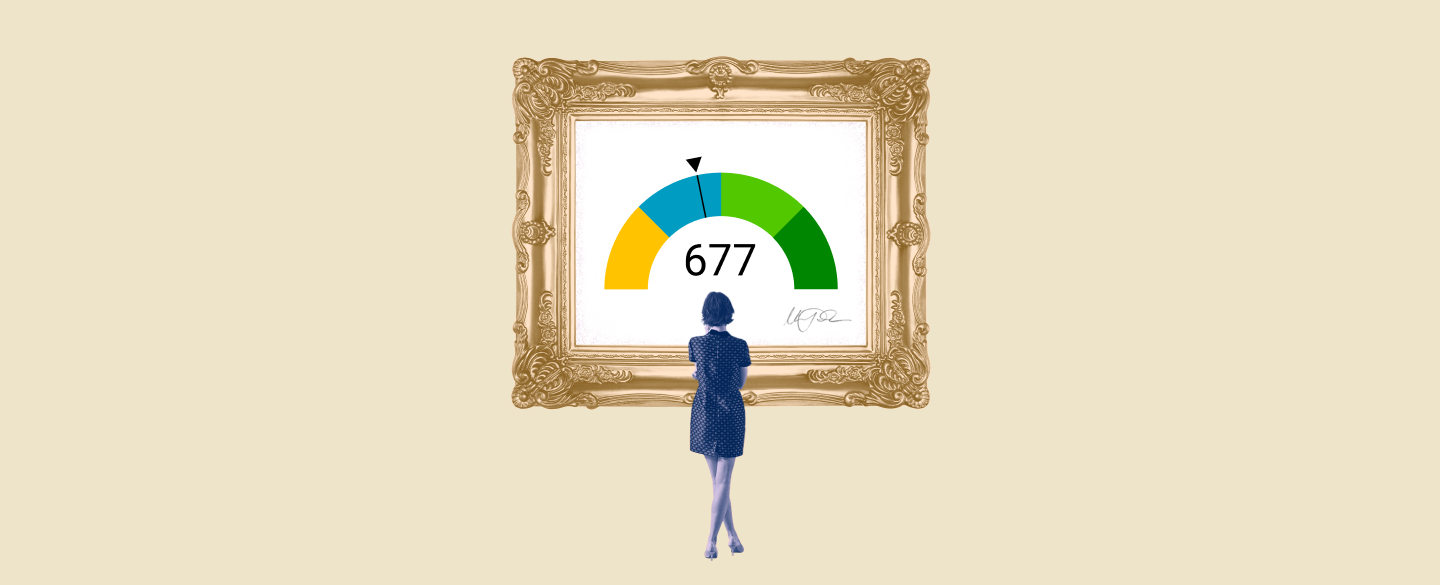

Your FICO score is a three-digit number that tells lenders how likely you are to pay back a loan or line of credit. A FICO score of 677 falls in the “good” range, meaning it’s high enough for most lenders to consider you a low-risk borrower. This means they may be more willing to offer you better terms and interest rates on loans and other financial products.

Table Of Content:

- 677 Credit Score: Is it Good or Bad?

- Is 677 a good credit score? | Lexington Law

- 677 Credit Score: What Does It Mean? | Credit Karma

- Is 677 a Good Credit Score? What It Means, Tips & More

- 677 Credit Score: Good or Bad? | Credit Card & Loan Options

- What Is A Good Credit Score? – Forbes Advisor

- 677 Credit Score (+ #1 Way To Improve it )

- 677 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 677 Credit Score – Is it Good or Bad? How to Improve Your 677 ...

- 677 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 677 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/677-credit-score/ A FICO® Score of 677 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

A FICO® Score of 677 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

2. Is 677 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/677 Oct 11, 2021 ... If you have a credit score of 677, you might be asking yourself, “is 677 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 677, you might be asking yourself, “is 677 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

3. 677 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/677 Apr 30, 2021 ... A 677 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 677 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. Is 677 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/677-credit-score/

A credit score of 677 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

5. 677 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/677/ Nov 11, 2021 ... A credit score of 677 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 677 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

6. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

7. 677 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/677-credit-score

Jun 11, 2022 ... A 677 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 677 Credit Score. Lenders like to ...

8. 677 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/677-credit-score-mortgage/

If your credit score is a 677 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

9. 677 Credit Score – Is it Good or Bad? How to Improve Your 677 ...

https://www.creditrepairexpert.org/677-credit-score/ How to Improve Your 677 FICO Score. Before you can do anything to increase your 677 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 677 FICO Score. Before you can do anything to increase your 677 credit score, you need to identify what part of it needs to be improved, ...

10. 677 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/677-credit-score/ A credit score of 677 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

A credit score of 677 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

What does a FICO score of 677 mean?

A FICO score of 677 falls in the “good” range, meaning it’s high enough for most lenders to consider you a low-risk borrower. This means they may be more willing to offer you better terms and interest rates on loans and other financial products.

Should I be concerned if my credit score is lower than 677?

If your credit score is lower than 677, that could signal to lenders that you are considered a higher risk borrower. You may be offered higher interest rates or have your application rejected by certain lenders. To improve your credit score, make sure all bills are paid on time, maintain low levels of debt, and review your credit report regularly.

Does having a good credit score matter when applying for jobs?

While there isn’t a direct correlation between your FICO score and job prospects, employers do look at prospective candidates' overall financial well-being when making hiring decisions. Having a good credit record shows responsibility which could help boost your employability chances.

How can I maintain my ‘good’ FICO score?

The best way to maintain your ‘good’ FICO score is by paying off debts on-time, staying within your limits for any lines of credits or loans, avoiding any forms of bankruptcy or foreclosure proceedings and regularly checking your report for errors or discrepancies.

Conclusion:

In conclusion, having a ‘good’ FICO Credit Score (677+) can help with accessing better loan terms from lending institutions as well as improving one's employability prospects. However as this number can change over time due to life events such as job loss or medical issues; establishing sensible financial practices will help ensure it stays within the ‘good’ range long term.