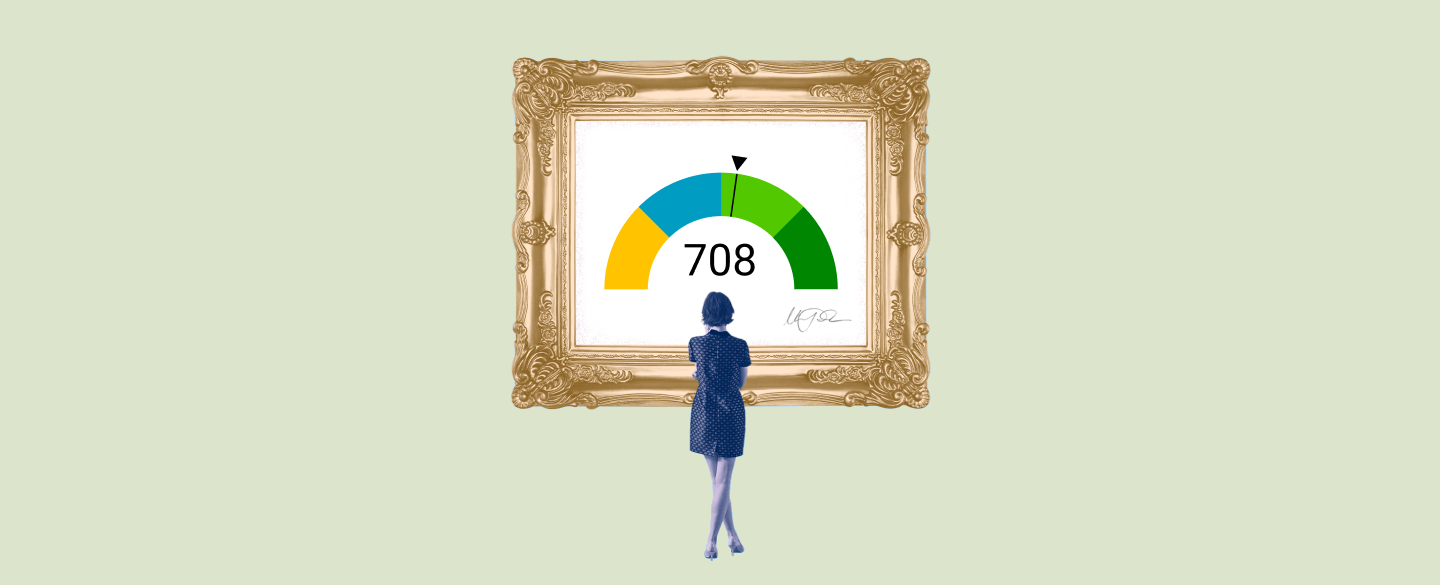

Your credit score is a three-digit number that represents your overall creditworthiness and impacts important financial decisions, such as whether you qualify for a loan or a credit card. A 708 credit score is considered to be a good one and puts you on the higher end of the spectrum of acceptable scores.

Table Of Content:

- 708 Credit Score: Is it Good or Bad?

- 708 Credit Score: What Does It Mean? | Credit Karma

- 708 Credit Score

- Is 708 a good credit score? | Lexington Law

- 708 Credit Score (+ #1 Way To Improve it )

- 708 Credit Score: Is it Good or Bad? (Approval Odds)

- What Credit Score is Needed to Buy a House? | SmartAsset.com

- Average FICO Score Hits Record High in 2019, According to ...

- How to Improve Your Credit Score | Kiplinger

- 708 Credit Score - Is it Good or Bad? What does it mean in 2022?

1. 708 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/708-credit-score/ A 708 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 708 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

2. 708 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/708 Apr 2, 2021 ... A 708 credit score is considered a good credit score by many lenders. ... “Good” score range identified based on 2021 Credit Karma data. A credit ...

Apr 2, 2021 ... A 708 credit score is considered a good credit score by many lenders. ... “Good” score range identified based on 2021 Credit Karma data. A credit ...

3. 708 Credit Score

https://wallethub.com/credit-score-range/708-credit-score/

A 708 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. Is 708 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/708 Oct 11, 2021 ... If you have a credit score of 708, you might be asking yourself, “is 708 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 708, you might be asking yourself, “is 708 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

5. 708 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/708-credit-score

6. 708 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/708-credit-score/ Is 708 a good credit score? FICO scores range from 300 to 850. As you can see below, a 708 credit score is considered Good.

Is 708 a good credit score? FICO scores range from 300 to 850. As you can see below, a 708 credit score is considered Good.

7. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house What interest rate can I get with my credit score? · Excellent (760-850) – Your credit score will have no impact on your interest rate. · Very good (700-760) – ...

What interest rate can I get with my credit score? · Excellent (760-850) – Your credit score will have no impact on your interest rate. · Very good (700-760) – ...

8. Average FICO Score Hits Record High in 2019, According to ...

https://www.cnbc.com/select/average-fico-score-hits-record-high-703/ FICO score ranges · Very poor: 300 to 579 · Fair: 580 to 669 · Good: 670 to 739 · Very good: 740 to 799 · Excellent: 800 to 850.

FICO score ranges · Very poor: 300 to 579 · Fair: 580 to 669 · Good: 670 to 739 · Very good: 740 to 799 · Excellent: 800 to 850.

9. How to Improve Your Credit Score | Kiplinger

https://www.kiplinger.com/article/credit/t017-c001-s001-how-to-improve-your-credit-score.htmlMy 26-year-old daughter recently checked her credit score through Equifax and was surprised that it was just 708. She thought it would be higher -- she has ...

10. 708 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/good-credit/708/ Having a 708 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to ...

Having a 708 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to ...

What does 708 Credit Score Mean?

A 708 FICO® Score is considered good. Within the range between 300 – 850, it falls on almost the top side — very close to being an excellent credit score. Your 708 FICO® Score increases your chances of getting approved with lower interest rates and better terms than those offered to borrowers with fair or average scores.

Are There any Risk Factors Associated with this Credit Score?

Although 708 is considered to be good, there may still be some risks associated with it. For example, lenders might feel wary about lending money to someone with an already high-risk category of credit score, so they might charge higher interest rates or even deny the loan altogether. It's always important to check in advance what kind of terms lenders are willing to offer before taking out any loans.

What Can You Do To Improve This Credit Score?

There are several steps you can take to improve your 708 credit score and move towards an excellent score range. These include making all payments on time, reducing your overall debt levels through paying off existing debt and keeping balances low on open accounts, limiting hard inquiries from creditors checking your report, and regularly reviewing your report for errors or fraud attempts.

What Other Benefits Come With Having Good Credit?

Aside from having improved chances of getting approved for loans or credit cards at much better terms than someone with average credit would have access to, having a good credit score also comes with many other benefits including improved access when renting an apartment or house, wider selection when shopping around for insurance plans (like car or home insurance), easier application approval for jobs that involve handling money, discounts from certain vendors like cell phone providers and more.

Conclusion:

In conclusion, having a 708 credit score provides access to many benefits such as improved approval rates and better terms when applying for loans/credit cards as well as other advantages like discounts from certain vendors and easier job application approvals. It’s important however not to rest too much upon it; take steps necessary like making all payments on time and reducing overall debt levels so that you continue improving your finances further up the scale towards excellent scores!