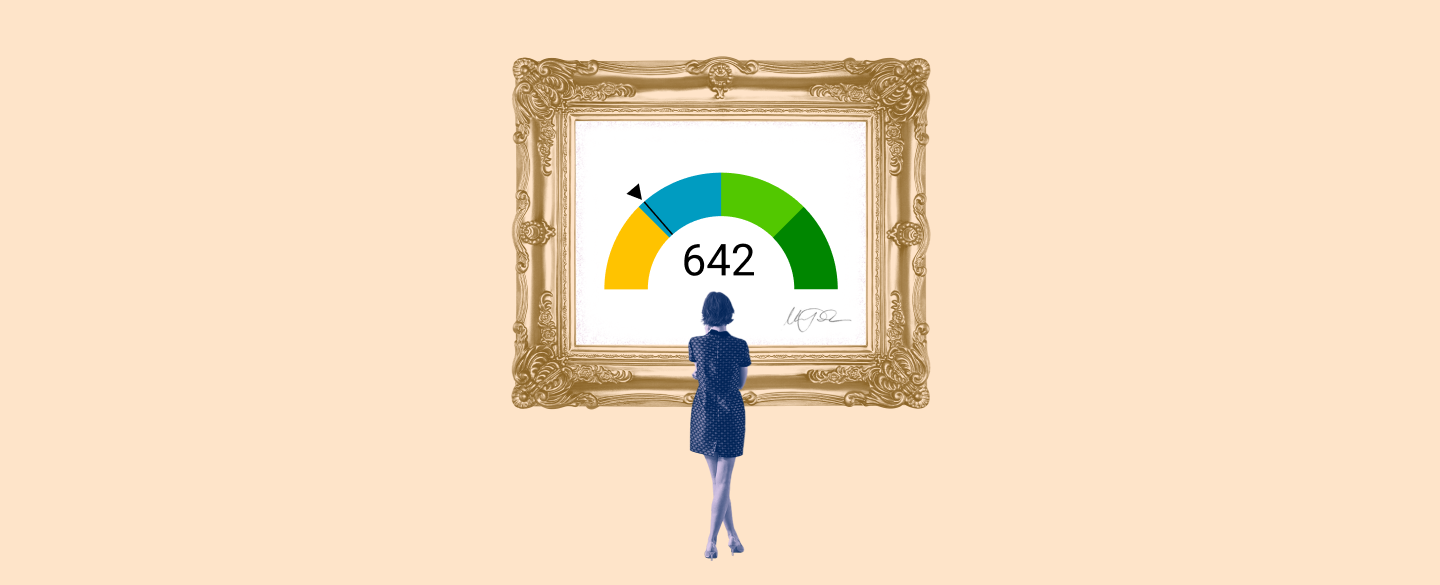

A FICO score is a three-digit number that summarizes your credit history and indicates how likely you are to pay back debt obligations. A FICO score of 642 falls within the Fair credit scoring range which is between 580-669. This range often requires higher-than-average interest rates but may still be able to get approved for a loan or credit card.

Table Of Content:

- 642 Credit Score: Is it Good or Bad?

- 642 Credit Score: What Does It Mean? | Credit Karma

- Is 642 a Good Credit Score? What It Means, Tips & More

- 642 Credit Score (+ #1 Way To Fix It )

- Is 642 a good credit score? | Lexington Law

- 642 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- If my FICO score is 642, what is my approximate credit score? - Quora

- 642 Credit Score – Is it Good or Bad? How to Improve Your 642 ...

- 642 Credit Score - Is it Good or Bad? What does it mean in 2022?

- 642 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 642 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/642-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 642 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 642 FICO® Score is below the average credit score.

2. 642 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/642 Apr 30, 2021 ... A 642 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 642 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

3. Is 642 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/642-credit-score/

A 642 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 642 credit score isn't "bad," ...

4. 642 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/642-credit-score

Jul 1, 2022 ... A 642 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 642 Credit Score. Lenders ...

5. Is 642 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/642 Oct 11, 2021 ... 642 credit score mortgage loan options. When it comes to getting a mortgage, experts recommend having a credit score of at least 760 to qualify ...

Oct 11, 2021 ... 642 credit score mortgage loan options. When it comes to getting a mortgage, experts recommend having a credit score of at least 760 to qualify ...

6. 642 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/642-credit-score-mortgage/

FHA Loan with 642 Credit Score ... FHA loans only require that you have a 580 credit score, so with a 642 FICO, you can definitely meet the credit score ...

7. If my FICO score is 642, what is my approximate credit score? - Quora

https://www.quora.com/If-my-FICO-score-is-642-what-is-my-approximate-credit-score

642 is your FICO score which IS your credit score. 90% of lending decisions are being made currently on your FICO score. FICO stands for “Fair Isaacs ...

8. 642 Credit Score – Is it Good or Bad? How to Improve Your 642 ...

https://www.creditrepairexpert.org/642-credit-score/ How to Improve Your 642 FICO Score. Before you can do anything to increase your 642 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 642 FICO Score. Before you can do anything to increase your 642 credit score, you need to identify what part of it needs to be improved, ...

9. 642 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/poor-credit/642/ Basically, those with high scores are considered less of a risk and thus more credit worthy as compared to those with low scores. Credit score 642 and below ...

Basically, those with high scores are considered less of a risk and thus more credit worthy as compared to those with low scores. Credit score 642 and below ...

10. 642 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/642-credit-score/ A 642 credit score is considered as “poor” score. While people with the 642 FICO score won't have as much trouble getting loans as those with lower credit, ...

A 642 credit score is considered as “poor” score. While people with the 642 FICO score won't have as much trouble getting loans as those with lower credit, ...

What do lenders generally look at when assessing my FICO score?

Lenders look at your payment history, the amount of debt compared to available credit, and the length of your credit history. They also consider any public record information such as bankruptcy and foreclosure filings. Your current FICO score can influence their decision whether to approve or deny your application.

What should I do if I have a lower than average FICO score?

Paying off debts on time, decreasing your overall debt load, and avoiding opening too many new accounts can all improve your scores over time. It’s important to understand what factors are impacting your scores so that you can work to address them and bring up your numbers accordingly.

How long does it take for my FICO score to improve?

It varies depending on how much debt you have and how quickly you pay it off but in general it could take up to six months for noticeable improvement. However, if you address any negative items on your credit report directly then you may see an improvement sooner rather than later.

Conclusion:

A 642 FICO score puts consumers firmly in the Fair scoring range which can make approval for a loan or credit card more difficult due to higher interest rates associated with this type of risk level. Taking active steps such as paying down debt, reducing available lines of credit, and monitoring public records will help individuals work towards improving their scores over time.