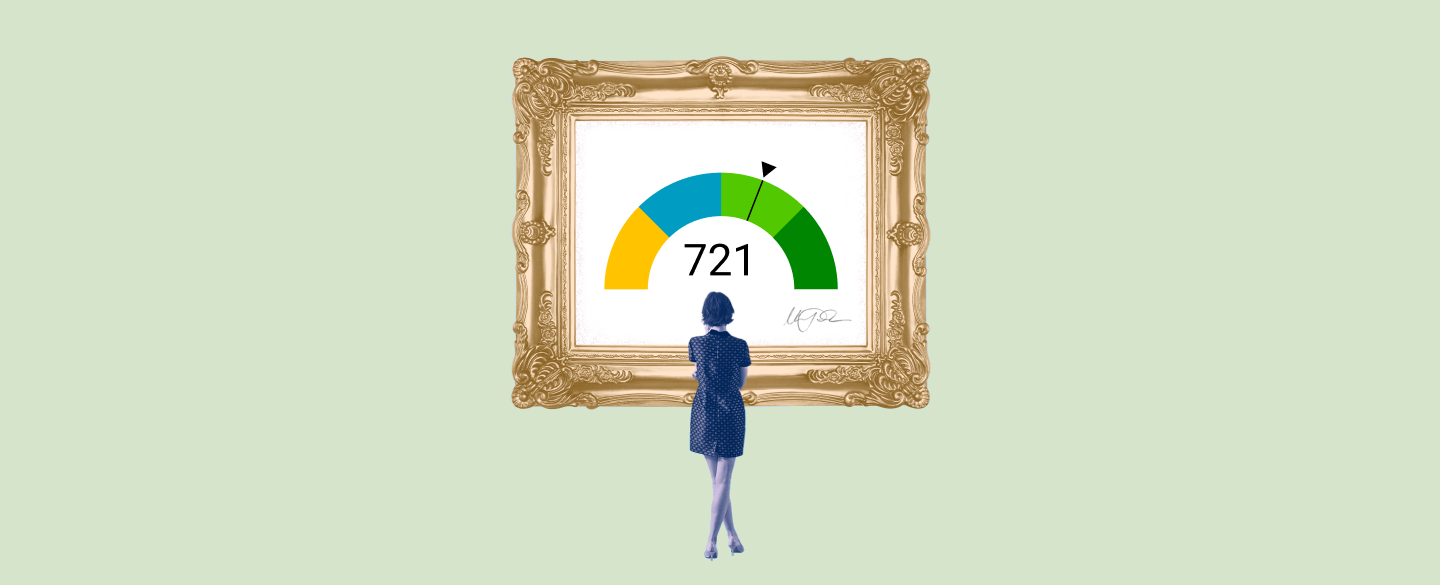

Having a credit score of 721 is an excellent score. As such, it comes with great interest rates on loans when compared to those with lower credit scores. Understanding what the 721 credit score interest rate could mean for you and your finances should be a priority.

Table Of Content:

- Is 721 a good credit score? | Lexington Law

- 721 Credit Score: Is it Good or Bad?

- Car loan interest rates with 721 credit score in 2022

- 721 Credit Score: Is it Good or Bad? (Approval Odds)

- 721 Credit Score: What Does It Mean? | Credit Karma

- 721 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 721 Credit Score (+ #1 Way To Improve it )

- The credit score you need to take out a mortgage

- 721 Credit Score: Good or Bad? | Credit Card & Loan Options

- How much will my vehicle payments be? | myFICO

1. Is 721 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/721 Oct 11, 2021 ... A 721 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

Oct 11, 2021 ... A 721 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

2. 721 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/721-credit-score/ A 721 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 721 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

3. Car loan interest rates with 721 credit score in 2022

https://creditscoregeek.com/good-credit/721/auto/ All the calculation and examples below are just an estimation*. Individuals with a 721 FICO credit score pay a normal 3.4% interest rate for a 60-month new auto ...

All the calculation and examples below are just an estimation*. Individuals with a 721 FICO credit score pay a normal 3.4% interest rate for a 60-month new auto ...

4. 721 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/721-credit-score/ Most lenders will approve you for a personal loan with a 721 credit score. However, your interest rate may be somewhat higher than someone who has “Very ...

Most lenders will approve you for a personal loan with a 721 credit score. However, your interest rate may be somewhat higher than someone who has “Very ...

5. 721 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/721 Apr 2, 2021 ... A 721 credit score is considered a good credit score by many lenders. Here's what it means to have good credit and how you can maintain your ...

Apr 2, 2021 ... A 721 credit score is considered a good credit score by many lenders. Here's what it means to have good credit and how you can maintain your ...

6. 721 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/721-credit-score/ The interest rate on the car loan with 721 credit score is 3.8682%, your monthly payment will be $1031.29. The total paid amount will be $37126.39.

The interest rate on the car loan with 721 credit score is 3.8682%, your monthly payment will be $1031.29. The total paid amount will be $37126.39.

7. 721 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/721-credit-score

8. The credit score you need to take out a mortgage

https://www.cnbc.com/2019/07/15/median-credit-score-mortgage.html Jul 15, 2019 ... While you can likely qualify for a home loan with a rate lower than the median, a higher credit score typically means better interest rates ...

Jul 15, 2019 ... While you can likely qualify for a home loan with a rate lower than the median, a higher credit score typically means better interest rates ...

9. 721 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/721/

Nov 11, 2021 ... Learn what a credit score of 721 means, if it's good or bad, ... Car loan, Eligible, but you'll have to pay a higher interest rate.

10. How much will my vehicle payments be? | myFICO

https://www.myfico.com/credit-education/financial-calculators/vehicle-payments

Equifax Credit Report is a trademark of Equifax, Inc. and its affiliated companies. Many factors affect your FICO Scores and the interest rates you may receive.

What is the average interest rate for a 721 credit score?

Generally the average interest rate for a 721 credit score is around 4-5%, depending on the type of loan you are trying to get. The better your credit score, the lower your interest rate tends to be.

Does my 721 credit score guarantee me an interest rate?

No, having a 721 credit score does not guarantee you an interest rate as there are many other factors that lenders consider when evaluating applicants. However, those with higher scores tend to receive better rates than those with lower scores.

What can I do if I have a 721 credit score but I am denied an attractive loan option?

You may want to look into alternative financing options or talk to your lender about pre-qualifying for a loan so that you can make sure you are getting the best deal available for your situation. Additionally, improving your credit score before applying can help increase your chances of getting approved for attractive loan options.

Conclusion:

Having a high FICO Score of 721 is something that can save one money on loans in terms of getting great interest rates; however, it is important to remember that other factors come into play when considering if one qualifies and how much they will pay in terms of interests as well as ensuring you find the best deal available for yourself.