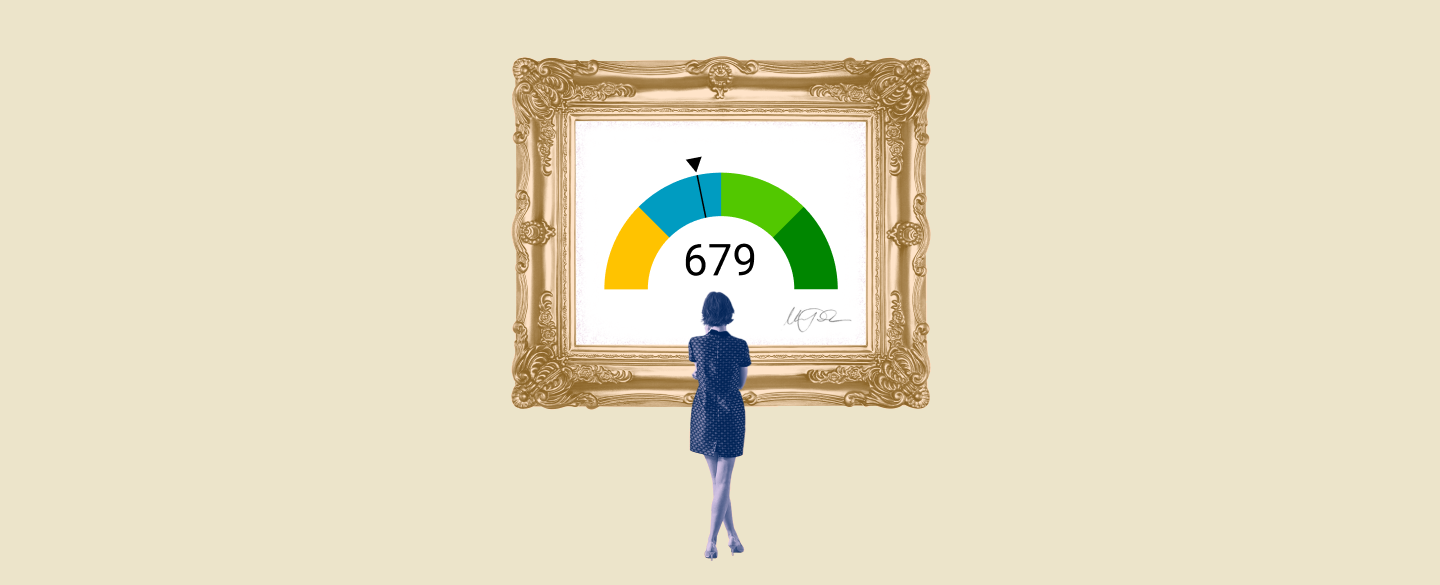

A 679 credit score car loan offers an efficient and straightforward way to fund the purchase of a new or used vehicle. A loan specifically created for those with a 679 credit score can provide competitive rates, flexible payment terms, and access to a wide variety of lenders. With the right research, you can get approved for a 679 credit score car loan quickly and easily.

Table Of Content:

- 679 Credit Score: Is it Good or Bad?

- 679 Credit Score: What Does It Mean? | Credit Karma

- Is 679 a good credit score? | Lexington Law

- Is 679 a Good Credit Score? What It Means, Tips & More

- 679 Credit Score (+ #1 Way To Improve it )

- Car loan interest rates with 679 credit score in 2022

- Best Auto Loan Rates With a Credit Score of 670 to 679

- 679 Credit Score: Good or Bad? | Credit Card & Loan Options

- 679 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 679 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

1. 679 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/679-credit-score/ 44% Individuals with a 679 FICO® Score have credit portfolios that include auto loan and 27% have a mortgage loan. Recent applications. When you apply for a ...

44% Individuals with a 679 FICO® Score have credit portfolios that include auto loan and 27% have a mortgage loan. Recent applications. When you apply for a ...

2. 679 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/679 There's no single minimum credit score needed for a car loan. But generally speaking, credit scores in the ...

There's no single minimum credit score needed for a car loan. But generally speaking, credit scores in the ...

3. Is 679 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/679 Oct 11, 2021 ... A 679 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

Oct 11, 2021 ... A 679 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

4. Is 679 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/679-credit-score/

What Does a 679 Credit Score Get You? ; Favorite Store's Credit Card, YES ; Airline/Hotel Credit Card, NO ; Best Mortgage Rates, NO ; Auto Loan with 0% Intro Rate ...

5. 679 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/679-credit-score

Jun 11, 2022 ... A 679 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 679 Credit Score. Lenders like to ...

6. Car loan interest rates with 679 credit score in 2022

https://creditscoregeek.com/fair-credit/679/auto/ Interest rate on car loan with 679 credit score can go anywhere from 8% to 12%, but it also depends on the lender and the specific background credit history ...

Interest rate on car loan with 679 credit score can go anywhere from 8% to 12%, but it also depends on the lender and the specific background credit history ...

7. Best Auto Loan Rates With a Credit Score of 670 to 679

https://finmasters.com/best-auto-loan-rates-credit-score-670-to-679/ The average interest rate for a new car loan with a credit score of 670 to 679 is 3.56%. Most dealerships will advertise plenty of incentives for buying a new ...

The average interest rate for a new car loan with a credit score of 670 to 679 is 3.56%. Most dealerships will advertise plenty of incentives for buying a new ...

8. 679 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/679/

Nov 11, 2021 ... A credit score of 679 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

9. 679 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/679-credit-score/ Car Loan Options ... This is a relatively average credit score range, so an auto loan interest rates with 679 credit score are neither subpar or superb. More ...

Car Loan Options ... This is a relatively average credit score range, so an auto loan interest rates with 679 credit score are neither subpar or superb. More ...

10. 679 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/679-credit-score-mortgage/

The types of programs that are available to borrowers with a 679 credit score are: conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, and non- ...

What kind of interest rate can I expect from my 679 credit score car loan?

The APR on your 679 credit score car loan will depend largely on your financial history and the amount borrowed. Generally speaking, someone with a 679 credit score who is borrowing a smaller amount can expect to see an interest rate between 4-6%.

How long will my 679 credit score car loan take to process?

The length of time it takes to process a 679 credit score car loan depends largely on the lender you’re working with. However, in many cases, lenders are able to approve loans within just 24 hours.

Are there any documents or paperwork that I need for my 679 credit score car loan?

Generally speaking, you should be prepared to submit proof of income and employment when applying for your 679 credit score car loan. Other documents you may need include pay stubs, bank account statements, tax returns, and vehicle information (if applicable).

Are there penalties or fees associated with my 679 credit score car loan?

Most lenders charge late payment fees if you miss payments on your 679 credit score car loan. Additionally, some lenders may have prepayment penalties if you pay off your balance early. It’s important to read the details of each lender carefully before making any commitments.

Will my 679 Credit Score Car Loan affect my Credit Score?

Yes - when you take out a 679 Credit Score Car Loan it will likely affect your overall Credit Score. However, if you make regular payments on time and keep up with payments in full then it is possible for your Credit Score to improve over time as well!

Conclusion:

Applying for a 679 credit score car loan is not only easy but also provides access to competitive rates and flexible repayment options that can help you save money over time. With careful research and consideration, potential borrowers can find the perfect fit for their situation while improving their overall financial outlook at the same time!