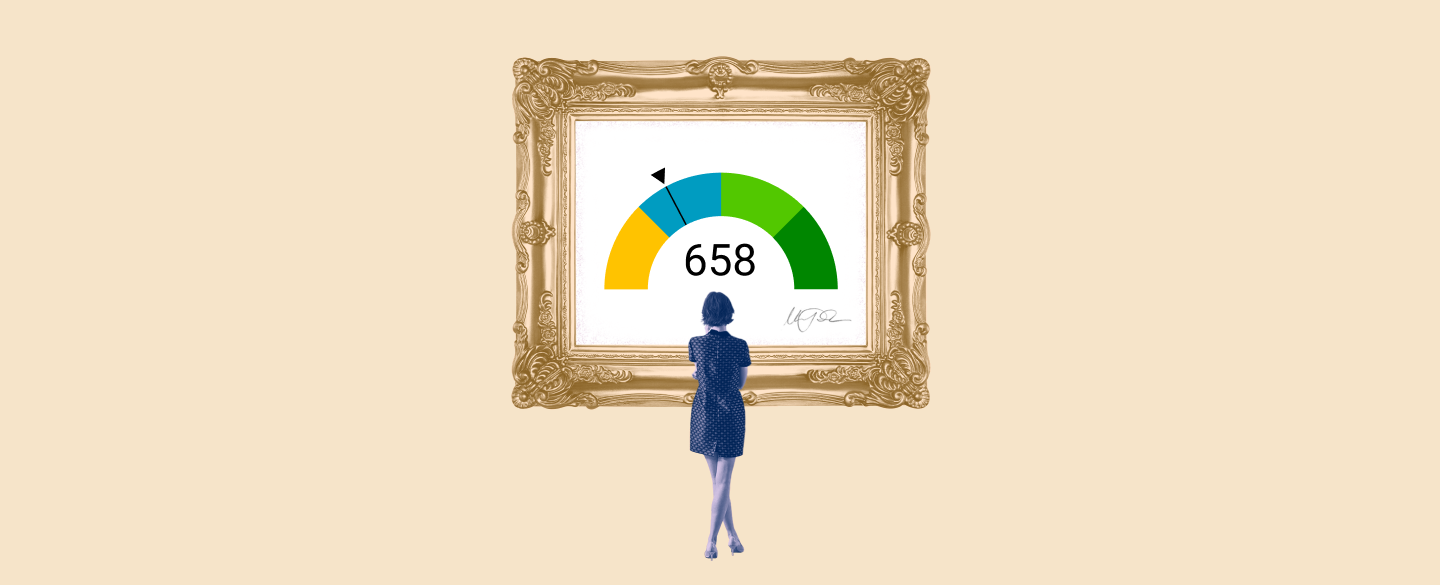

A FICO score is a three-digit number, ranging from 300 to 850, that lenders use to assess an individual's credit risk. The score takes into account your payment history, debt-to-credit ratio and other parameters when determining your borrowing potential. With the aim of helping you make financial decisions, a FICO score of 658 is considered good enough for lenders to approve most loan applications.

Table Of Content:

- 658 Credit Score: Is it Good or Bad?

- 658 Credit Score: What Does It Mean? | Credit Karma

- Is 658 a Good Credit Score? What It Means, Tips & More

- 658 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 658 Credit Score (+ #1 Way To Fix It )

- Is 658 a good credit score? | Lexington Law

- Will a 658 credit score get me an auto loan with no money down ...

- 658 Credit Score: Is it Good or Bad? (Approval Odds)

- What Credit Score Do You Need To Buy A House? | Rocket Mortgage

- Car loan interest rates with 658 credit score in 2022

1. 658 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/658-credit-score/ The average FICO® Score is 711, somewhat higher than your score of 658, which means you've got a great opportunity to improve. 70% of U.S. consumers' FICO® ...

The average FICO® Score is 711, somewhat higher than your score of 658, which means you've got a great opportunity to improve. 70% of U.S. consumers' FICO® ...

2. 658 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/658 Apr 30, 2021 ... A 658 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 658 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

3. Is 658 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/658-credit-score/

A 658 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 658 credit score isn't "bad," ...

4. 658 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/658-credit-score-mortgage/

If your credit score is a 658 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

5. 658 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/658-credit-score

6. Is 658 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/658 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

7. Will a 658 credit score get me an auto loan with no money down ...

https://www.compareauto.loan/credit-scores/will-a-658-credit-score-get-me-an-auto-loan

If you've got a credit score around 658, you will definitely have the best luck being approved for an auto loan if you put in a request for vehicle loans online ...

8. 658 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/658-credit-score/ Is 658 a good credit score? FICO scores range from 300 to 850. As you can see below, a 658 credit score is considered Fair.

Is 658 a good credit score? FICO scores range from 300 to 850. As you can see below, a 658 credit score is considered Fair.

9. What Credit Score Do You Need To Buy A House? | Rocket Mortgage

https://www.rocketmortgage.com/learn/what-credit-score-is-needed-to-buy-a-house May 26, 2022 ... After all, your FICO® Score is reported by three different bureaus. If you're applying for a loan on your own, lenders get your credit score ...

May 26, 2022 ... After all, your FICO® Score is reported by three different bureaus. If you're applying for a loan on your own, lenders get your credit score ...

10. Car loan interest rates with 658 credit score in 2022

https://creditscoregeek.com/fair-credit/658/auto/ Interest rate on car loan with 658 credit score can go anywhere from 8% to 12%, but it also depends on the lender and the specific background credit history ...

Interest rate on car loan with 658 credit score can go anywhere from 8% to 12%, but it also depends on the lender and the specific background credit history ...

What does a FICO score of 658 indicate?

A FICO score of 658 indicates that you are likely to be approved for most loan requests. Although it does not guarantee approval, it is considered within the range of scores lenders will accept.

How can I improve my FICO score?

To improve your FICO score, make sure to pay all bills on time and maintain a healthy debt-to-credit ratio. Additionally, monitor your credit report annually for any errors or discrepancies that might affect your credit rating.

What happens if my FICO score falls below 658?

If your FICO score drops below 658, creditors may be more reluctant to lend you money because they view you as having higher credit risk than an individual with a higher FICO score. This means that loan approval may be more difficult or require more favorable terms from the lender.

Conclusion:

A good understanding of how your FICO Score works can help you make informed financial decisions such as taking out loans or opening new accounts without fear of rejection due to low credit risk ratings. With a score of 658, borrowers should still demonstrate responsible borrowing behavior in order to maintain their good standing with lenders.