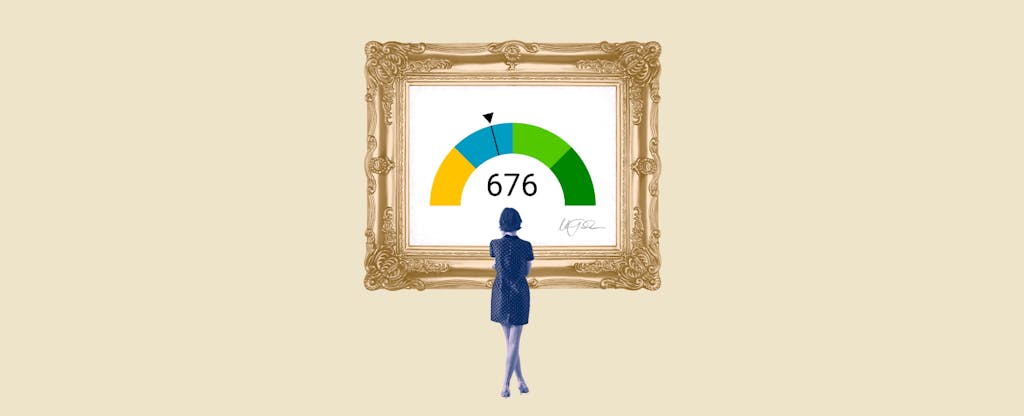

A FICO score is a three-digit number, ranging from 300 to 850, used to predict the risk of a borrower defaulting on their credit obligations. A 676 FICO score is considered good and is above the national average. It indicates that you have exhibited responsible financial management habits and have a greater likelihood of being approved for credit products such as mortgages, auto loans and credit cards.

Table Of Content:

- 676 Credit Score: Is it Good or Bad?

- Is 676 a good credit score? | Lexington Law

- Is 676 a Good Credit Score? What It Means, Tips & More

- 676 Credit Score: What Does It Mean? | Credit Karma

- What Is A Good Credit Score? – Forbes Advisor

- 676 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 676 Credit Score (+ #1 Way To Improve it )

- What Is a Good Credit Score? | Credit.com

- 676 Credit Score: Is it Good or Bad? (Approval Odds)

- 676 Credit Score – Is it Good or Bad? How to Improve Your 676 ...

1. 676 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/676-credit-score/ A FICO® Score of 676 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

A FICO® Score of 676 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

2. Is 676 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/676 Oct 11, 2021 ... If you have a credit score of 676, you might be asking yourself, “is 676 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 676, you might be asking yourself, “is 676 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

3. Is 676 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/676-credit-score/

A credit score of 676 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

4. 676 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/676 Apr 30, 2021 ... A 676 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 676 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

5. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

6. 676 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/676-credit-score-mortgage/

If your credit score is a 676 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

7. 676 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/676-credit-score

8. What Is a Good Credit Score? | Credit.com

https://www.credit.com/credit-scores/what-is-a-good-credit-score/ Jan 8, 2021 ... Some lenders even have their own scoring models. But most lenders and credit card companies use FICO scores or VantageScores. >> Learn more ...

Jan 8, 2021 ... Some lenders even have their own scoring models. But most lenders and credit card companies use FICO scores or VantageScores. >> Learn more ...

9. 676 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/676-credit-score/ Is 676 a good credit score? FICO scores range from 300 to 850. As you can see below, a 676 credit score is considered Good.

Is 676 a good credit score? FICO scores range from 300 to 850. As you can see below, a 676 credit score is considered Good.

10. 676 Credit Score – Is it Good or Bad? How to Improve Your 676 ...

https://www.creditrepairexpert.org/676-credit-score/ How to Improve Your 676 FICO Score. Before you can do anything to increase your 676 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 676 FICO Score. Before you can do anything to increase your 676 credit score, you need to identify what part of it needs to be improved, ...

What is a FICO score?

A FICO score is a three-digit number between 300 and 850 that predicts the risk of a borrower's ability to repay their obligations. It is commonly used by lenders for loan approval decisions.

Is 676 a good FICO score?

Yes, 676 is considered good. It is above the national average which shows responsible financial management habits that can increase your chances of getting approved for credit products.

What factors affect your FICO score?

Your payment history, level of debt compared to available credit, length of credit history, new credit inquiries, types of credit accounts (i.e., revolving or installment) all factor in to calculate your overall FICO score.

Can I improve my 676 FICO score?

Yes, you can improve your 676 FICO score by paying your bills on time and keeping low balances on existing accounts. You should also apply for new sources of credit sparingly and refrain from taking out too much additional debt.

How long does it take to improve my 676 FICO score?

Depending on how many negative items are in your report (such as late payments), it can take anywhere from several months to several years to raise your score significantly. Good financial habits will help improve it more quickly.

Conclusion:

Overall, having a 676 FICO score means that you are in good standing financially and have demonstrated responsible financial management practices over time which increases the chances of being approved for various loan options including mortgages, auto loans or personal lines of credit. Although it may take some time, following proper steps such as consistently paying bills on time and reducing overall debt can help you continue raising this number even further into excellent territory (780+).