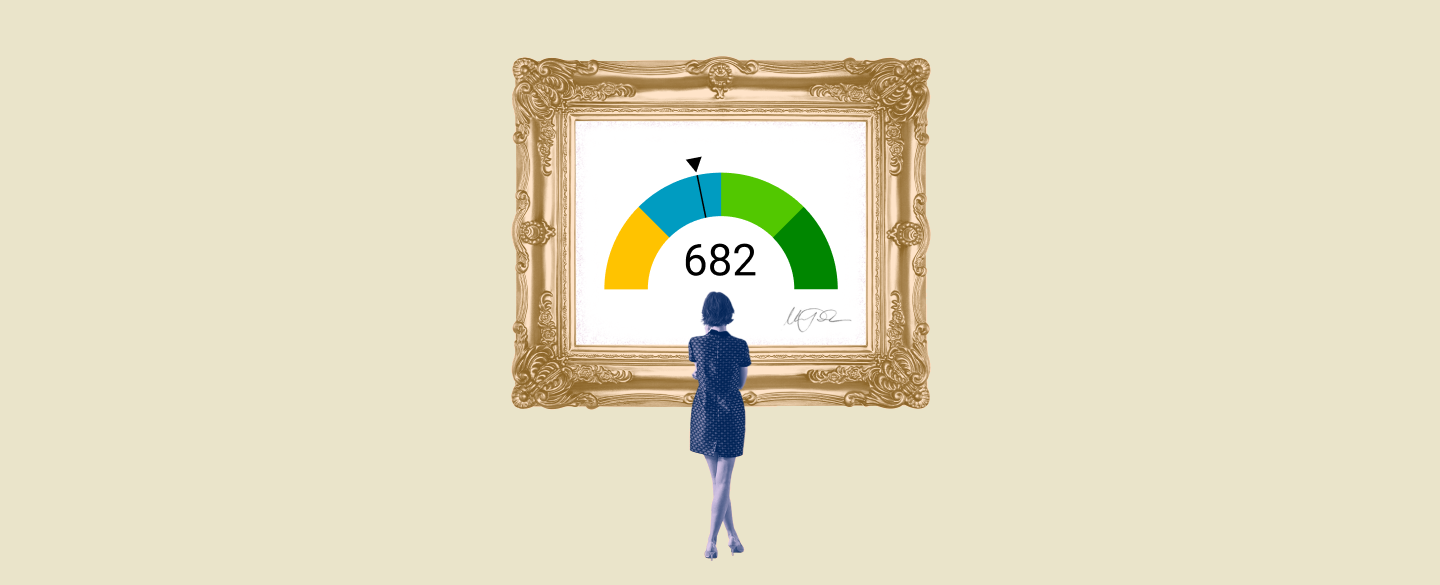

Your FICO score is a 3-digit number that can play an important role in your financial life, impacting your ability to obtain credit and loan approval. It is based on information from your credit report, with the FICO score of 682 falling in the Fair range. To help you understand more about this rating, here are some answers to key questions about it.

Table Of Content:

- 682 Credit Score: Is it Good or Bad?

- Is 682 a good credit score? | Lexington Law

- 682 Credit Score: What Does It Mean? | Credit Karma

- Is 682 a Good Credit Score? What It Means, Tips & More

- 682 Credit Score (+ #1 Way To Improve it )

- 682 Credit Score: Good or Bad? | Credit Card & Loan Options

- 682 Credit Score: Is it Good or Bad? (Approval Odds)

- 682 Credit Score – Is it Good or Bad? How to Improve Your 682 ...

- What is a Good Credit Score? | Credit Score Ranges Explained

- How a 680 credit score affects your mortgage rate | 2022

1. 682 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/682-credit-score/ A FICO® Score of 682 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

A FICO® Score of 682 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

2. Is 682 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/682 Oct 11, 2021 ... If you have a credit score of 682, you might be asking yourself, “is 682 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 682, you might be asking yourself, “is 682 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

3. 682 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/682 Apr 30, 2021 ... A 682 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 682 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. Is 682 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/682-credit-score/

A credit score of 682 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

5. 682 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/682-credit-score

6. 682 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/682/ Nov 11, 2021 ... A credit score of 682 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 682 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

7. 682 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/682-credit-score/ Is 682 a good credit score? FICO scores range from 300 to 850. As you can see below, a 682 credit score is considered Good.

Is 682 a good credit score? FICO scores range from 300 to 850. As you can see below, a 682 credit score is considered Good.

8. 682 Credit Score – Is it Good or Bad? How to Improve Your 682 ...

https://www.creditrepairexpert.org/682-credit-score/ How to Improve Your 682 FICO Score. Before you can do anything to increase your 682 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 682 FICO Score. Before you can do anything to increase your 682 credit score, you need to identify what part of it needs to be improved, ...

9. What is a Good Credit Score? | Credit Score Ranges Explained

https://credit.org/blog/what-is-a-good-credit-score-infographic/ Good credit score = 680 – 739: Credit scores around 700 are considered the threshold to “good” credit. Lenders are comfortable with this FICO score range, and ...

Good credit score = 680 – 739: Credit scores around 700 are considered the threshold to “good” credit. Lenders are comfortable with this FICO score range, and ...

10. How a 680 credit score affects your mortgage rate | 2022

https://themortgagereports.com/18447/fico-credit-score-home-buyer-mortgage-rates Nov 11, 2021 ... FICO puts a 680 credit score in the “good” range. That means a 680 credit score is high enough to qualify you for most loans. However, while 680 ...

Nov 11, 2021 ... FICO puts a 680 credit score in the “good” range. That means a 680 credit score is high enough to qualify you for most loans. However, while 680 ...

What does a FICO score of 682 mean?

A FICO score of 682 is considered to be in the Fair range and indicates that lenders may view you as having a higher risk than someone with a higher score. With this rating, it may not be easy to get approved for loans or other types of credit when you apply.

Who uses my FICO score?

Your FICO score is used by lenders when they review your credit reports to decide if they will approve loan requests such as for mortgages or auto financing. It is also used by landlords and employers in some cases to assess your qualification for rental property or job opportunities.

What affects my FICO score?

Generally speaking, factors such as payment history, outstanding balances on accounts, amount of credit utilized, length of credit history, types of accounts opened and recent inquiries into your credit records all affect your overall FICO score.

What can I do to improve my FICO score?

You can start by reviewing each of your three major credit reports (Experian, TransUnion and Equifax) for any incorrect information or identity theft markers. You should also focus on making payments on time and reducing debt levels over time by making larger payments than just the minimums required each month.

Conclusion:

Knowing where your current FICO Score stands can help you better understand how lenders perceive you and what steps you can take to either maintain or build up your rating further in the future. With smart financial habits combined with patience and perseverance, improving one’s overall FICO Score over time is possible.