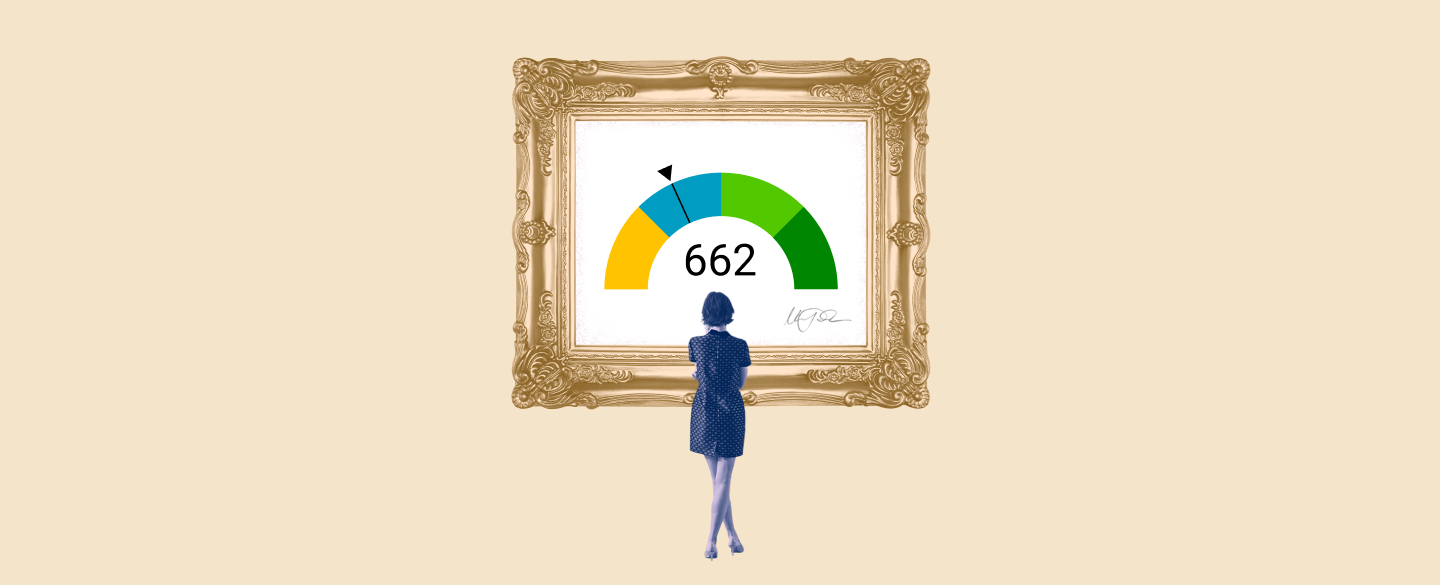

A credit score of 662 is considered "good" and can help open the door to potential financial stability. It means you’re managing your credit well, and that lenders are likely to perceive you as responsible and low-risk when it comes to lending.

Table Of Content:

- 662 Credit Score: Is it Good or Bad?

- Is 662 a Good Credit Score? What It Means, Tips & More

- 662 Credit Score: What Does It Mean? | Credit Karma

- 662 Credit Score (+ #1 Way To Fix It )

- Is 662 a good credit score? | Lexington Law

- 662 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 662 Credit Score: Is it Good or Bad? (Approval Odds)

- 662 Credit Score – Is it Good or Bad? How to Improve Your 662 ...

- What Is A Good Credit Score? | Equifax®

- 662 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 662 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/662-credit-score/ A 662 credit score is considered fair. Find out more about your credit score and learn steps you can take to improve your credit.

A 662 credit score is considered fair. Find out more about your credit score and learn steps you can take to improve your credit.

2. Is 662 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/662-credit-score/

A credit score of 662 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

3. 662 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/662 Apr 30, 2021 ... A 662 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

Apr 30, 2021 ... A 662 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

4. 662 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/662-credit-score

Jun 11, 2022 ... Is 662 a Good Credit Score? ... A 662 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a ...

5. Is 662 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/662 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

6. 662 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/662-credit-score-mortgage/

If your credit score is a 662 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range ...

7. 662 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/662-credit-score/ Is 662 a good credit score? FICO scores range from 300 to 850. As you can see below, a 662 credit score is considered Fair.

Is 662 a good credit score? FICO scores range from 300 to 850. As you can see below, a 662 credit score is considered Fair.

8. 662 Credit Score – Is it Good or Bad? How to Improve Your 662 ...

https://www.creditrepairexpert.org/662-credit-score/ 662 Credit Score – Is it Good or Bad? How to Improve Your 662 FICO Score. Before you can do anything to increase your 662 credit score, you need to identify ...

662 Credit Score – Is it Good or Bad? How to Improve Your 662 FICO Score. Before you can do anything to increase your 662 credit score, you need to identify ...

9. What Is A Good Credit Score? | Equifax®

https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score/

What is a Good Credit Score? Reading time: 3 minutes. Highlights: Credit scores are calculated using information in your credit reports.

10. 662 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/662-credit-score/ A credit score of 662 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

A credit score of 662 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

What does a 662 credit score mean?

A 662 credit score means that you have good credit and are likely to be seen as low-risk by lenders. This could open up more opportunities for financing, such as loans or mortgages.

How can I improve my credit score?

Improving your credit score is not necessarily an overnight process, but there are some things you can do to increase it over time. Paying bills on time, reducing debt, and using a variety of different types of accounts (e.g., having both secured and unsecured loans) can all help improve your credit score over time.

How important is a good credit score?

Having a good credit score is an essential part of financial health since lenders use it to determine whether someone is eligible for certain products or services like loans or mortgages. A good credit score helps demonstrate that an individual is able to manage their finances responsibly and may be more likely to receive favorable terms from lenders.

Conclusion:

A 662 credit score is generally seen as “good” – which will open the door to potential financial stability in the future. While improving it further takes time, there are steps you can take today in order begin increasing your overall rating - helping to achieve even greater financial security down the line.