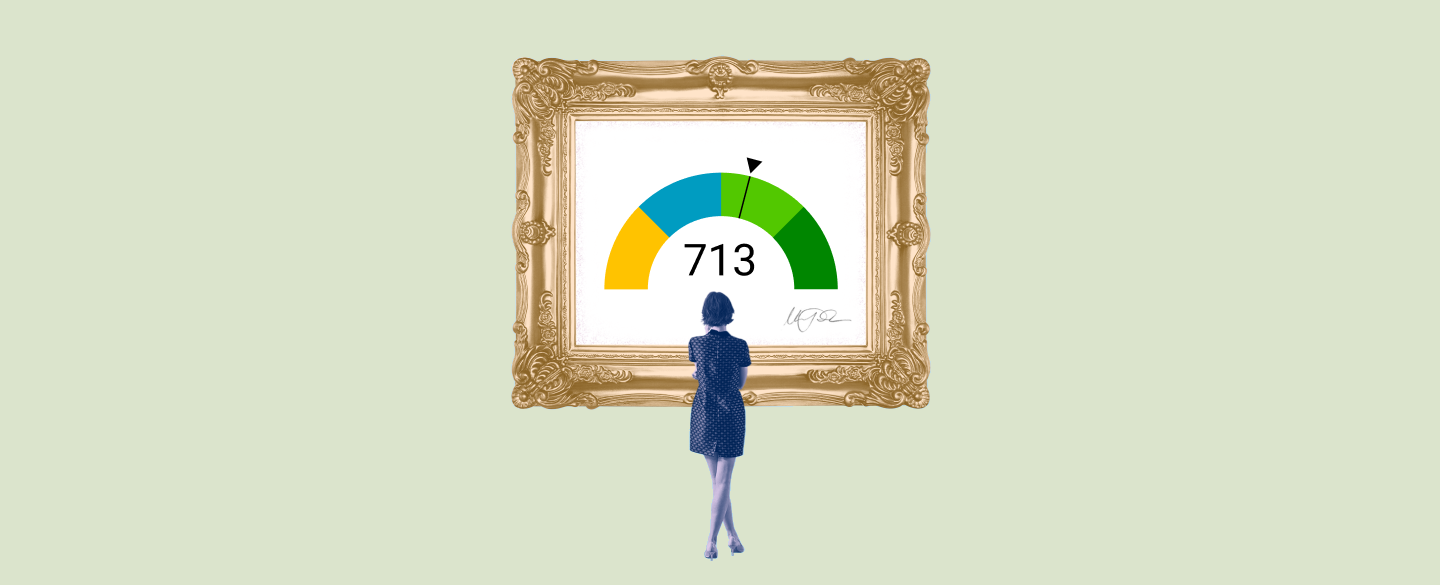

Your credit score is critical to your financial health, and understanding the nuances of this number can help make sure you’re managing your finances in the right way. A 713 credit score is considered good, and it can open up many opportunities for you.

Table Of Content:

- 713 Credit Score: Is it Good or Bad?

- 713 Credit Score: What Does It Mean? | Credit Karma

- Is a 713 Credit Score Good? 713 Credit Score Explained

- Is 713 a good credit score? | Lexington Law

- 713 Credit Score (+ #1 Way To Improve it )

- 713 Credit Score: Is it Good or Bad? (Approval Odds)

- The credit score you need to take out a mortgage

- 713 Credit Score - Is it Good or Bad? What does it mean in 2022?

- 713 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 713 Credit Score – Is it Good or Bad? How to Improve Your 713 ...

1. 713 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/713-credit-score/ 713 Credit Score: Is it Good or Bad? ... Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U.S. FICO® Score, ...

713 Credit Score: Is it Good or Bad? ... Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U.S. FICO® Score, ...

2. 713 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/713 “Good” score range identified based on 2021 Credit Karma data. A credit score is a number that lenders use to help ...

“Good” score range identified based on 2021 Credit Karma data. A credit score is a number that lenders use to help ...

3. Is a 713 Credit Score Good? 713 Credit Score Explained

https://wallethub.com/credit-score-range/713-credit-score/

A 713 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. Is 713 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/713 Oct 11, 2021 ... If you have a credit score of 713, you might be asking yourself, “is 713 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 713, you might be asking yourself, “is 713 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

5. 713 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/713-credit-score

6. 713 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/713-credit-score/ FICO scores range from 300 to 850. As you can see below, a 713 credit score is considered Good. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 713 credit score is considered Good. Credit Score, Credit Rating, % of population.

7. The credit score you need to take out a mortgage

https://www.cnbc.com/2019/07/15/median-credit-score-mortgage.html Jul 15, 2019 ... FICO credit scores range from 300 to 850, and the national average is 704. Any score between 700 and 749 is typically deemed “good,” while ...

Jul 15, 2019 ... FICO credit scores range from 300 to 850, and the national average is 704. Any score between 700 and 749 is typically deemed “good,” while ...

8. 713 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/good-credit/713/ If you are wondering if 713 credit score is “good” or “bad”, then you have no need to worry. The answer is that credit score under 713 is considered a good ...

If you are wondering if 713 credit score is “good” or “bad”, then you have no need to worry. The answer is that credit score under 713 is considered a good ...

9. 713 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/713-credit-score/ A credit score 713 is considered a good score. If you have a score in this range, you are very likely to be approved for credit cards and loans.

A credit score 713 is considered a good score. If you have a score in this range, you are very likely to be approved for credit cards and loans.

10. 713 Credit Score – Is it Good or Bad? How to Improve Your 713 ...

https://www.creditrepairexpert.org/713-credit-score/ 713 Credit Score – Is it Good or Bad? How to Improve Your 713 FICO Score. Before you can do anything to increase your 713 credit score, you need to identify ...

713 Credit Score – Is it Good or Bad? How to Improve Your 713 FICO Score. Before you can do anything to increase your 713 credit score, you need to identify ...

What does a 713 credit score mean?

A 713 credit score falls within the range of a good credit score according to FICO scores, rating from 300–850. It typically means that payment history is in good standing, that there is no or low delinquent accounts, and that the overall balance owed across all open lines of credit are below the average person with similar or same profile/credit history.

How will a 713 credit score impact my ability to get financing?

A FICO Score of 713 means that you have a good chance of getting approved for loans and other financing options like mortgages and car loans. However, lenders may still require additional information beyond just your credit score. Income level, assets on hand, employment status, loan terms requested among other factors may also be evaluated during their decision-making process.

How can I maintain a 713 FICO Score?

To maintain a good FICO Score like this one you should ensure that you pay your bills on time every month including mortgage payments if applicable. Keep track of your balances and keep them low compared to available limits. Try not to apply for multiple lines of new credit all at once as well since this can hurt scores short term until it stabilizes over time again.

Conclusion:

Having an overall healthy financial situation is key to making sure you have access to all the best options when it comes to spending wisely and protecting your wealth long-term. A solid 713 FICO Score is an excellent start for anyone looking to build their financial future responsibly.