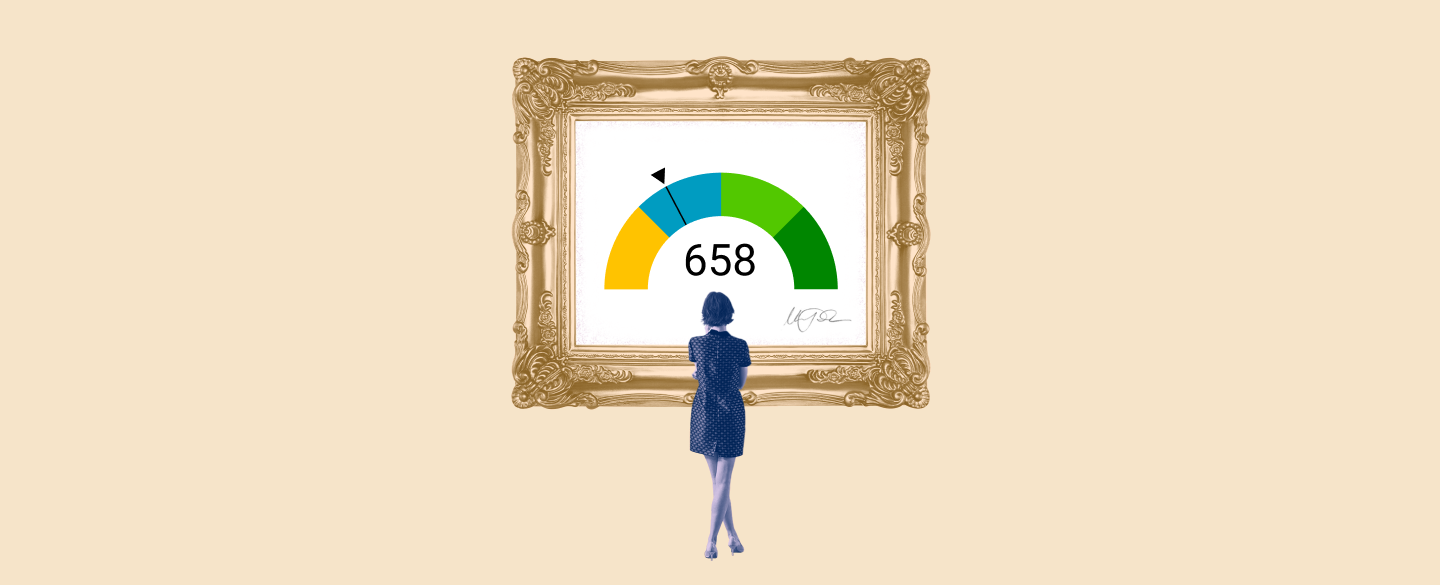

Your credit score is an important factor in determining your financial wellbeing. It’s a number between 300 and 850, and credit scores of 658 are considered fair. A 658 credit score may prevent you from getting the best offers, but you can still get access to some of the same loans available to people with higher scores.

Table Of Content:

- 658 Credit Score: Is it Good or Bad?

- Is 658 a Good Credit Score? What It Means, Tips & More

- 658 Credit Score: What Does It Mean? | Credit Karma

- Is 658 a good credit score? | Lexington Law

- 658 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 658 Credit Score (+ #1 Way To Fix It )

- Will a 658 credit score get me an auto loan with no money down ...

- 658 Credit Score: Is it Good or Bad? (Approval Odds)

- Is a 658 credit score ranked as fair or good? - Quora

- 658 Credit Score – Is it Good or Bad? How to Improve Your 658 ...

1. 658 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/658-credit-score/ The average FICO® Score is 711, somewhat higher than your score of 658, which means you've got a great opportunity to improve. 70% of U.S. consumers' FICO® ...

The average FICO® Score is 711, somewhat higher than your score of 658, which means you've got a great opportunity to improve. 70% of U.S. consumers' FICO® ...

2. Is 658 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/658-credit-score/

A 658 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 658 credit score isn't "bad," ...

3. 658 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/658 Apr 30, 2021 ... A 658 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 658 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. Is 658 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/658 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

5. 658 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/658-credit-score-mortgage/

If your credit score is a 658 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

6. 658 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/658-credit-score

7. Will a 658 credit score get me an auto loan with no money down ...

https://www.compareauto.loan/credit-scores/will-a-658-credit-score-get-me-an-auto-loan

If you've got a credit score around 658, you will definitely have the best luck being approved for an auto loan if you put in a request for vehicle loans online ...

8. 658 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/658-credit-score/ Is 658 a good credit score? FICO scores range from 300 to 850. As you can see below, a 658 credit score is considered Fair.

Is 658 a good credit score? FICO scores range from 300 to 850. As you can see below, a 658 credit score is considered Fair.

9. Is a 658 credit score ranked as fair or good? - Quora

https://www.quora.com/Is-a-658-credit-score-ranked-as-fair-or-good

A 658 FICO is considered a “fair” score, meaning that you may be approved for a loan, but you won't get a low interest rate. Talk to your local credit unions ...

10. 658 Credit Score – Is it Good or Bad? How to Improve Your 658 ...

https://www.creditrepairexpert.org/658-credit-score/ How to Improve Your 658 FICO Score. Before you can do anything to increase your 658 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 658 FICO Score. Before you can do anything to increase your 658 credit score, you need to identify what part of it needs to be improved, ...

What does a 658 credit score mean?

A 658 credit score is considered a fair score. It’s not the highest or best score, but it’s far from the worst and it can be improved with effort.

Does having a 658 credit score negatively impact my ability to get a loan?

Although having a 658 credit score may not provide you with the best loan terms or interest rates, it does not necessarily disqualify you from getting a loan. You should shop around for different lenders to find the one that works best for your needs.

What are some ways I can improve my 658 credit score?

Some ways to improve your 658 credit score are to pay off any existing debt, reduce your overall debt-to-income ratio, make all payments on time without exceptions, pay down your balance rather than just making minimum payments each month, limit applications for new lines of credit or loans, and check your credit report regularly for errors.

How long will it take before I see improvements in my 658 credit score?

Improvements in your credit score depend on many factors such as how much debt you have and how diligent you are in paying bills on time. Most people should ideally start seeing improvements within six months if they follow the steps outlined above and remain consistent with their repayment plan.

Conclusion:

Improving your 658 credit score takes dedication and patience but is possible with hard work over time. Consider shopping around for different lenders as well as monitoring your progress through regular checks of your credit report in order to increase your chances of being approved for loans at lower interest rates or better terms over time.