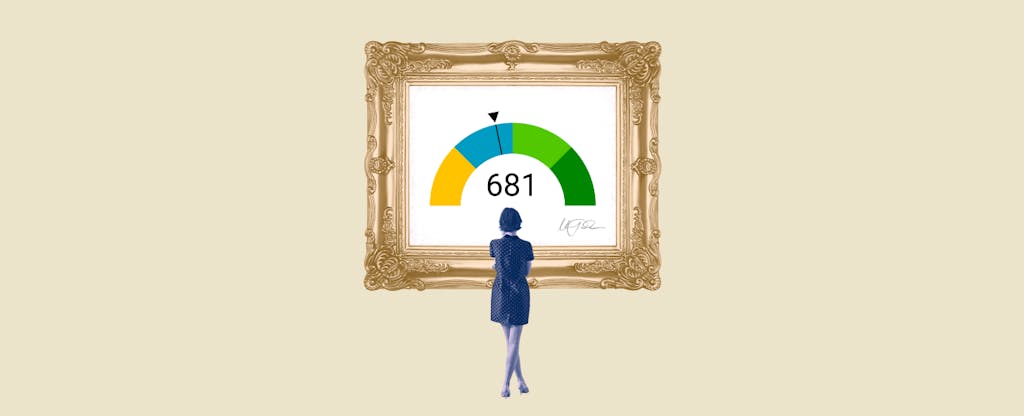

A 681 FICO score is a credit score that is considered to be just above average. It’s right in the middle of bad and good credit scores, and demonstrates an individual has a solid payment history with good credit utilization habits. Having a 681 FICO score may qualify you for slightly better rates on loans and other financial products, as it shows lenders that you’re dependable enough to pay back whatever debt you take on.

Table Of Content:

- 681 Credit Score: Is it Good or Bad?

- Is 681 a Good Credit Score? What It Means, Tips & More

- 681 Credit Score: What Does It Mean? | Credit Karma

- 681 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 681 a good credit score? | Lexington Law

- 681 Credit Score (+ #1 Way To Improve it )

- Can I get a car loan with a 681 credit score? | Jerry

- 681 Credit Score: Is it Good or Bad? (Approval Odds)

- 681 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- What Is A Good Credit Score? | Equifax®

1. 681 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/681-credit-score/ A FICO® Score of 681 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

A FICO® Score of 681 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

2. Is 681 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/681-credit-score/

A credit score of 681 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

3. 681 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/681 Apr 30, 2021 ... A 681 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 681 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. 681 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/681/ Nov 11, 2021 ... A credit score of 681 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 681 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

5. Is 681 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/681 Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 681, you have a high probability of ...

Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 681, you have a high probability of ...

6. 681 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/681-credit-score

7. Can I get a car loan with a 681 credit score? | Jerry

https://getjerry.com/questions/can-i-get-a-car-loan-with-a-681-credit-score![]() Feb 25, 2022 ... You can probably get a car loan with a 681 credit score. This puts you in the prime range of borrowers, which should open access to lower ...

Feb 25, 2022 ... You can probably get a car loan with a 681 credit score. This puts you in the prime range of borrowers, which should open access to lower ...

8. 681 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/681-credit-score/ FICO scores range from 300 to 850. As you can see below, a 681 credit score is considered Good. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 681 credit score is considered Good. Credit Score, Credit Rating, % of population.

9. 681 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/681-credit-score/ A credit score of 681 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

A credit score of 681 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

10. What Is A Good Credit Score? | Equifax®

https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score/

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such ...

What is a 681 FICO score?

A 681 FICO score is a credit score between 630 and 719 that’s considered to be in the middle range. It shows lenders that you have been reliable when it comes to making payments on time, which can make you eligible for better terms or rates on financial products.

How can I improve my FICO score?

Improving your FICO score requires paying your bills on time, minimizing debt, avoiding new inquiries on your credit report, and using revolving accounts responsibly. Additionally, regularly checking your credit report for errors or fraudulent activity can help ensure your information is up-to-date and accurate.

What kind of benefits can I get with a 681 FICO score?

With a 681 FICO score, you may be able to get access to slightly better rates or terms for financial products such as loan applications, credit cards, mortgages and others. Additionally, having this kind of credit rating may open up more options than if you had lower ratings in other categories such as fair or bad credit scores.

Does having a 681 FICO score disqualify me from certain things?

A 681 FICO score does not disqualify anyone from certain things but depending on the product or financial institution requirements they might prefer applicants who have higher scores than this one (i.e., 720 or above). However, having this kind of good-but-not-great rating should still give some level of assurance to lenders that their funds will be returned in full at some point in due time since it demonstrates consistently responsible behavior with repayment obligations.

Is there anything else I should be aware of when dealing with my FICO Score?

Make sure all the information reflected on your credit report is up-to-date and accurate before applying for any kind of financial product; if there are any discrepancies make sure these are addressed immediately so your application isn’t hindered by them. Additionally, constantly monitor how much debt you carry over month after month as this also affects your overall rating significantly - try to keep it below 30% utilization ratio as much as possible to maintain good standing with creditors over the long run.

Conclusion:

: In conclusion, having a 681 Fico Score puts individuals in the middle range when it comes to their consumer finance history - while not excellent it still provides evidence that someone has kept their finances in order which makes them eligible for better loan rates and terms on many occasions compared with those who have lower scores classified under Fair Credit category (below 630) or even Bad Credit category (below 579). Ultimately everyone should aim at keeping their scores above 720 points but until then continuing along this same path should prove advantageous often enough too!