentives for buying a new ...

The average interest rate for a new car loan with a credit score of 730 to 739 is 3.56%. Most dealerships will advertise plenty of incentives for buying a new ...

3. 739 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/739 “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to ...

“Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to ...

4. 739 Credit Score

https://wallethub.com/credit-score-range/739-credit-score/

A 739 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

5. Car loan interest rates with 739 credit score in 2022

https://creditscoregeek.com/good-credit/739/auto/ Getting your 739 FICO score up from 500 to 600 would get you to around a 9.4% auto loan rate and spare you near $3000. Whenever possible, it's a smart thought ...

Getting your 739 FICO score up from 500 to 600 would get you to around a 9.4% auto loan rate and spare you near $3000. Whenever possible, it's a smart thought ...

6. 739 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/739-credit-score/ Credit Score of 739: Car Loans ... Credit scores in this range will result in extremely low interest rates. However, with a higher score you may receive a no ...

Credit Score of 739: Car Loans ... Credit scores in this range will result in extremely low interest rates. However, with a higher score you may receive a no ...

7. 739 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/739-credit-score

Jun 11, 2022 ... Is 739 a Good Credit Score? A 739 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 739 ...

8. 739 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/739/ Nov 11, 2021 ... Loans and Credit You Can Get with a 739 Credit Score ... Car loan, Eligible, but you'll have to pay a higher interest rate.

Nov 11, 2021 ... Loans and Credit You Can Get with a 739 Credit Score ... Car loan, Eligible, but you'll have to pay a higher interest rate.

9. Is 739 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/739 Oct 11, 2021 ... 739 credit score car loan options. A 739 score should easily secure you a car loan. On average, your score should get you an interest rate ...

Oct 11, 2021 ... 739 credit score car loan options. A 739 score should easily secure you a car loan. On average, your score should get you an interest rate ...

10. What is a Good Credit Score to Buy a Car? - Self. Credit Builder.

https://www.self.inc/blog/whats-a-good-credit-score-to-buy-a-car Apr 16, 2021 ... How your credit score impacts your car loan ... In this range, auto loans typically have an interest rate of ... Good Credit (670-739).

Apr 16, 2021 ... How your credit score impacts your car loan ... In this range, auto loans typically have an interest rate of ... Good Credit (670-739).

What are the benefits of a 739 credit score auto loan?

A 739 credit score auto loan provides low-interest rates for those with good credit scores. It can also provide you with more buying power when making large purchases, such as cars or trucks. Plus, it typically requires much less paperwork than other types of loans, making the application process easier and quicker.

What type of APR can I expect with a 739 credit score auto loan?

Depending on your lender and other financial factors, you may be able to qualify for an APR, or annual percentage rate, between 2.99% and 8.0%. Typically, those with higher credit scores will qualify for more competitive rates than those with lower scores.

Does my income affect my eligibility for a 739 credit score auto loan?

Yes - your income is one factor that lenders use to determine your ability to repay an auto loan or not. You'll need to provide proof of income in order to qualify for most loans - usually an employer’s statement or pay stubs will suffice - but having a higher income could help you get better terms or possibly even lower APRs on certain loans.

How long does it take to receive approval for a 739 credit score auto loan?

The time it takes to receive approval can vary from lender to lender and depending on your particular circumstances; however, typically lenders have been known to approve applications within 24 hours if all information is provided upfront accurately and approved by the underwriter. So, approvals are often accomplished quickly once all required documentation has been provided correctly.

Is there anything else I should consider before applying for a 739 credit score auto loan?

Yes - make sure you understand all fees associated with taking out an auto loan before signing any contracts. Common fees include application fees (usually around $100), origination fees (usually around 1% of the total loan amount), early repayment fees (which can be tricky if interest rates change after you have already applied) and other miscellaneous fees which might include taxes that may apply in certain states.

Conclusion:

Taking out a 739 credit score auto loan can be an great option when looking for an affordable car financing solution while still getting competitive interest rates with more purchasing power at hand. Just remember to double check all hidden costs before signing anything!