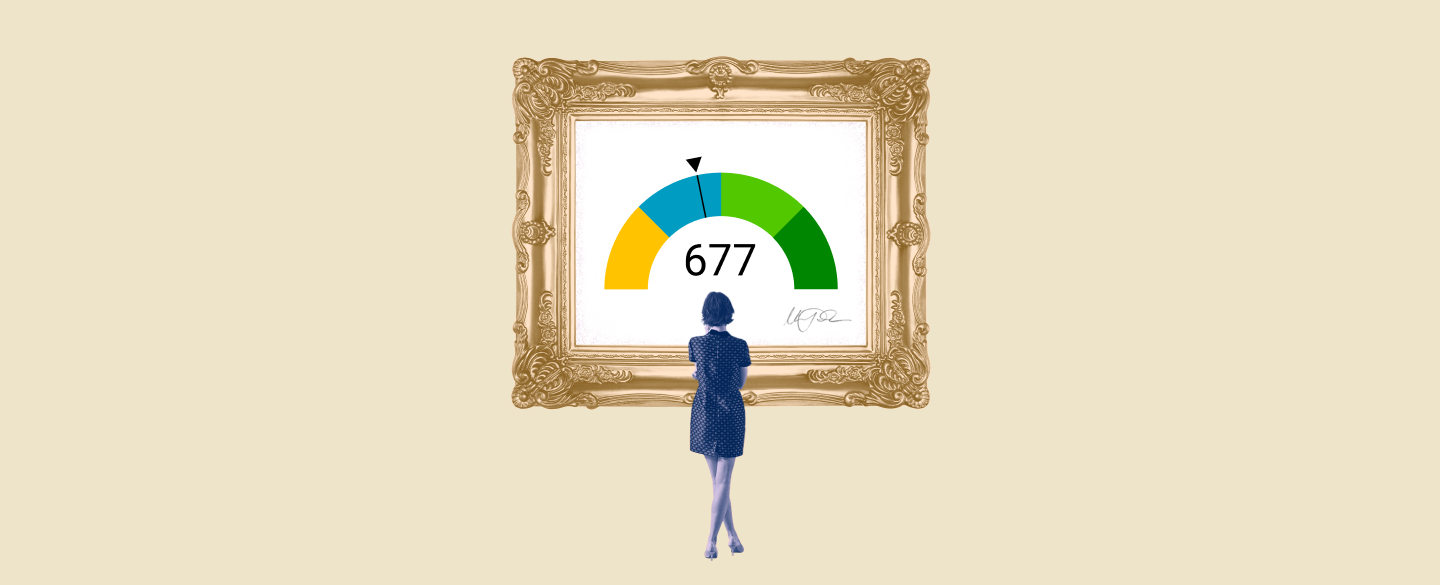

A credit score of 677 is considered good, and could be a sign of financial health. It may indicate that you have a good credit history, making it likely that any future loans or credit applications will be approved. But it's important to understand what goes into the calculation of this score to make sure your credit remains in good standing.

Table Of Content:

- 677 Credit Score: Is it Good or Bad?

- 677 Credit Score: What Does It Mean? | Credit Karma

- Is 677 a good credit score? | Lexington Law

- Is 677 a Good Credit Score? What It Means, Tips & More

- 677 Credit Score: Good or Bad? | Credit Card & Loan Options

- What Is A Good Credit Score? – Forbes Advisor

- 677 Credit Score (+ #1 Way To Improve it )

- 677 Credit Score Mortgage Lenders of 2022 | Bad Credit Mortgages

- 677 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 677 Credit Score – Is it Good or Bad? How to Improve Your 677 ...

1. 677 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/677-credit-score/ A 677 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

A 677 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

2. 677 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/677 Apr 30, 2021 ... A 677 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

Apr 30, 2021 ... A 677 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

3. Is 677 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/677 Oct 11, 2021 ... If you have a credit score of 677, you might be asking yourself, “is 677 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 677, you might be asking yourself, “is 677 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

4. Is 677 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/677-credit-score/

A credit score of 677 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

5. 677 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/677/ Nov 11, 2021 ... A credit score of 677 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 677 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

6. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

7. 677 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/677-credit-score

Jun 11, 2022 ... A 677 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 677 Credit Score. Lenders like to ...

8. 677 Credit Score Mortgage Lenders of 2022 | Bad Credit Mortgages

https://www.nonprimelenders.com/677-credit-score-mortgage/

If your credit score is a 677 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range ...

9. 677 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/677-credit-score/ A credit score of 677 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

A credit score of 677 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

10. 677 Credit Score – Is it Good or Bad? How to Improve Your 677 ...

https://www.creditrepairexpert.org/677-credit-score/ 677 Credit Score – Is it Good or Bad? How to Improve Your 677 FICO Score. Before you can do anything to increase your 677 credit score, you need to identify ...

677 Credit Score – Is it Good or Bad? How to Improve Your 677 FICO Score. Before you can do anything to increase your 677 credit score, you need to identify ...

What factors are included in a 677 Credit Score?

A 677 Credit Score includes several different factors such as payment history, amount owed, length of credit history, types of credit used, new credit inquiries and more. The exact combination of factors that comprise your score may vary depending on who is calculating it.

What can I do to improve my 677 Credit Score?

There are various steps you can take to improve your 677 Credit Score including paying all bills and debts on time, reducing existing debt levels, maintaining low balances on open accounts and avoiding opening too many new accounts at once. Additionally, regularly monitoring your credit report can help you identify any areas that require improvement or potential errors.

Are there other benefits I can enjoy with my 677 Credit Score?

Yes! With a 677 Credit Score you may be eligible for lower interest rates on loans and other credits cards which could save you money over time. You may also find improved access to car loans and mortgages as well as increased approval chances for most types of financing products on the market today.

Conclusion:

A 677 Credit Score is generally considered good and shows that you have taken responsible measures when managing your finances in the past. Despite this positive aspect, there are still steps you can take to further improve this score if desired such as paying bills promptly, reducing existing debt levels and monitoring your report regularly for any discrepancies or errors.