A 652 credit score mortgage is one of the most popular types of loans for borrowers with a good credit history. With this type of loan, you can get access to competitive interest rates and a wide range of financing options. This type of loan is ideal for borrowers looking to purchase or refinance a home, and it’s widely available from banks, credit unions, and mortgage lenders.

Table Of Content:

- 652 Credit Score: Is it Good or Bad?

- 652 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 652 Credit Score: What Does It Mean? | Credit Karma

- Is 652 a Good Credit Score? What It Means, Tips & More

- Is 652 a good credit score? | Lexington Law

- 652 Credit Score (+ #1 Way To Fix It )

- This is precisely how horrendous millennial credit scores are ...

- 652 Credit Score: Good or Bad? | Credit Card & Loan Options

- What Credit Score is Needed to Buy a House? | SmartAsset.com

- FHA Loan Credit Score Requirements For 2022 | Quicken Loans

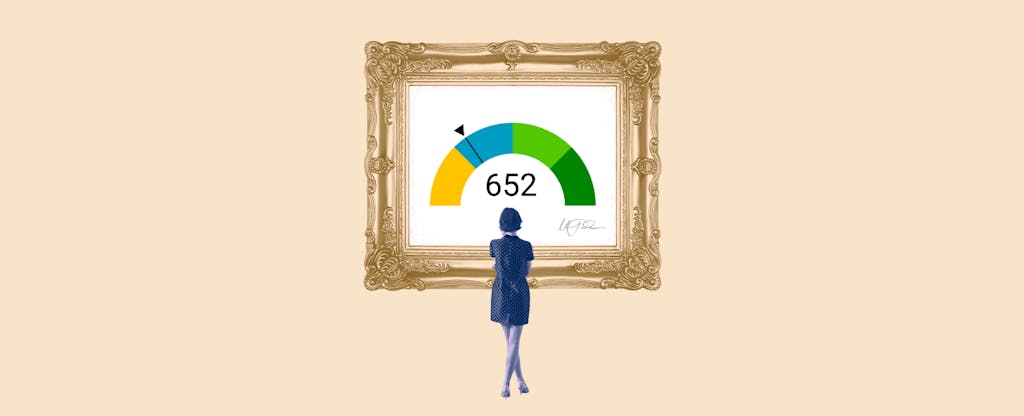

1. 652 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/652-credit-score/ A FICO® Score of 652 places you within a population of consumers whose credit may be seen as Fair. Your 652 FICO® Score is lower than the average U.S. credit ...

A FICO® Score of 652 places you within a population of consumers whose credit may be seen as Fair. Your 652 FICO® Score is lower than the average U.S. credit ...

2. 652 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/652-credit-score-mortgage/

If your credit score is a 652 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

3. 652 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/652 A 652 credit score is generally a fair score. While a lot of people have fair scores, you may still find it ...

A 652 credit score is generally a fair score. While a lot of people have fair scores, you may still find it ...

4. Is 652 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/652-credit-score/

A 652 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 652 credit score isn't "bad," either ...

5. Is 652 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/652 Oct 11, 2021 ... 652 credit score mortgage loan options. When it comes to getting a mortgage, experts recommend having a credit score of at least 760 to ...

Oct 11, 2021 ... 652 credit score mortgage loan options. When it comes to getting a mortgage, experts recommend having a credit score of at least 760 to ...

6. 652 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/652-credit-score

Jun 11, 2022 ... A 652 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 652 Credit Score. Lenders ...

7. This is precisely how horrendous millennial credit scores are ...

https://www.marketwatch.com/story/this-is-precisely-how-horrendous-millennial-credit-scores-are-2018-08-22 Aug 22, 2018 ... Indeed, the average credit score of a younger millennial (aged 22-28) is just 652 and of an older millennial (aged 29-35) just 665, ...

Aug 22, 2018 ... Indeed, the average credit score of a younger millennial (aged 22-28) is just 652 and of an older millennial (aged 29-35) just 665, ...

8. 652 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/652/ Nov 9, 2021 ... 652 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model. Scores ...

Nov 9, 2021 ... 652 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model. Scores ...

9. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

10. FHA Loan Credit Score Requirements For 2022 | Quicken Loans

https://www.quickenloans.com/learn/fha-loan-credit-score Nov 19, 2021 ... So, lenders can offer loans to borrowers with lower credit scores and small down payment funds. How FHA Credit Score Requirements To Buy A House ...

Nov 19, 2021 ... So, lenders can offer loans to borrowers with lower credit scores and small down payment funds. How FHA Credit Score Requirements To Buy A House ...

What Credit Score Is Needed For A 652 Mortgage?

To qualify for a 652 Mortgage, you need to have at least a 652 credit score. Other factors such as employment history, income level, and other debt-to-income ratio requirements may also come into play.

What Interest Rates Can I Get With A 652 Credit Score?

The interest rate you get on a 652 credit score mortgage will depend on several factors including your overall financial health and the lender's assessment of risk associated with your loan. Generally speaking though, those with higher scores could be eligible for lower interest rates than those with lower scores.

Are There Fees Associated With A 652 Credit Score Mortgage?

Yes, there may be fees associated with taking out a 652 mortgage depending on the lender and type of loan that you choose. Common fees may include application fees, origination fees, appraisal fees and closing costs. Make sure to shop around with different lenders to find the best terms available for your loan.

How Long Does It Take To Get Approved For A 652 Credit Score Mortgage?

Applying for a 652 mortgage doesn’t take too long but approval time will vary based on your individual circumstances. Typically the process can take anywhere from 30 days to several months in some cases. Certain lenders may be able to approve you more quickly if they deem it necessary or if an existing relationship has been established between them and the borrower.

Conclusion:

A 652 credit score mortgage provides borrowers with great access to competitive interest rates as well as many different financing options when looking to purchase or refinance their home. Before applying for any mortgage though make sure to understand all related terms and conditions so that you make informed decisions when it comes time to sign off on the final paperwork.